- United States

- /

- IT

- /

- NasdaqCM:MLGO

MicroAlgo (MLGO): Evaluating Valuation After S&P Global BMI Index Inclusion

MicroAlgo (NasdaqCM:MLGO) just scored a highly visible milestone by being added to the S&P Global BMI Index. If you have been following the company, you already know that this sort of index inclusion can bring in fresh attention from institutional investors and fund managers. For those on the fence about the stock, the big question now is whether this event is a game-changer or just another headline in a volatile year.

This development comes after a string of mixed returns for MicroAlgo, with the stock climbing nearly 19% over the month but still down sharply over the year. The larger context is hard to ignore, as the share price remains deep in negative territory despite this recent increase. Momentum may be stirring anew, and a major index listing is often a chance for a company to shift the narrative, even if just temporarily.

With that in mind, is MicroAlgo trading at a discount with new growth ahead, or are investors getting ahead of the fundamentals by bidding the stock up after the index news?

Price-to-Earnings of 16.7x: Is it justified?

Based on the Price-to-Earnings (P/E) ratio, MicroAlgo currently trades at 16.7 times its earnings, a significantly lower multiple compared to both its peer average of 55.5x and the US IT industry average of 31.3x. This suggests that the market values MicroAlgo's earnings at a substantial discount relative to similar companies in the sector.

The Price-to-Earnings ratio is a key benchmark for investors evaluating tech companies, as it reflects how much investors are willing to pay for each dollar of profit. Lower ratios may signal undervaluation or questions about future growth, while higher ratios often indicate strong growth expectations.

The meaning is clear: if MicroAlgo can deliver sustainable earnings, the current multiple could signal a bargain. However, the low valuation may also reflect market skepticism about the company's growth prospects, recent volatility, or other underlying risks.

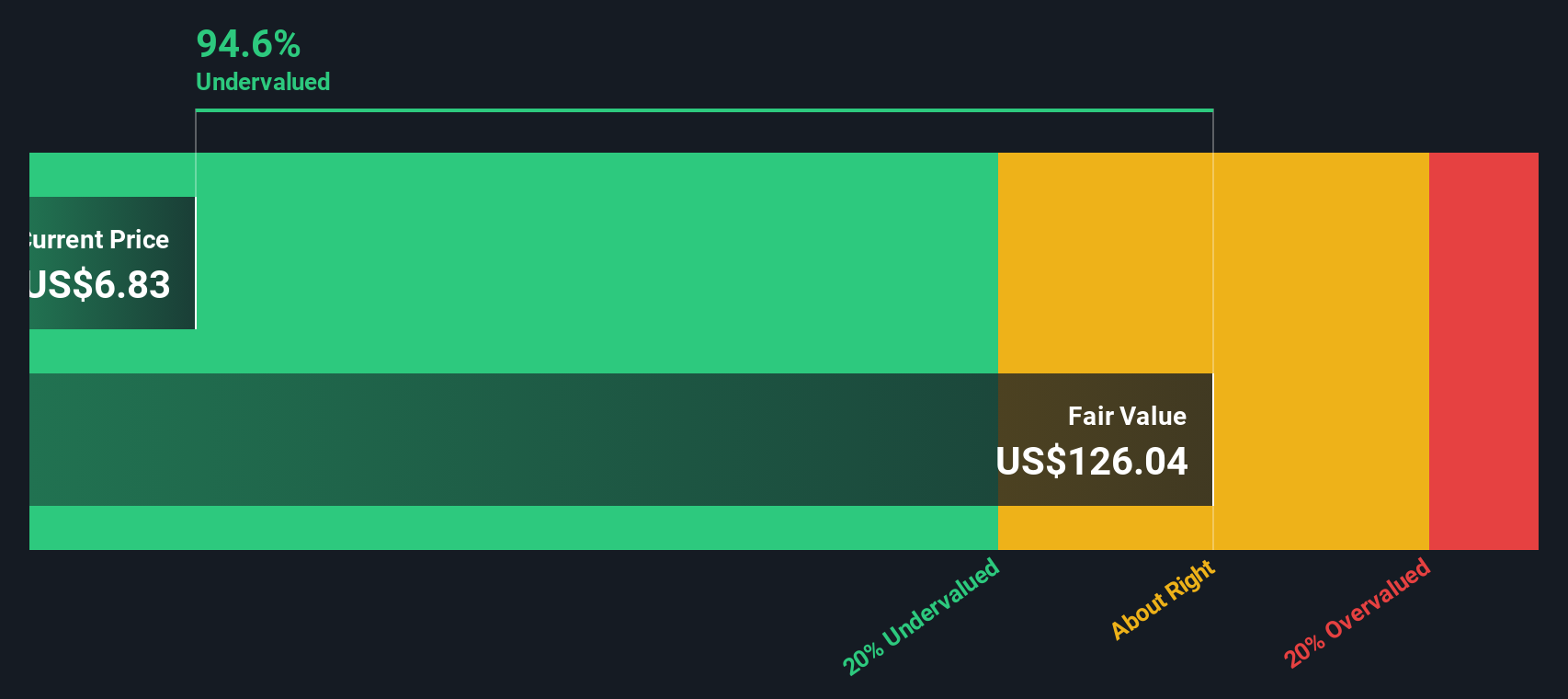

Result: Fair Value of $127.38 (UNDERVALUED)

See our latest analysis for MicroAlgo.However, weak long-term returns and stalled growth in revenues or profits could challenge the bullish case, even after a positive index inclusion headline.

Find out about the key risks to this MicroAlgo narrative.Another View: What Does the SWS DCF Model Say?

Looking from a different angle, our DCF model also indicates that MicroAlgo is trading below its estimated fair value, echoing the conclusion reached by comparing earnings multiples. But does this agreement make the undervaluation story any more convincing? Or is there something both methods could be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MicroAlgo Narrative

If you feel the story told here does not match your own outlook, you can easily run your own analysis and uncover fresh angles in just minutes. Do it your way

A great starting point for your MicroAlgo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors never settle for just one idea. Broaden your perspective and get ahead by tapping into stocks positioned for the next big wave. Check out these powerful ideas you do not want to overlook:

- Supercharge your portfolio with companies at the forefront of artificial intelligence breakthroughs by seeking out AI penny stocks.

- Target exceptional long-term returns by finding hidden gems trading below their real worth using our list of undervalued stocks based on cash flows.

- Boost your income with shares offering robust payouts and stability through our handpicked picks of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MLGO

MicroAlgo

Develops and applies central processing algorithm solutions to customers in internet advertisement, gaming, and intelligent chip industries in the People’s Republic of China, Hong Kong, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

ESPN’s NFL Power Play: How Disney’s Sports Engine Could Drive the Next Leg of Stock Growth

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!