- United States

- /

- Software

- /

- NasdaqGS:NBIS

Is Nebius Group Fairly Priced After 24.5% Drop and Product Expansion News?

Reviewed by Bailey Pemberton

- Thinking about whether Nebius Group is fairly priced? Let’s take a closer look at what has been driving interest, as well as what could matter for investors evaluating the stock’s value.

- The stock has kept traders active, with a recent 24.5% slide over the past month. Despite this, it remains up 210.4% year-to-date and 341.9% over the past 12 months.

- There has been ongoing news about Nebius Group’s ambitious product expansion plans and growing partnerships, capturing the attention of both investors and industry analysts. These developments have contributed to excitement and speculation, which helps explain some of the recent dramatic price swings.

- In a quick valuation check, Nebius Group scores a 2 out of 6. This suggests there could be value or potential warning signs beneath the surface. Traditional valuation methods will be explored next, so stay tuned for a deeper look at whether Nebius Group is a bargain or a risk.

Nebius Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nebius Group Discounted Cash Flow (DCF) Analysis

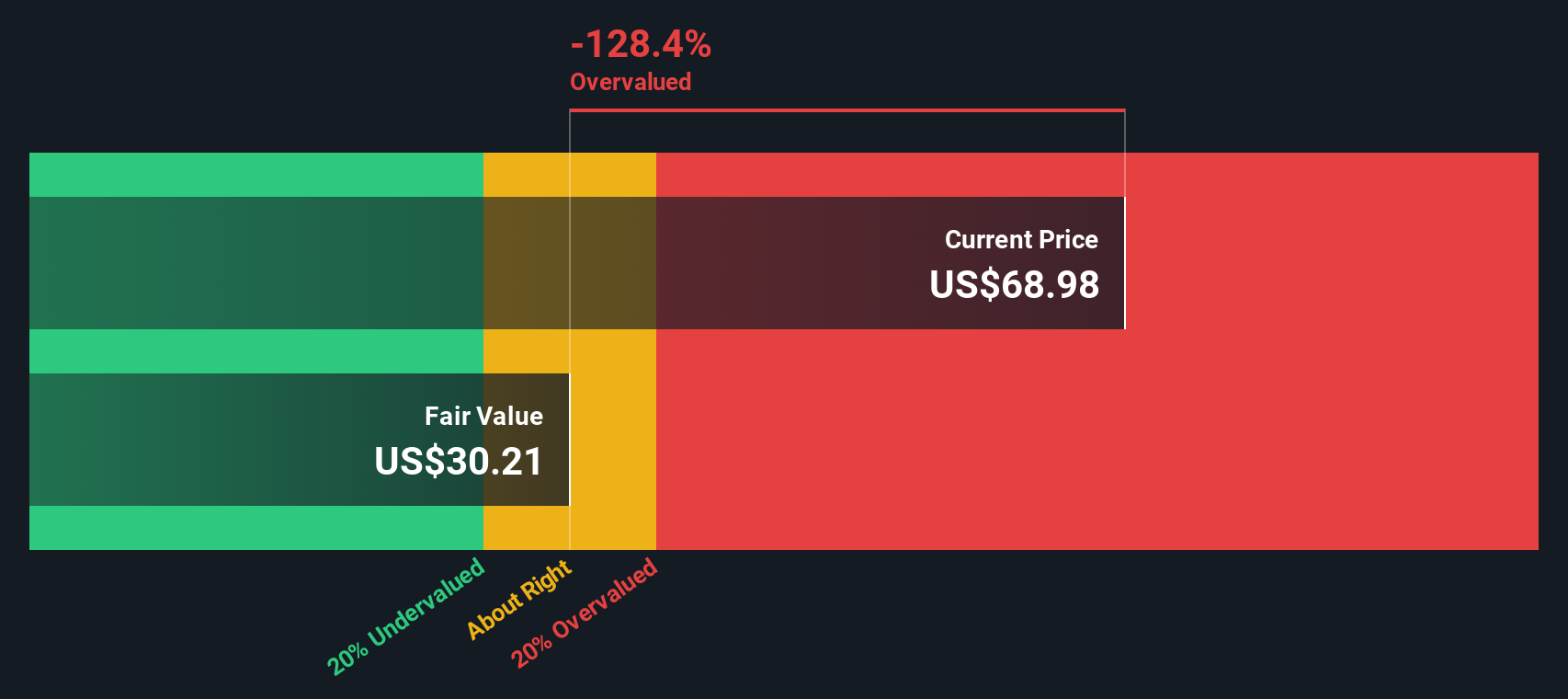

The Discounted Cash Flow (DCF) model estimates what a business is worth by taking future cash flows that the company is expected to generate and discounting them back to their value today. For Nebius Group, this approach uses the 2 Stage Free Cash Flow to Equity model, which factors in analyst forecasts up to 2029 and extends projections through 2035.

Nebius Group’s latest twelve months free cash flow stands at negative $1.13 billion, meaning the company is currently burning through cash. Analysts expect that by 2029, annual free cash flow will flip positive to $767.1 million. Over the next ten years, projected free cash flows rise significantly, driven by rapid revenue and margin expansion. Free cash flow is projected to eventually reach $3.7 billion by 2035, with much of this future growth extrapolated by analysts beyond the first five years.

Based on these forecasts and discounted to today’s value, the model calculates Nebius Group’s intrinsic value at $103.06 per share. Comparing this to the current trading price, the DCF indicates the stock is about 8.1% undervalued.

Result: ABOUT RIGHT

Nebius Group is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

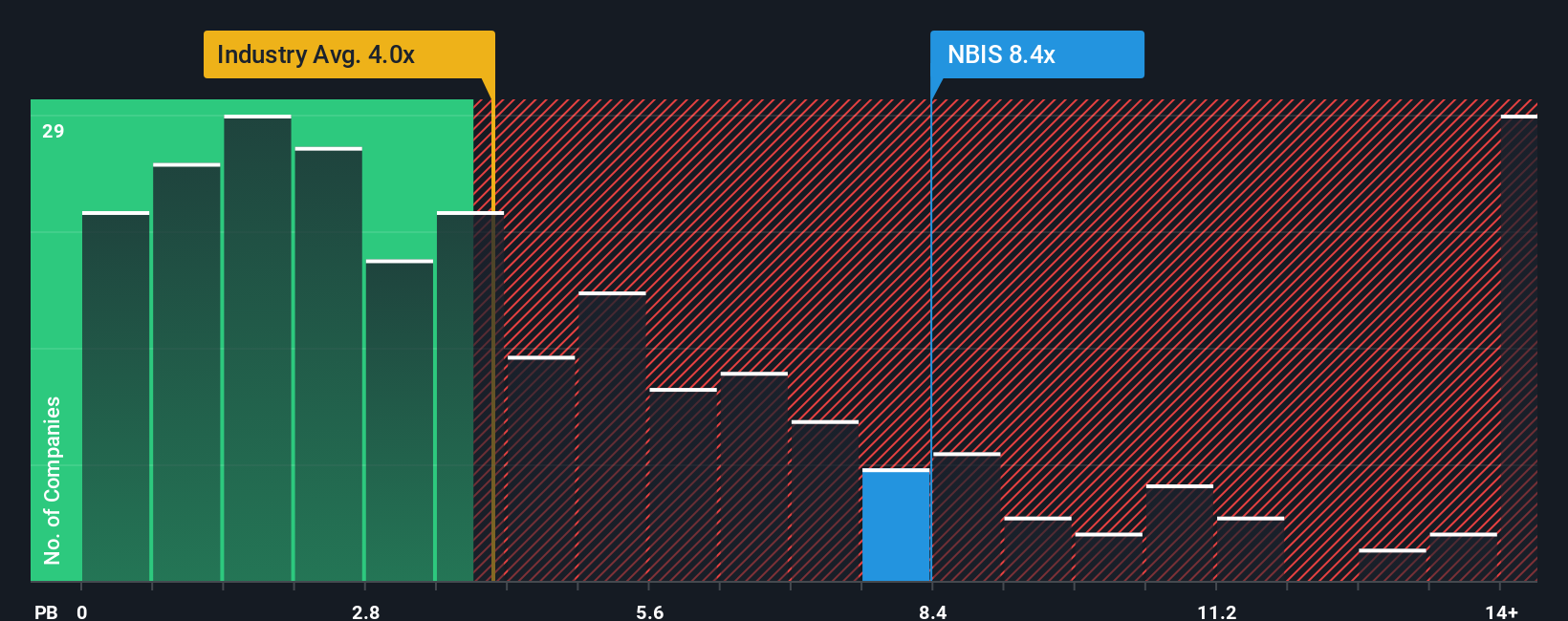

Approach 2: Nebius Group Price vs Book

The Price-to-Book (P/B) ratio is often used to value companies in the software industry because it provides insight into how the market values a company's net assets. This makes it especially useful for firms with significant tangible or intangible assets. For profitable companies, a P/B ratio can offer a reality check on how much investors are willing to pay above the company’s book value. Higher ratios often reflect optimism about future growth or competitive advantages.

When evaluating what a “normal” or “fair” P/B ratio might be, it is important to consider both growth prospects and risk. Higher growth companies can command above-average P/B ratios, while elevated risks or weaker profitability generally result in lower multiples.

Nebius Group currently trades at a P/B ratio of 4.96x, which is above the software industry average of 3.35x but below the peer average of 6.27x. These benchmarks can be helpful, but they do not account for the full picture of a company’s unique growth outlook or risk profile.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike broad industry or peer comparisons, the Fair Ratio estimates what the multiple should be given Nebius Group’s specific growth rates, profitability, business risks, industry, and size. As such, it provides a tailored benchmark for investors looking to judge whether the current valuation is justified.

Comparing Nebius Group’s current P/B of 4.96x with its Fair Ratio, we see the company is trading at about the right level. This suggests the market price accurately reflects its underlying value considering all relevant factors.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nebius Group Narrative

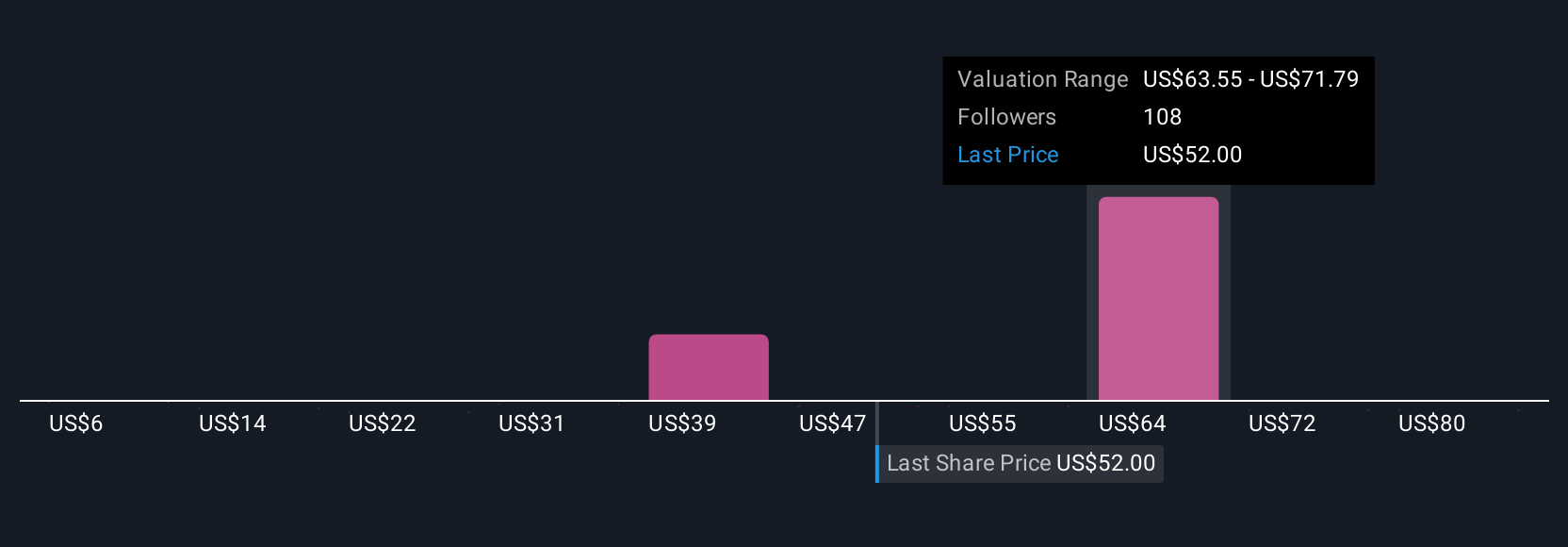

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a clear, easy-to-use framework that lets you articulate your own story about a company. You can outline how you see its future, your expectations for growth, profitability, and risks, turning numbers into a meaningful investment perspective.

With Narratives, you connect a company’s unique story directly to customized financial forecasts and then to a fair value, bridging the gap between headline metrics and your personal investment thesis in a way numbers alone cannot achieve. Available to everyone on Simply Wall St’s Community page, Narratives makes it simple for investors of all experience levels to capture, share, and compare their outlook on Nebius Group using tools trusted by millions worldwide.

Narratives offer a dynamic edge: when news breaks or earnings are released, fair value estimates update in real time, giving you a current view of whether Nebius Group is under- or overvalued compared to its price. For instance, one user’s Narrative based on bullish projections and new AI contracts might estimate Nebius Group’s fair value at $166 per share. In contrast, a more cautious investor, concerned about competition and regulation, could set their fair value closer to $47 per share.

Do you think there's more to the story for Nebius Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)