- United States

- /

- Software

- /

- NasdaqGS:MNDY

Is monday.com Set for a Rebound After 34% Drop in 2024?

Reviewed by Bailey Pemberton

If you’re scratching your head over what to do with monday.com stock, you’re not alone. This enterprise software standout has been on quite the ride, sometimes up, sometimes tumbling down. Over the past year, shares have slid more than 34.2%, with a 20.3% dip since the start of the year. If you zoom out, though, the story is very different. monday.com is still up an impressive 95.8% over the last three years, signaling that long-term believers have seen significant growth, even if feelings lately have been mixed.

Global shifts in digital transformation have certainly played their part, sharpening investor attention on workflow automation and remote collaboration tools. When the broader tech sector rallies, monday.com tends to ride the wave, but it is also sensitive to changes in risk appetite. While short-term weakness might make some investors nervous, others see it as a window of opportunity to step in at a better price.

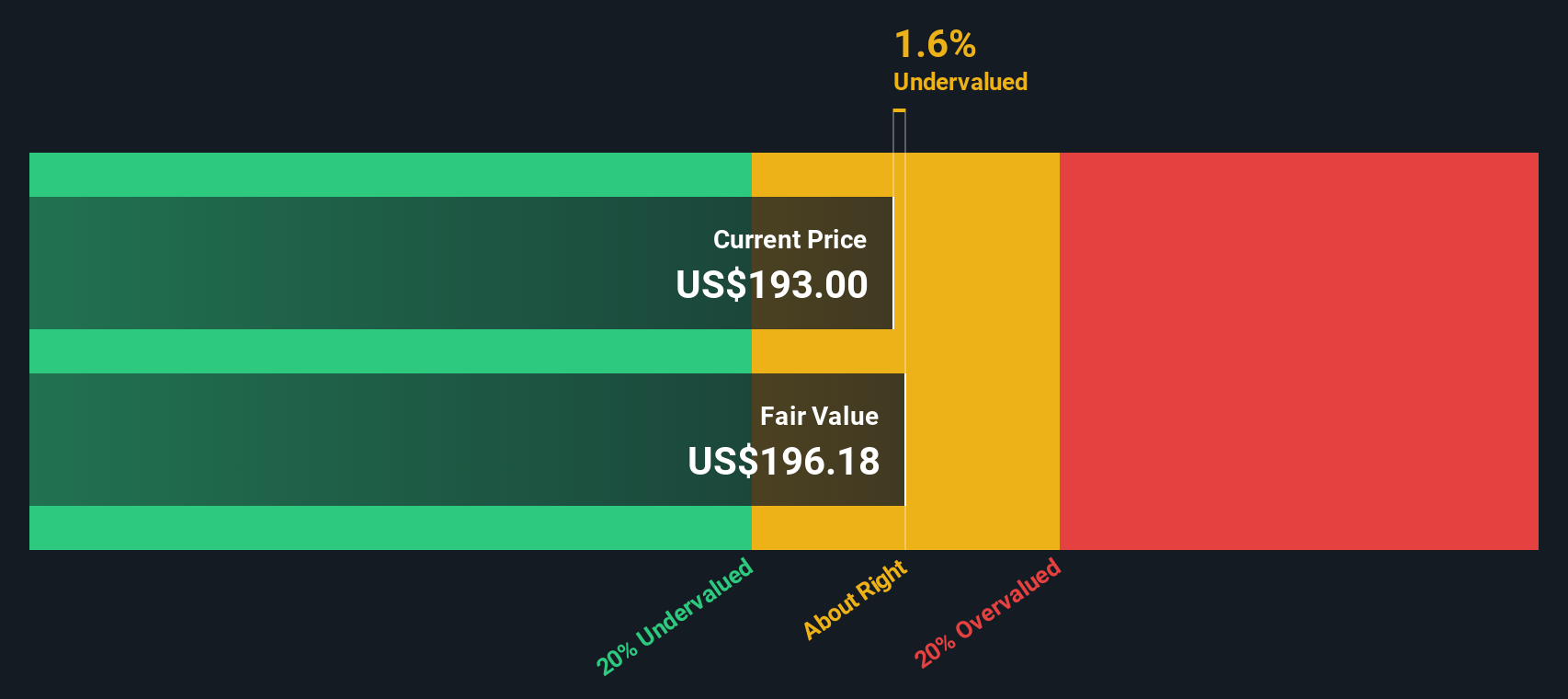

Valuation, of course, is the heart of that decision. Our value score skips the guesswork and looks at concrete numbers: monday.com scores a 3 out of 6, meaning it is undervalued in half the key checks we use. Curious what goes into that score? Let’s dive into the valuation methods. At the end, I will share an even sharper lens for thinking about what monday.com might really be worth.

Why monday.com is lagging behind its peers

Approach 1: monday.com Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's terms. This approach helps investors understand what a business might be worth based on its ability to generate cash over time.

For monday.com, the current Free Cash Flow (FCF) stands at $321.8 Million. According to analysts, FCF is expected to grow rapidly in the coming years, reaching $795 Million by 2029. These projections are based on both analyst forecasts and further extrapolation, painting a picture of strong potential for ongoing growth.

Using these cash flow projections, the DCF model estimates monday.com's fair value at $219.71 per share. This figure is about 16.2% higher than the current share price, suggesting the stock is undervalued based on its future cash-generating prospects.

In short, the DCF analysis points to monday.com having meaningful upside if the business can deliver on these growth expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests monday.com is undervalued by 16.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: monday.com Price vs Sales

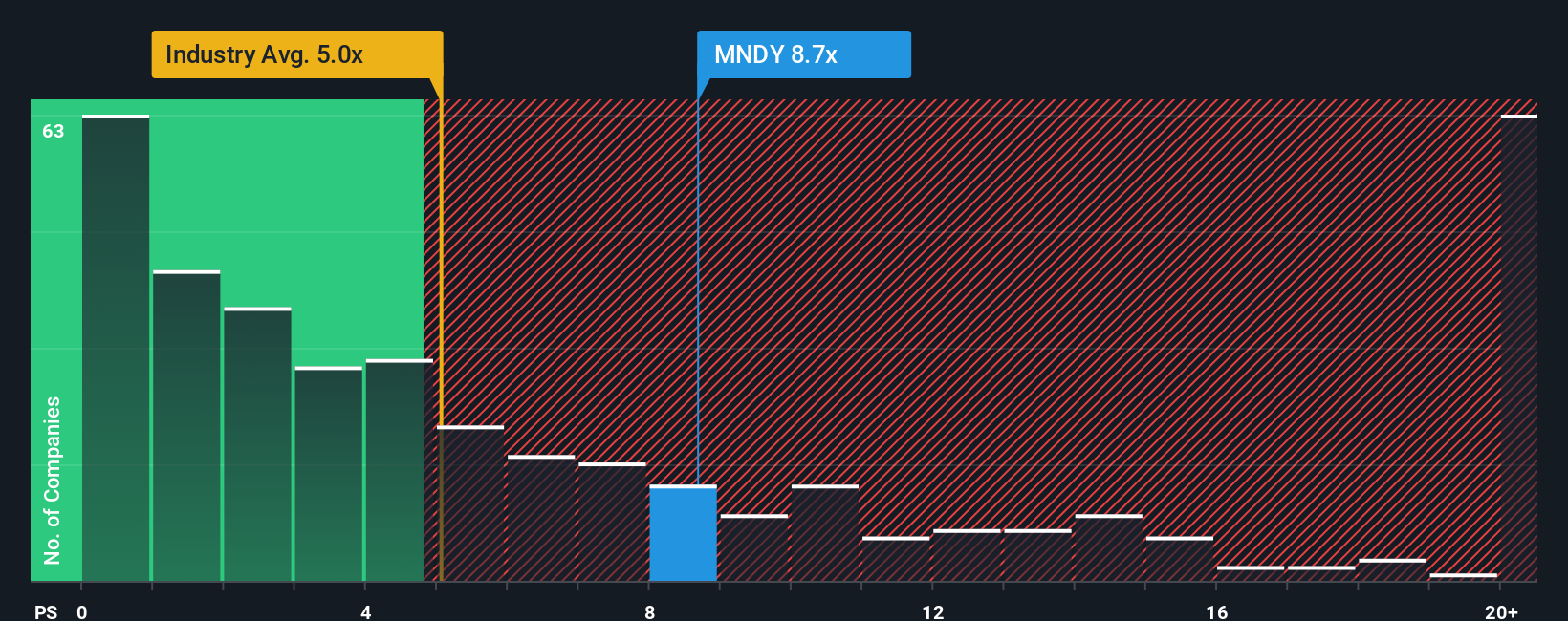

When analyzing companies with strong revenue growth but minimal or unpredictable profits, the Price-to-Sales (P/S) multiple serves as a valuable valuation tool. This is especially true for technology and software firms like monday.com, where reinvesting heavily for future expansion may keep current earnings low. This can signal significant growth potential ahead.

The P/S ratio essentially compares a company’s market value to its total sales and acts as a rough gauge of how much investors are willing to pay for every dollar of revenue. A higher P/S often reflects strong growth expectations, but it can also signal greater risk if those expectations do not materialize. In monday.com's case, the current P/S multiple stands at 8.63x, which is above the software industry average of 5.35x and higher than its peer group’s average of 7.22x. This premium may reflect the company’s robust topline growth and industry-leading platform.

To refine the analysis, Simply Wall St uses a proprietary “Fair Ratio” model. This model incorporates factors like revenue growth, profit margin, risk, market capitalization, and industry dynamics. Unlike simple peer or industry comparisons, this Fair Ratio reflects a more tailored benchmark for what a reasonable P/S should be for monday.com in its current context. The Fair Ratio for monday.com is calculated at 11.87x.

Since monday.com's current P/S of 8.63x is well below its Fair Ratio, the stock appears undervalued on this metric. This suggests investors may be underappreciating its growth prospects when compared to the fundamentals and market dynamics.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your monday.com Narrative

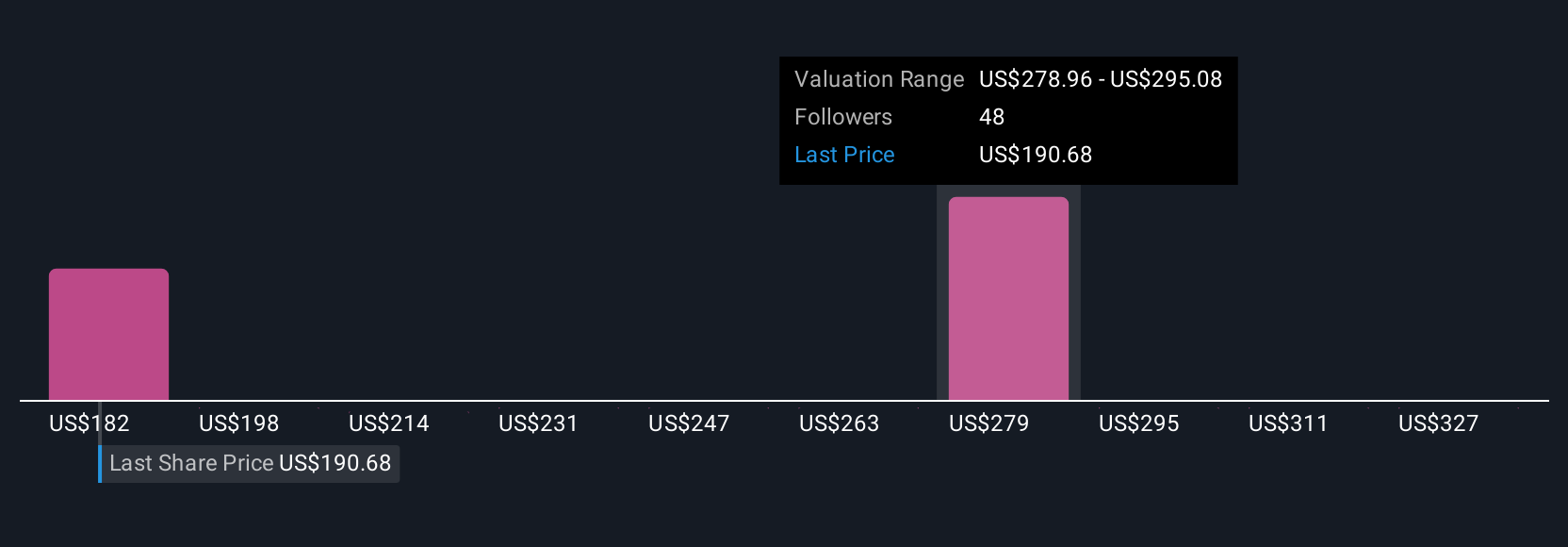

Earlier, we mentioned there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your story about a company, combining your perspective on its future with the numbers you expect, like fair value, revenue, and profit margins. Narratives bridge the gap between a company's unfolding story and the financial forecasts that drive its share price. This creates a direct link from your research to a clear view of what you think the stock is worth.

On Simply Wall St’s Community page, millions of investors easily build and share Narratives for companies like monday.com. Narratives update in real time when news or earnings drop, helping you see how changes impact your estimated fair value and whether you think the market price is genuinely attractive at that moment. By comparing your Fair Value to the current market Price, Narratives make it easy to decide when you would buy, hold, or sell.

For example, some investors believe AI-powered innovation will accelerate monday.com's growth, setting a fair value as high as $450. Others, more cautious about competition, peg it closer to $205. Narratives make these perspectives transparent and actionable, so you can invest with clarity and confidence.

Do you think there's more to the story for monday.com? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives