- United States

- /

- Software

- /

- NasdaqGS:NCNO

nCino (NCNO): Evaluating Valuation as New AI Mortgage Tools Target Lending Efficiency

Reviewed by Kshitija Bhandaru

nCino (NCNO) just rolled out a suite of mortgage-focused AI solutions aimed at speeding up loan origination and cutting down on underwriting tasks. These upgrades highlight the company's ongoing push to modernize how lenders and borrowers interact.

See our latest analysis for nCino.

Momentum for nCino’s stock has been slow to build in 2024, with the share price recently closing at $26.23 and the one-year total shareholder return slipping just over 15%. Recent innovation headlines point to growth ambition, but investors are still waiting for gains to materialize.

If you’re keen to spot other software disruptors and potential turnaround stories, now is a good time to broaden your outlook and discover fast growing stocks with high insider ownership

But with shares trading well below analyst price targets and nCino still unprofitable despite solid revenue growth, the question now is whether there is real value left on the table or if the market has already accounted for all future upside.

Most Popular Narrative: 26% Undervalued

With nCino closing at $26.23 and the most widely followed narrative placing fair value sharply higher, expectations are mounting. But is the optimism justified? Let’s examine one of the most important drivers behind this bullish outlook.

A large-scale shift by banks and credit unions from legacy, fragmented IT infrastructure to cloud-native, end-to-end SaaS core banking platforms is leading to ongoing net new customer growth and major expansions, evidenced by wins with top U.S. and European banks, supporting sustained revenue and ACV growth.

Want to know what powers this steep upside estimate? It’s not just hope. The narrative is underpinned by rapid earnings growth, bold profit margin forecasts, and an aggressive price multiple. These are numbers that might surprise even seasoned investors. Curious about which assumptions tip the scales and how high future profits are projected to climb? The full narrative reveals what’s fueling that $35+ fair value call.

Result: Fair Value of $35.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high investment in AI development and the risk of intensifying competition could dampen both margin gains and the company’s growth trajectory.

Find out about the key risks to this nCino narrative.

Another View: What Do the Ratios Tell Us?

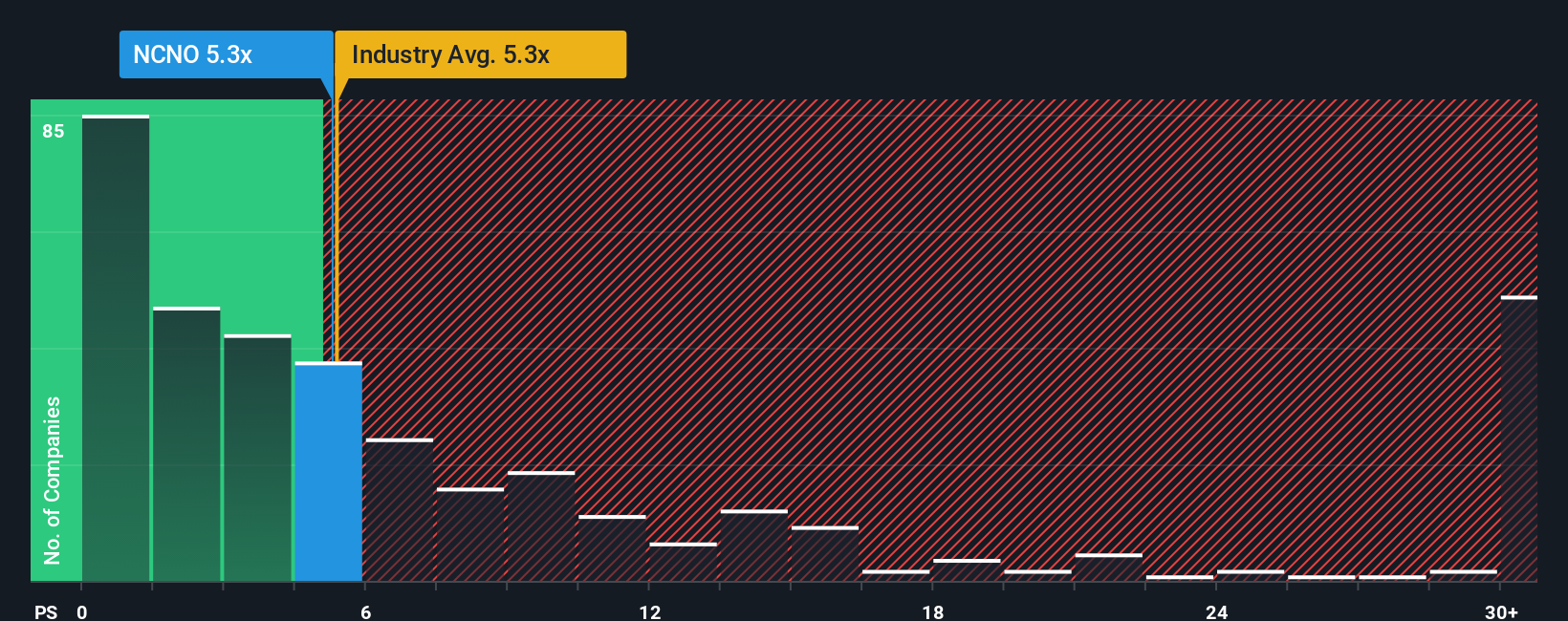

Now, let’s consider nCino’s price-to-sales ratio, which stands at 5.3x. This matches the overall US software industry average and is better value than the peer group average of 6.9x. However, it remains notably higher than the fair ratio of 3.5x, highlighting a potential valuation risk if market sentiment changes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nCino Narrative

If you think the current fair value story misses key details or want to dive deeper into the numbers yourself, you can craft your own narrative with fresh data and insights in just a few minutes. Do it your way

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know there is always another opportunity on the horizon. Don’t miss your chance to get ahead of the next trend and grow your portfolio faster. These handpicked stock ideas can give you a crucial edge before the crowd catches on.

- Capitalize on tomorrow’s technology breakthroughs by scanning these 24 AI penny stocks for companies poised for rapid growth in artificial intelligence.

- Unlock consistent income streams with these 19 dividend stocks with yields > 3% offering attractive yields, perfect for bolstering your returns even when markets are uncertain.

- Harness market mispricings and secure potential bargains by targeting these 896 undervalued stocks based on cash flows backed by strong fundamentals and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NCNO

nCino

A software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives