- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Launches AI-Powered Strategy Mosaic for Enhanced Data Connectivity

Reviewed by Simply Wall St

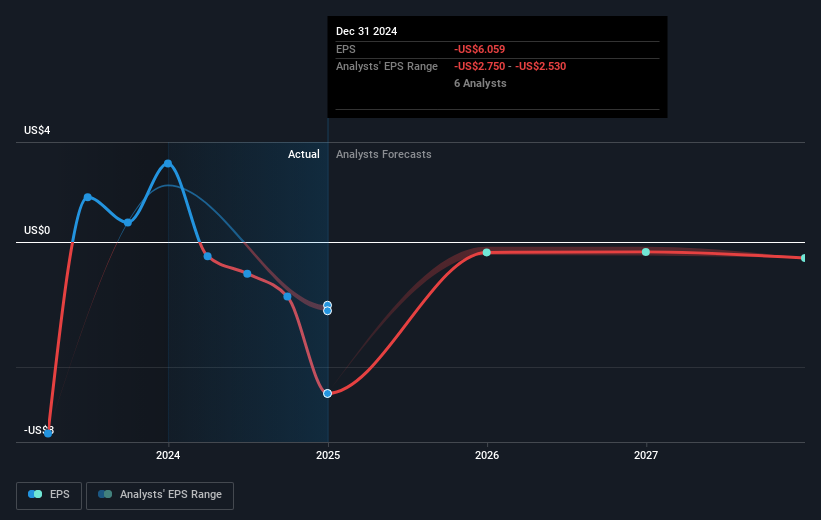

MicroStrategy (NasdaqGS:MSTR) recently announced the launch of Strategy Mosaic™, an AI-powered platform designed to integrate and unify disparate data sources across organizations. This announcement may have added weight to the company's share price increase of 16% over the last quarter. Despite a tough earnings report indicating a significant net loss, the introduction of innovative solutions like Strategy Mosaic™ highlights the company's efforts to enhance its product offerings in the evolving AI landscape. While the market rose by 12% over the past year, MicroStrategy's new product strategies and initiatives may have contributed to its strong performance relative to broader trends.

Every company has risks, and we've spotted 1 risk for MicroStrategy you should know about.

MicroStrategy's shares have seen a very large increase of total return at 3,100.51% over the past five years, showcasing significant long-term appreciation. In the last year, the company outperformed the US market, which returned 12.2%, and surpassed the US Software industry, which returned 19.7%. This outperformance reflects positively on its strategic initiatives and market presence despite facing operational challenges and financial losses.

The recent product innovations and strategic moves, as highlighted by the introduction of Strategy Mosaic™, could contribute positively to revenue and earnings projections by enhancing demand for the company’s AI solutions. However, actual impact remains to be seen given the complex market dynamics and financial pressures. With a current discount to its consensus analyst price target of US$530.29, MicroStrategy’s share price indicates room for potential growth, reflecting investor confidence in its future strategies despite current profitability hurdles.

Jump into the full analysis health report here for a deeper understanding of MicroStrategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives