- United States

- /

- Software

- /

- NasdaqGS:MNDY

Can monday.com’s (MNDY) Premium Valuation Be Justified by Its Growth Story and Cash Strength?

Reviewed by Sasha Jovanovic

- In recent days, monday.com reported another quarter of revenue and earnings that exceeded analyst expectations, with forecasts indicating double-digit growth ahead and analysts highlighting the company's strong net cash position and enterprise contract momentum.

- This outperformance in business fundamentals comes despite mixed analyst ratings, as some cite monday.com's higher valuation compared to peers as a risk even while long-term growth projections remain robust.

- Following ongoing earnings surprises and outlook upgrades, we’ll explore how monday.com's sustained growth and premium valuation shape its current investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

monday.com Investment Narrative Recap

If you’re holding monday.com, you’re likely betting on the power of cloud software and AI-driven productivity in a world increasingly shaped by hybrid work. While upbeat quarterly results and continued enterprise momentum reinforce this investment thesis, the most important short-term catalyst remains the company’s ability to sustain large contract wins, with valuation concerns now the most significant risk. The latest results do not materially shift this balance in the near term, as strong fundamentals are countered by premium pricing.

Of the recent developments, monday.com’s unveiling of new AI features, such as monday agents and expanded workflow automation tools, stands out most. This innovation aligns directly with the push to differentiate in a crowded market, helping to strengthen the key catalyst of broadening enterprise adoption. If executed well, these advances could help offset pressure from competition and support higher-value contracts, reinforcing the core narrative underpinning recent results.

But for those considering new positions, it’s important to contrast the growth story with the reality that shares continue to trade well above peer multiples, so while strong business execution is encouraging, investors should be aware of...

Read the full narrative on monday.com (it's free!)

monday.com's narrative projects $2.0 billion in revenue and $157.5 million in earnings by 2028. This requires 22.9% yearly revenue growth and a $117.5 million earnings increase from $40.0 million currently.

Uncover how monday.com's forecasts yield a $272.35 fair value, a 44% upside to its current price.

Exploring Other Perspectives

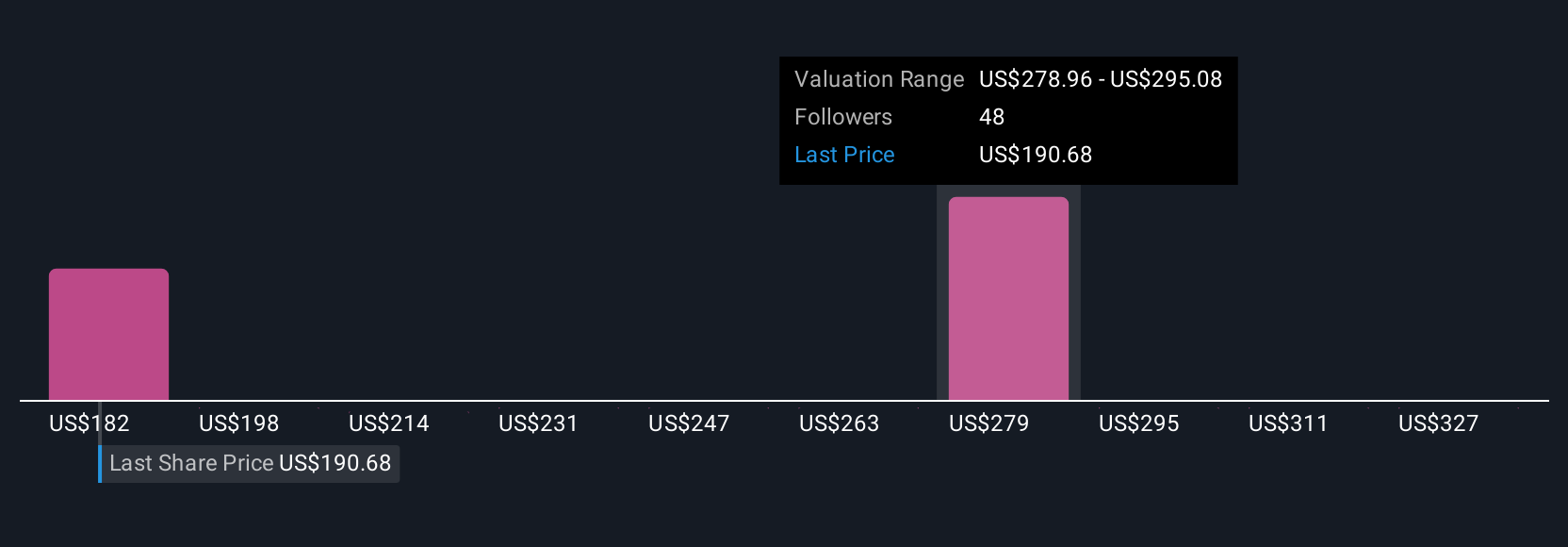

Simply Wall St Community members offered 14 fair value estimates for monday.com, from US$182.25 to US$343.44 per share, revealing widespread differences in outlook. Many focus on the risks around premium multiples compared to peers, suggesting you may want to weigh a full range of views before making your own judgment.

Explore 14 other fair value estimates on monday.com - why the stock might be worth just $182.25!

Build Your Own monday.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your monday.com research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free monday.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate monday.com's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives