- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Soars 14% As $722.5M Fixed-Income Offering Gains Traction

Reviewed by Simply Wall St

MicroStrategy (NasdaqGS:MSTR) experienced a 14% price increase over the last week, influenced by recent corporate actions and broader market trends. The company's announcement on March 20 about adding several prestigious co-lead underwriters for its $722.5 million Fixed-Income Offering likely contributed to investor optimism, indicating an enhanced financial strategy. Additionally, the board's dividend declaration on March 3 for series A perpetual preferred stock could have bolstered investor confidence. Meanwhile, as the broader market, represented by indexes like the Nasdaq, continued its rebound with a 1.8% climb, these factors collectively supported the remarkable weekly gain witnessed by MicroStrategy.

MicroStrategy has 3 warning signs (and 1 which can't be ignored) we think you should know about.

MicroStrategy has seen a very large total shareholder return over the last 5 years, reaching 2945.36%. This impressive performance reflects several key factors and strategic moves. The introduction of MicroStrategy ONE and subsequent enhancements significantly contributed, showcasing the company's focus on leveraging AI to enhance user experience. The company's vision aligns with helping businesses implement Bitcoin strategies, as demonstrated by initiatives like "Bitcoin for Corporations," emphasizing its commitment to digital currency adoption.

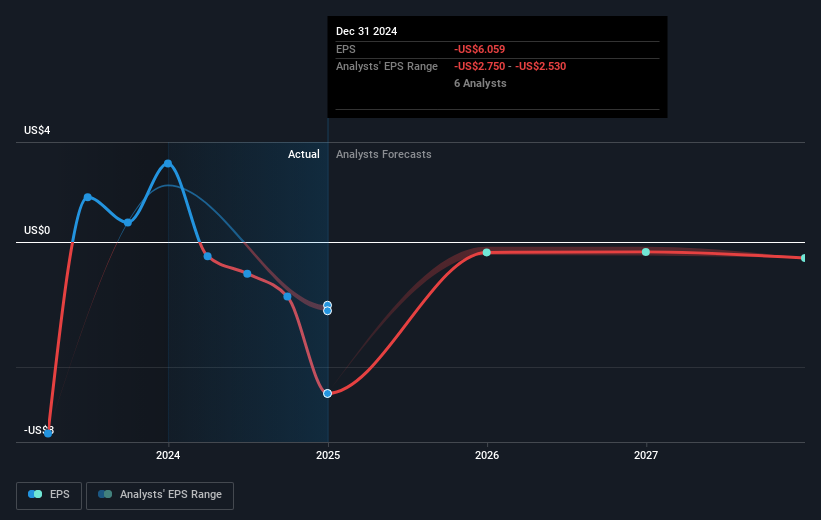

Key financial maneuvers also impacted its trajectory. The inclusion of prestigious co-lead underwriters for US$722.5 million offering and strategic adjustments, like the significant amendment to increase authorized shares, underpin its substantial gains. Despite negative earnings reports indicating a rising net loss, MicroStrategy's share performance nevertheless outpaced the US Software industry and the broader market over the past year, highlighting its resilience and unforeseen market sentiment.

Take a closer look at MicroStrategy's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives