Nutanix (NASDAQ:NTNX) Full Year 2025 Results

Key Financial Results

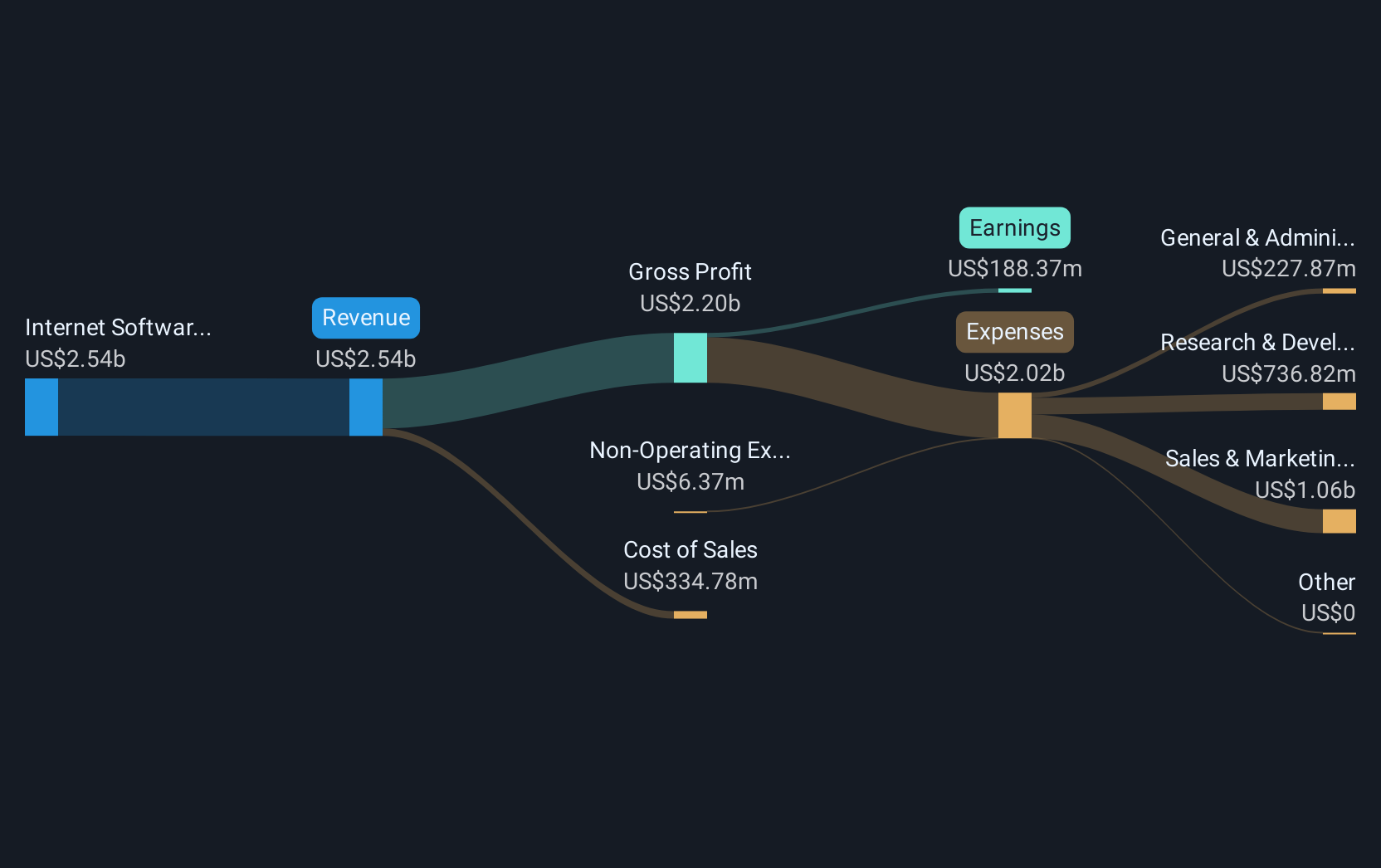

- Revenue: US$2.54b (up 18% from FY 2024).

- Net income: US$188.4m (up from US$124.8m loss in FY 2024).

- Profit margin: 7.4% (up from net loss in FY 2024). The move to profitability was driven by higher revenue.

- EPS: US$0.70 (up from US$0.51 loss in FY 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Nutanix EPS Beats Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 11%.

In the last 12 months, the only revenue segment was Internet Software & Services contributing US$2.54b. The largest operating expense was Sales & Marketing costs, amounting to US$1.06b (52% of total expenses). Over the last 12 months, the company's earnings were enhanced by non-operating gains of US$6.37m. Explore how NTNX's revenue and expenses shape its earnings.

Looking ahead, revenue is forecast to grow 13% p.a. on average during the next 3 years, compared to a 13% growth forecast for the Software industry in the US.

Performance of the American Software industry.

The company's shares are down 2.8% from a week ago.

Risk Analysis

What about risks? Every company has them, and we've spotted 3 warning signs for Nutanix (of which 2 shouldn't be ignored!) you should know about.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)