- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Shares Surge 16% Following New US$1.24 Dividend Announcement

Reviewed by Simply Wall St

MicroStrategy (NasdaqGS:MSTR) recently declared a quarterly cash dividend of $1.24 per share on its 8.00% series A perpetual strike preferred stock, with a payment date of March 31, 2025, and a record date of March 15, 2025. This announcement could be a significant factor in the company's notable 16% share price increase over the last week. The declaration of a dividend often attracts investor interest, particularly as broader market indices showed mixed performance during this period, with the Dow Jones gaining slightly while the S&P 500 and Nasdaq fell. During this time, the Federal Reserve's steady interest rate decision and its solid economic pace assessment might have further influenced investor confidence. Amid this backdrop, MicroStrategy's strong price movement aligns with an overall upward market trend, as the market has climbed 2% over the past week and 8% over the last 12 months.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the last five years, MicroStrategy's total shareholder return has been extraordinarily high, evidencing strong investor interest despite its unprofitability in recent periods. In this time, the company exceeded the US Software industry's performance by a large margin over the past year, which saw a 1.3% decline. It's worth noting the addition of MicroStrategy to the NASDAQ-100 Index in December 2024, possibly enhancing its visibility to investors. Furthermore, the company's initiatives to expand its product suite, like launching the MicroStrategy ONE with AI capabilities, likely bolstered investor confidence in its growth potential.

In the latter part of this period, strategic financial moves, such as the announcement of a $1.75 billion private offering of convertible senior notes, may have provided reassurance about the company’s financial strategies. The expansion of its board with the addition of three new members in February 2025 reflects a commitment to strengthening corporate governance, which may further enhance investor trust. These factors might collectively explain the substantial long-term gains for shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

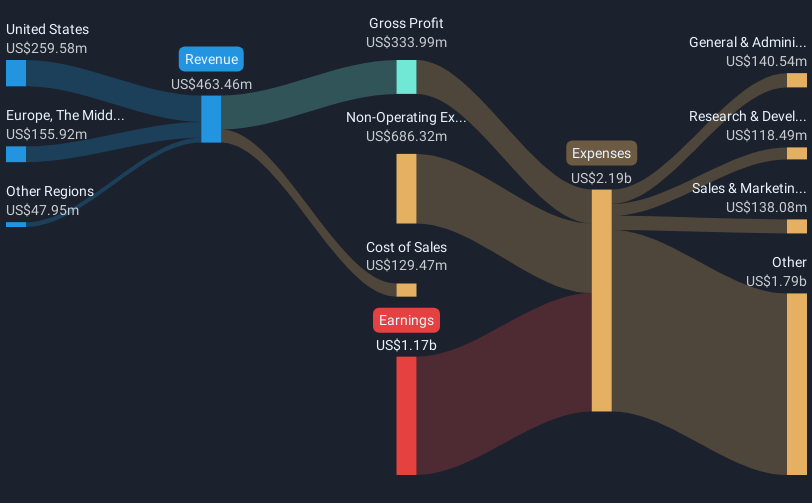

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives