- United States

- /

- Software

- /

- NasdaqGS:NBIS

Nebius Group (NBIS): Assessing Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Nebius Group (NBIS) has caught some attention lately as investors react to shifts in its business performance and broader market sentiment. The company’s recent swings in returns raise some intriguing questions about value and momentum going forward.

See our latest analysis for Nebius Group.

Nebius Group’s share price has been riding waves of market excitement, with a standout 228% return year-to-date and a hefty 289% total shareholder return over the past year. After an explosive multi-month climb, the recent sharp 23% drop in just 30 days shows volatility is still part of the story. Momentum remains strong in the bigger picture as the company continues to attract attention.

If rapid surges and market pivots interest you, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Nebius Group’s shares trading well below analyst targets despite impressive revenue and profit growth, the central question is whether the stock is truly undervalued or if the market has already priced in all the upside for future gains.

Most Popular Narrative: 37% Undervalued

With Nebius Group’s fair value estimate of $159 well above the last close price of $100.15, the most widely followed narrative suggests there is a significant gap between current market pricing and what analysts expect. This sets up an intriguing story for those watching both the company’s momentum and valuation.

Aggressive geographic expansion, notably into key markets such as the U.K., Israel, U.S. (New Jersey), and Finland, with imminent data center launches and local partnerships, positions Nebius to diversify its customer base, tap into regional AI investment booms, and unlock new enterprise opportunities. This could positively affect top-line growth and revenue stability.

How bold are the assumptions fueling this lofty fair value? The narrative relies on projections that may surprise most investors tracking AI infrastructure deals. Before you accept the consensus, you may want to discover the high-octane revenue growth and recalibrated margins behind the calculations. Ready to see what is driving these figures?

Result: Fair Value of $159 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained intensifying competition and potential regulatory hurdles could undermine Nebius Group's growth if expansion costs increase or market access challenges arise.

Find out about the key risks to this Nebius Group narrative.

Another View: A Look at Book Value

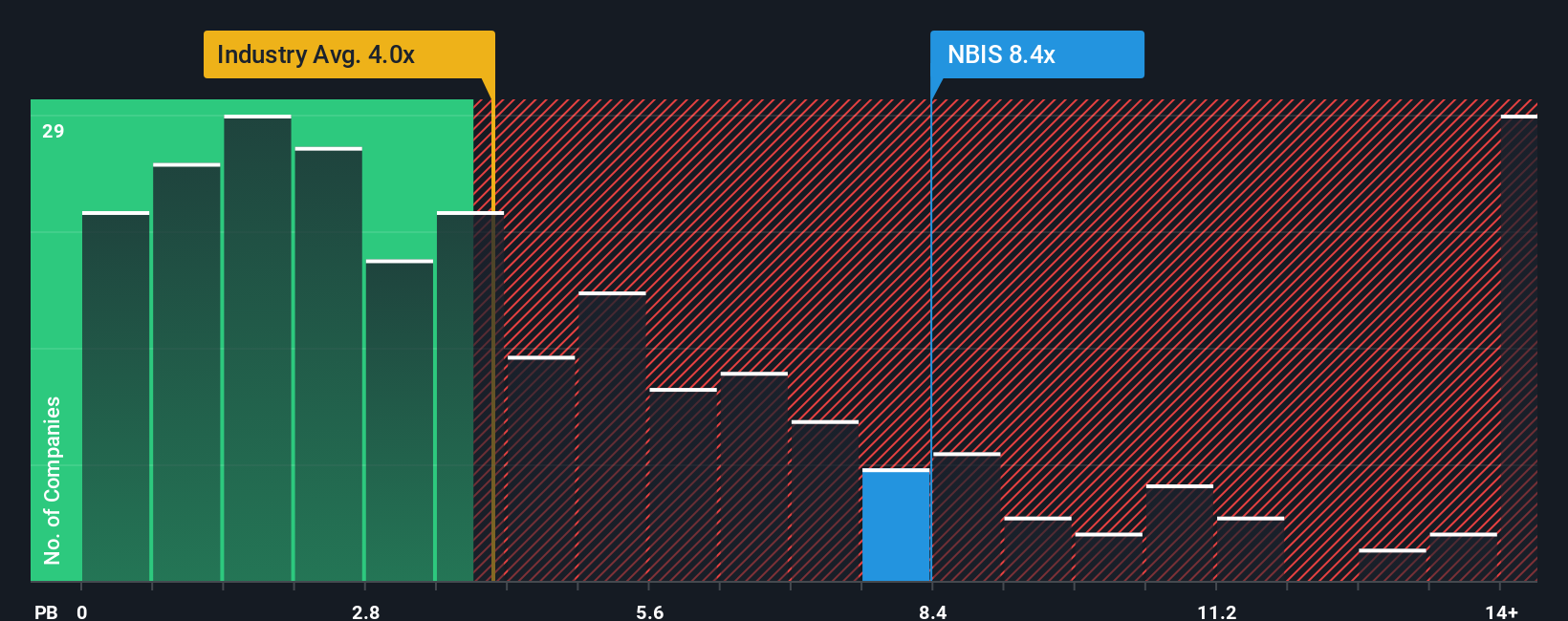

Stepping back from fair value estimates, let’s check Nebius Group’s value through the lens of its price-to-book ratio. At 5x, the company appears expensive against the US Software industry average of 3.4x, though it is notably cheaper than its peer group average of 10.8x. This mix of signals could point to both valuation risk and opportunity. Is the market optimistic, or simply overlooking different fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nebius Group Narrative

If you see things differently or want to dig into the details yourself, you can build your own story around Nebius Group in just minutes. Do it your way.

A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to one company. Give yourself the edge by checking out these compelling opportunities. These picks might be exactly what your portfolio needs right now.

- Tap into growth by accessing these 25 AI penny stocks, which are driving breakthroughs in artificial intelligence, automation, and transformative digital solutions shaping the next era of innovation.

- Boost your income with stability through these 14 dividend stocks with yields > 3%, offering yields above 3%, perfect for those who want reliable returns alongside long-term growth potential.

- Embrace the future of finance and technology as you explore these 81 cryptocurrency and blockchain stocks, at the forefront of the cryptocurrency and blockchain revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026