- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NTNX): Evaluating Valuation in Light of S&P 1000 Inclusion and Board Addition

Reviewed by Kshitija Bhandaru

Nutanix (NTNX) was recently added to the S&P 1000, which often attracts extra attention from institutional investors. The company has also welcomed Greg Lavender, a technology veteran, to its board of directors.

See our latest analysis for Nutanix.

With institutional attention growing following Nutanix’s addition to the S&P 1000 and a high-profile board appointment, the stock’s momentum appears to be gaining traction. The 1-year total shareholder return sits at an impressive 26%, pointing to resilience and long-term growth potential despite some shifts in earnings outlook.

If these recent moves have you thinking bigger, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up over 25% in the past year and growth expectations rising, the question for investors is whether Nutanix is still undervalued or if the market has already priced in its future potential, which could mean limited upside from here.

Most Popular Narrative: 11.6% Undervalued

Compared to Nutanix’s last close of $76.92, the most widely followed narrative sees fair value at $87.03. This sets the stage for significant upside if the projections hold true in a fast-evolving enterprise cloud market.

Accelerating adoption of hybrid and multi-cloud architectures, highlighted by new integrations with Google Cloud and deepening partnerships with AWS, Azure, Dell, and Pure Storage, positions Nutanix to capture a broader share of enterprise infrastructure modernization budgets. This expansion of its addressable market may drive sustained revenue growth. Ongoing enterprise digital transformation and demand for scalable solutions, as evidenced by large multi-year deals, major wins like Finanz Informatik, and increasing contributions from Global 2000 customers, provide a robust pipeline for future "land and expand" motions. This can improve both revenue visibility and opportunities for net new ARR expansion.

Curious what makes this estimate bold? The drivers are not just about partnerships or renewals, but eye-popping projected jumps in profitability and unchecked revenue expansion. Want the full blueprint behind these punchy numbers and why they set Nutanix apart? Dive in to crack the code on this standout valuation.

Result: Fair Value of $87.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer concentration and intensifying competition from major public cloud vendors could challenge Nutanix’s revenue growth and create pressure on future profitability.

Find out about the key risks to this Nutanix narrative.

Another View: Multiples Raise Caution

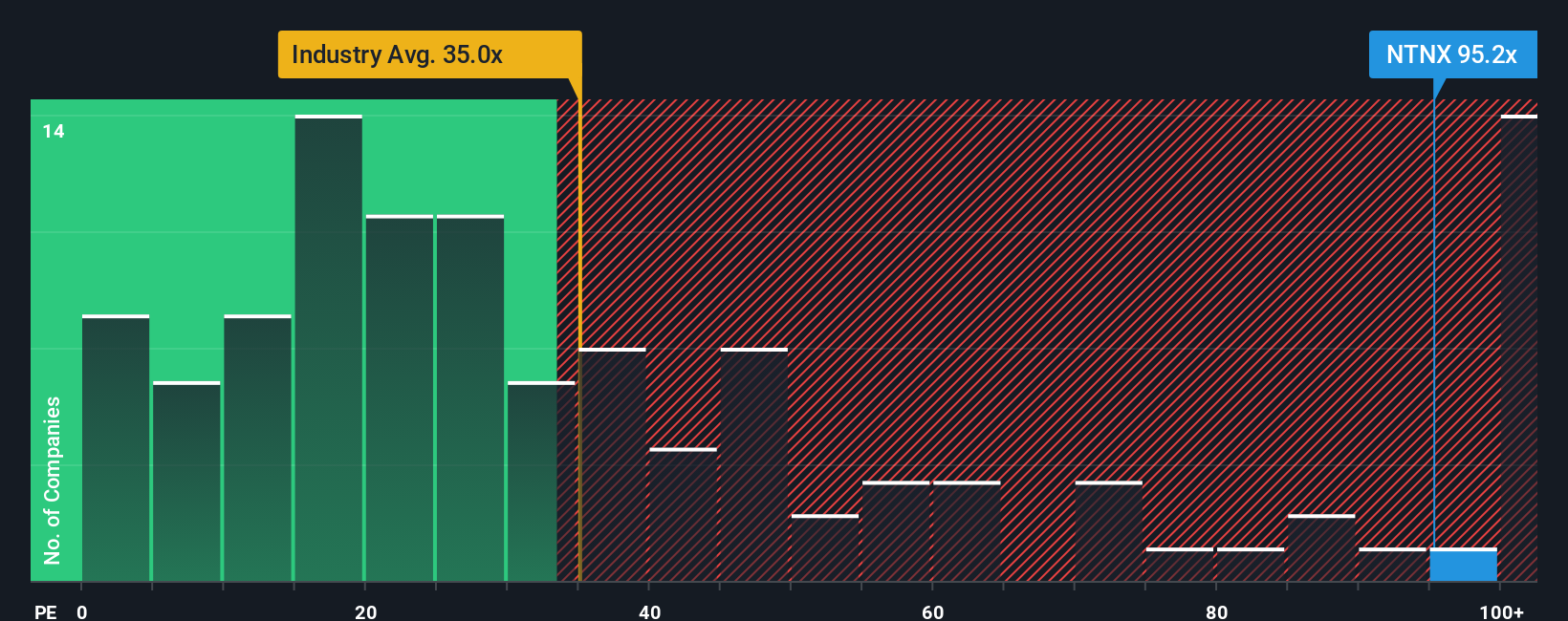

Looking at valuation from a different perspective, Nutanix currently trades at a price-to-earnings ratio of nearly 110 times, which is much higher than its peer average of 58.9 and also well above the industry norm of 35.6. The market's premium signals high expectations, but it also brings greater risk if growth slows. Interestingly, our fair ratio model suggests a lower figure of 52.6 times, a level the stock could revert to if optimism fades. Is the market’s confidence justified, or could it be setting up for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nutanix Narrative

If you see things differently or want to dive into the details yourself, it only takes a few minutes to build your own view from the data. Do it your way

A great starting point for your Nutanix research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investing Ideas?

Don't stop at just one opportunity. Make your next move by tapping into powerful trends and market niches with hand-picked stock ideas that could reshape your investing success.

- Unleash your growth potential by targeting these 23 AI penny stocks that are transforming industries with artificial intelligence.

- Capture value with these 914 undervalued stocks based on cash flows that are often overlooked, but primed for gains based on their real cash flow strength.

- Boost your income from these 19 dividend stocks with yields > 3% that offer attractive yields and the potential for stable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives