- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NTNX): Evaluating Valuation After Profit Milestone, Growth Guidance, and Strategic Customer Wins

Reviewed by Simply Wall St

If you’re following Nutanix (NTNX), this week’s earnings release might have you sitting up and reassessing where the company stands. Nutanix just notched its first full year of GAAP profitability, topping both revenue and earnings expectations with results that point to meaningful progress. Management paired the upbeat numbers with new guidance calling for continued growth into next year, and followed it up by announcing a substantial increase to the share buyback plan. These moves reinforce confidence from the top.

This surge of good news comes amid a year when Nutanix has steadily grown its top line and landed some high-profile partnerships. The recent strategic deal with Finanz Informatik, one of Germany’s largest banking IT providers, joins enhanced agreements with cloud heavyweights like AWS, Google, and NVIDIA. After solid gains earlier in the year, the stock’s momentum cooled in recent months, putting the one-year return just under 9% even as three- and five-year returns have been impressive. While the market’s appetite for growth stocks has shifted this summer, Nutanix’s fundamentals are showing marked improvement.

With shares trading near their recent highs and a stack of positive developments, the real question for investors is whether the market is giving Nutanix full credit for its achievements or if there is still upside if growth accelerates from here.

Most Popular Narrative: 25.9% Undervalued

The prevailing narrative sees Nutanix as deeply undervalued, with analysts projecting substantial future growth and a fair value target well above current levels.

Nutanix is experiencing strong new logo growth, particularly among Global 2000 companies. This is driven by customers seeking alternatives due to price increases from competitors, which is expected to positively impact future revenue growth. The company is positioned to capitalize on the growing interest in infrastructure modernization for GenAI deployments. By leveraging its Nutanix Cloud Platform, the company could potentially boost both revenue and earnings as enterprises invest in modernizing IT systems.

What is behind this bold price target? The answer lies in aggressive forecasts for revenue, margins and future profits, combined with striking future multiples. Want to discover which growth lever truly powers this optimistic view? Dig into the narrative for the numbers that back up the optimism.

Result: Fair Value of $90.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as unpredictable sales cycles and significant near-term investment could limit Nutanix's profitability if revenue growth falls short of forecasts.

Find out about the key risks to this Nutanix narrative.Another View: Looking Through a Different Lens

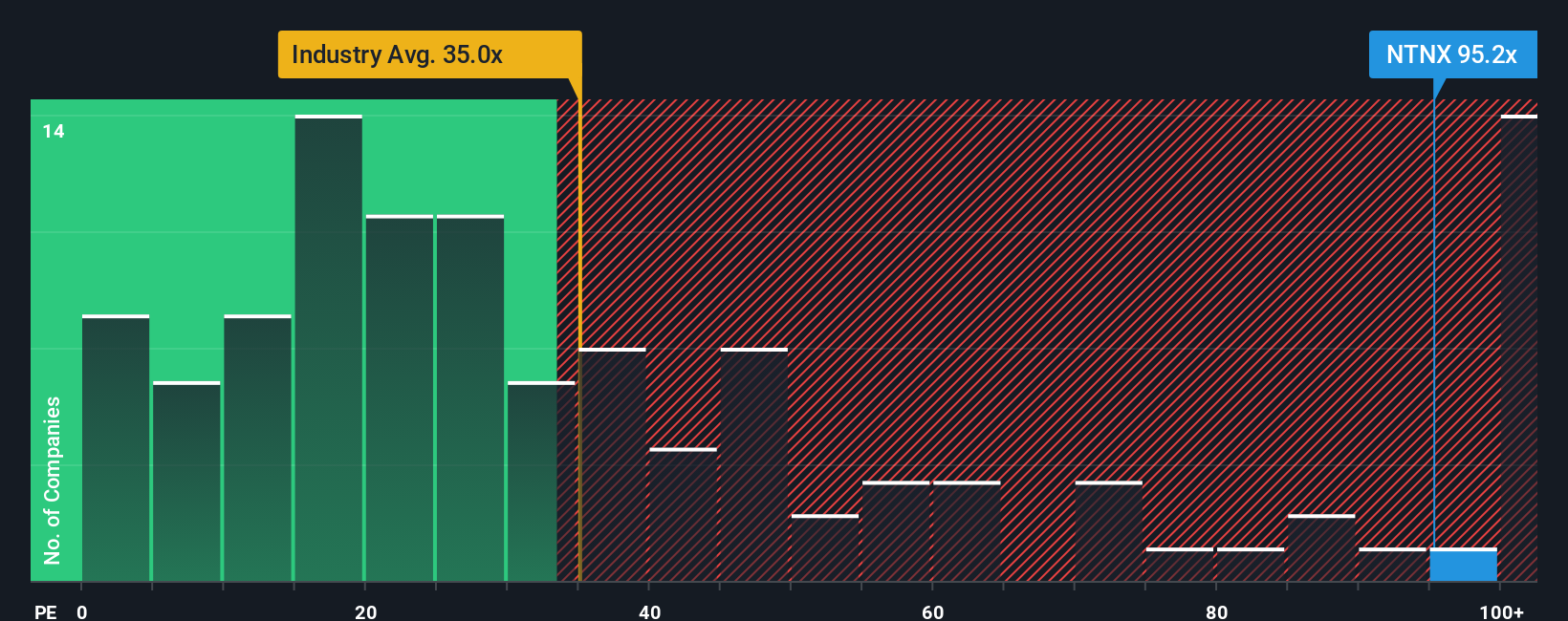

While many see upside based on growth forecasts, a look at traditional valuation ratios paints a different picture. By this method, shares appear expensive compared to industry averages. Does this challenge the optimistic outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Nutanix to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Nutanix Narrative

If you’re curious to explore the figures on your own terms or want a different perspective, crafting your own assessment takes just a few minutes. Let the data guide your analysis. Do it your way

A great starting point for your Nutanix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Find Your Next Standout Stock?

Don’t settle for just one opportunity. Powerful investing ideas are waiting if you know where to look. Take the next step and find your edge before others catch on.

- Unlock growth potential by checking out undervalued stocks based on cash flows for companies primed to deliver high returns based on strong fundamentals and discounted prices.

- Target tomorrow’s innovation leaders using AI penny stocks and uncover visionary businesses shaping the artificial intelligence landscape right now.

- Secure steady income streams with dividend stocks with yields > 3%, where you’ll pinpoint stocks offering reliable dividends and yields above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)