- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT) Joins Forces With DeepIQ To Revolutionize Energy Sector With Agentic AI

Reviewed by Simply Wall St

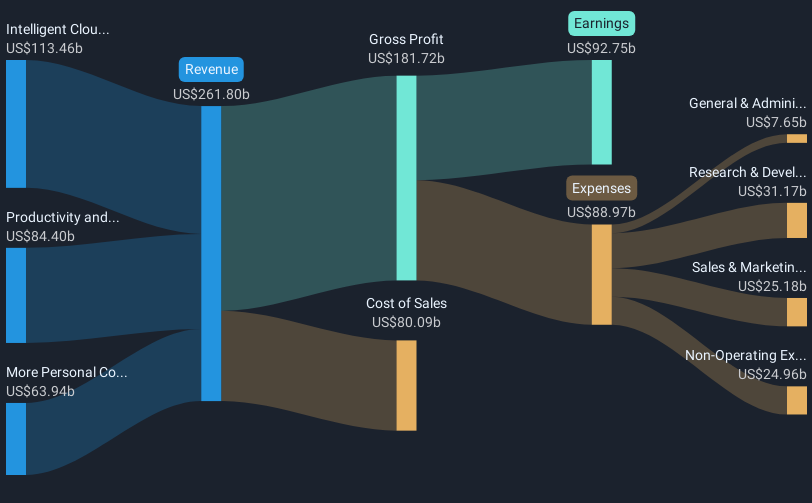

Microsoft (MSFT) has made significant strides in AI-driven collaborations, exemplified by its strategic alignment with DeepIQ and OMV Energy to enhance drilling operations using Agentic AI. This notable event coincided with a 7% share price increase for the company over the past quarter. The broader market also observed an upward trend, fueled by expectations of potential interest rate cuts following soft labor market data. Microsoft's earnings report, along with a range of new partnerships and product announcements, likely added positive momentum to this performance. Despite mixed sector trends, Microsoft's AI and technology focus underscores its market resilience.

Be aware that Microsoft is showing 1 possible red flag in our investment analysis.

The recent advancements in Microsoft's AI-driven collaborations, such as those with DeepIQ and OMV Energy, enhance the narrative of the company's focus on integrating AI and cloud services to drive future growth. This initiative, which coincided with a rise in Microsoft's share price, aligns well with its core strategy of expanding AI capabilities and could potentially enhance revenue streams and usage intensity. As these AI ventures mature, they may contribute positively to Microsoft's earnings forecasts.

Over the past five years, Microsoft's total shareholder return, encompassing share price gains and dividends, reached 156.63%. This significant long-term performance showcases its capacity to generate substantial returns for investors. Despite the impressive five-year performance, Microsoft's annual return was below the US Software industry's one-year growth of 28%, reflecting sector-specific challenges.

The company's current share price of US$505.35, when compared to the consensus price target of approximately US$613.89, indicates a potential upside. This suggests that there is room for further appreciation, provided the firm's AI and cloud initiatives continue to deliver on growth expectations and align with analyst forecasts. Future revenue growth, accelerated by these strategic partnerships, is likely to underpin continued investor interest and confidence in Microsoft's long-term prospects.

Gain insights into Microsoft's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives