- United States

- /

- Software

- /

- NasdaqGS:MSFT

The Two Sides of Microsoft: Strong Fundamentals vs. Insiders' Selling Activity

Reviewed by Michael Paige

Summary:

- MSFT has superior fundamentals, including a 36.7% profit margin, estimated earnings growth of 11% p.a.

- Analysts and our valuation model suggest that the company has 43% and 37% upside, respectively.

- Insider selling activity warrants a more cautious approach when analyzing the company, as there are likely things insiders understand better about the business.

Microsoft (NASDAQ:MSFT) lost 19.4% of its market cap despite exhibiting some strong fundamental qualities. The company seems to be growing the top line, as well as scaling margins. We analyzed the company to see if the decline is warranted for the $1.7t market cap stock and came up with some mixed results.

Check out our latest analysis for Microsoft

Evaluating The Fundamentals

If we look at our company report, we find a number of quality markers that are rare in other companies. Here is a rundown of Microsoft's key fundamental benefits:

Trading at 37.3% Below Our Estimate of Its Fair Value

Using a discounted cash flow valuation model, we estimate that the company's intrinsic value is worth $2.7t. It seems that the price of risk has been pressuring the stock in the past year. However, the free cash flows are expected to grow to between $125b and $150b in the next decade, which could potentially make the stock attractive again once market risk settles down.

Earnings Grew by 18.7% YoY, and are Forecasted to Grow 11.33% Annually

Microsoft has a solid track-record of earnings growth in the past. The company has successful projects internally with the cloud growth, as well as executing well on growth by acquisitions such as the LinkedIn back in 2016.

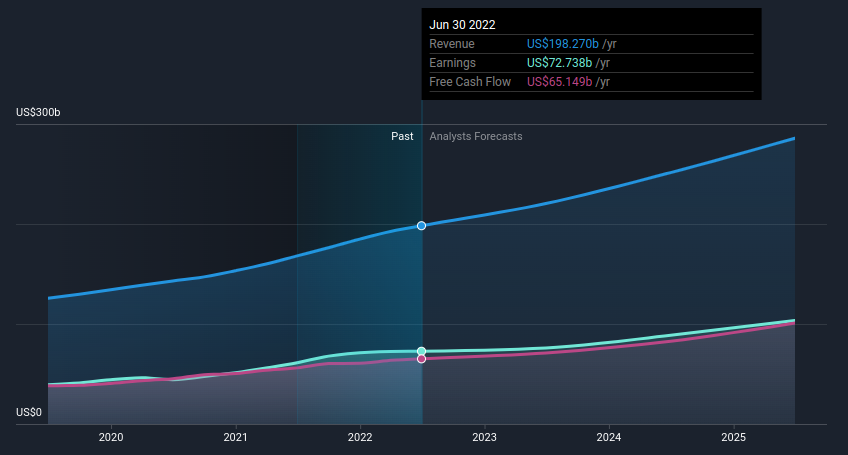

The chart below illustrates the successful growth story for Microsoft:

The company has also managed to scale the net profit margin from 28.3% in 2019 to 36.7% in the last 12 months. Producing higher profits while growing revenue is a hallmark sign of value creation.

Trading at Good Value vs. the Peer Average Price-To-Earnings Ratio

Microsoft's peers are trading at an average price to earnings ratio of 19.7x, while the company is currently trading at a 23.9x PE. As earnings are expected to grow 11.3% in the next 12 months, this brings the forward PE to 23x. A PE above 17.4x implies a premium on the 5-year market average, but may be justified given the size and stability of Microsoft.

Analysts in Good Agreement for a 43.3% Upside

The average 1-year price target for Microsoft is $333.8 per share, and the 42 analysts covering the company seem to be in good agreement, with less than a 15% spread between estimates. The chart below shows that analysts are still bullish on the stock's performance:

In summary, we can see that Microsoft's fundamentals have a wide margin and are expected to keep growing in the future. Analysts are also in agreement that the stock price has been underperforming, which is in-line with our valuation estimates.

However, there are some things that the fundamentals can't tell us, and we can use other sources to double-check our assumptions.

A Wedge in the Story

In general, we want to see congruence between a company's fundamentals and the trading activity of people who know the stock inside-out. The assumption is that these insiders know more about the future of a business than analysts who have limited access to information.

When insiders are selling or buying stock in their company, it is always a good signal to pay attention to. We always expect a certain amount of insider activity, but ideally we would like that activity to be random, and disconnected with the movement of the stock. However, when we have an insider such as the CEO Satya Nadella, top ticking $285m worth of shares, at an average of $349 per share, we start wondering if this is a result of his judgement on the business potential. To be clear, the selling decision may have also been made for other reasons such as the anticipation of a worsened macro environment, which evidently happened after 2021.

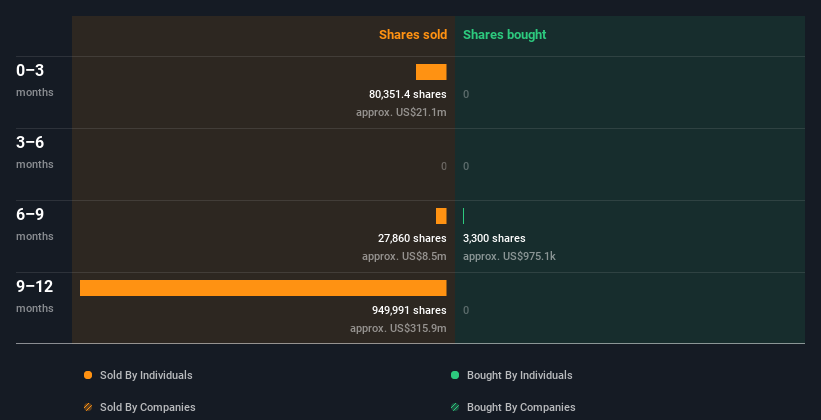

Looking at the big picture, we see that Microsoft insiders sold more than they bought over the last year.

You can see the insider transactions (by companies and individuals) over the last year, depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If this dampens your interest, you can check out the other side of the spectrum with this free list of growing companies that insiders are buying.

The last three months saw significant insider selling at Microsoft. In total, insiders dumped $21m worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Conclusion

While the fundamentals remain strong for Microsoft, it seems that the macro environment may be keeping both investors and insiders on the sidelines for the stock. When analyzing a stock like Microsoft, we want to see consistency between the fundamentals, investors' expectations on risk and the behavior of top management.

If you preferred to check out other companies, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion