- United States

- /

- Software

- /

- NasdaqGS:MSFT

Some Bubbles Stimulate Innovation - Why Microsoft Corporation (NASDAQ:MSFT) May be Undervalued

We looked at the U.S. Tech Sector and found that Software and Systems are still held in high regard by the market. In this analysis, we start from the Market valuation, go down the branches via the Software Industry and finally analyze Microsoft Corporation (NASDAQ:MSFT).

With this analysis, we want investors to get a better picture of what is expected from the industry and how this particular stock compares.

Here is a quick summary of our findings:

- Barring a geopolitical escalation, the U.S. market may actually be close to fair value.

- Bubbles can be found in industries with expected innovation, which may not be as damaging.

- Microsoft is slightly undervalued based on the P/E ratio, and is expected to keep innovation growth.

Market Valuation

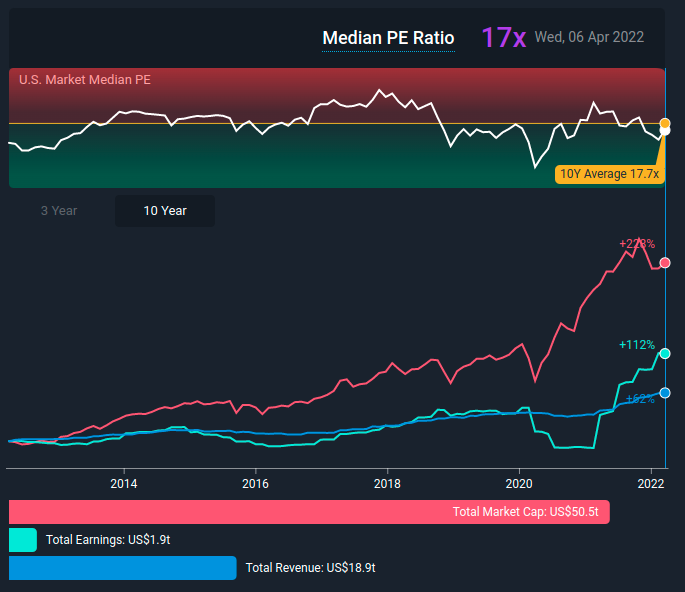

Starting from the top-down, we see the U.S. market has a current median P/E 16.8x which is close to the 10-Year average of 17.7x. On a relative basis, it seems that the market is close to fair value. However, current earnings are US$1.9t and the forecasted annual earnings growth is 13%. We can use these metrics to get an intrinsic value for the Market: Current Earnings * (1+ Future Growth) / Implied Enterprise Risk Premium = Market Value

Calculation: $1,9t × 1,13 ÷ 0,0475 = $45,2t

Based on this, the U.S. Market seems to be 10.5% overvalued, well within the margin of error. Keep in mind that if any of the mentioned estimates change in the future, then the valuation will also change.

Also, this approach shouldn't be used with markets that have an expectation of long future growth periods (like emerging markets) - What we are essentially doing is assuming that the U.S. will retain its projected earnings level and not grow much more.

You will notice on the chart above, that the market cap seems to indicate what some would call a "bubble". While this is true, here is something to consider: in 2021 the market was making-up for what was lost during 2021, which is why you can see the jump in earnings. Barring a large scale geopolitical deterioration, 2022 will likely result in a normalization of these earnings and the market may adjust down.

Now, there is one more relevant factor for the high market cap - speculation in the tech industry (as you will see below). One can argue that the market is funding new ideas that imply high growth, which, to be fair, may not materialize. However, bubbles are a feature, not necessarily a bug in the system, because they allow innovation to happen with the extra capital, and for a healthy economy we might want to be comfortable with some degree of "bubbles" as they may result in high future growth.

Continuing down the branch, we reach the Tech sector and the Software Industry.

Software Industry Valuation

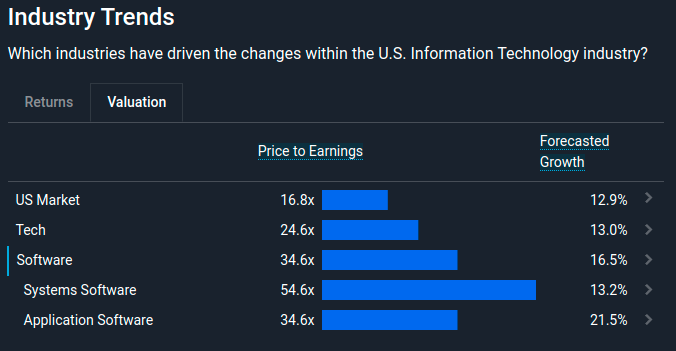

The industry market cap has risen some 96% in the last 3 years, while earnings grew 30%. This implies that the market is ahead of earnings and expects the industry to make-up for it with significant future growth.

Analysts are also expecting the industry to keep growing and forecast a 16.5% growth in earnings, with a 21.5% growth in the Application sub-category.

We can also see that both the general and app software P/E is about 34x, while the systems sub-category has a 54.6x P/E. This likely means that the systems industry is the most exposed to a correction, considering the low forecasted growth and the high difference from the 3-Year average P/E of 32x. For this reason, we will focus on App software stocks, as they may deliver high growth and are closer to historic P/E averages.

If you want to find stocks in the software industry, you can view our overview in the Markets section.

One of the stocks, that have lost some of their market cap, but have strong fundamentals in this industry is Microsoft Corporation (NASDAQ:MSFT), which is what we will evaluate next.

Microsoft's Relative Valuation

With a price-to-earnings (or "P/E") ratio of 31.5x Microsoft seems to be trading in-line, if not slightly under the Software Industry average.

The company has a high 38% net profit margin and a 30% return on capital employed (up from 18.7% 3 years ago). It is no wonder why investors are excited about this stock and is one of the hallmarks of the market. For investors, most of the returns from Microsoft come from the stock price gains, although the stock also has a modest 0.83% dividend.

View our latest analysis for Microsoft

As we noted before, a high P/E implies the expectation of future growth and innovation. That is why we need to compare the company's pricing with future growth expectations.

Looking ahead now, EPS is anticipated to climb by 14% per year during the coming three years according to the analysts following the company and revenue is also expected to climb at a slightly higher rate of 12.5% annually.

The massive profits, high margin, and positioning in a field where innovation is still possible make Microsoft a robust stock for investors.

Next Steps:

In order to get a better sense before making a decision, there are a few more important things to consider:

- Relative value is great, but try examining it together with Microsoft's intrinsic value to get a better picture.

- Microsoft's CEO Staya Nadella has managed to revitalize the company since taking the position, which is why a good management team is crucial for future success.

- After 12 months of insider selling, we noted the first small insider transaction that bought stock. These transactions can give hints to how management feels about the future of their stock.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

HAMR Time: Dominating the High-Capacity Cloud

The NAND Powerhouse Returns: Autonomy in the AI Era

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion