- United States

- /

- Software

- /

- NasdaqCM:MITK

Mitek Systems (MITK): Revisiting Valuation After Mixed Earnings, Strong 2025 Guidance and Recent Share Price Rebound

Reviewed by Simply Wall St

Mitek Systems (MITK) just released fresh earnings and 2025 guidance, and the headline is a mixed picture: steady revenue growth with sharply higher full-year profit, but a weaker quarterly bottom line.

See our latest analysis for Mitek Systems.

The earnings update seems to have reminded investors of Mitek’s steady progress, with the 1 month share price return of 12.15% lifting the latest share price to $10.06, even as the 5 year total shareholder return remains deeply negative and longer term momentum is still rebuilding.

If this kind of rebound story has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as another way to uncover potential growth ideas with aligned insiders.

With shares still trading at a steep discount to analyst targets despite modest growth and improving profitability, the key question now is whether Mitek is genuinely undervalued or whether markets are already pricing in its future gains.

Most Popular Narrative Narrative: 22.6% Undervalued

With the most followed narrative pointing to fair value above the current $10.06 share price, the spotlight shifts to the growth and profitability assumptions behind that gap.

Ongoing shift towards SaaS and recurring revenue models (now at 41% of trailing 12 month revenue and growing) is steadily improving predictability, while the company's focus on operational discipline and automation has driven service gross margin improvements of up to 200 basis points year over year, indicating enhanced long term net margin potential.

Curious how modest top line growth, rising margins and a richer future earnings multiple can still justify a higher price tag? The full narrative unpacks the revenue mix shift, embeds detailed margin trajectories and leans on a premium valuation multiple that may surprise you. Want to see exactly which profit and share count assumptions power that outlook and how they add up to today’s fair value call?

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in check usage and intensifying competition in digital identity could erode revenue streams and challenge the optimistic valuation narrative.

Find out about the key risks to this Mitek Systems narrative.

Another Lens on Valuation

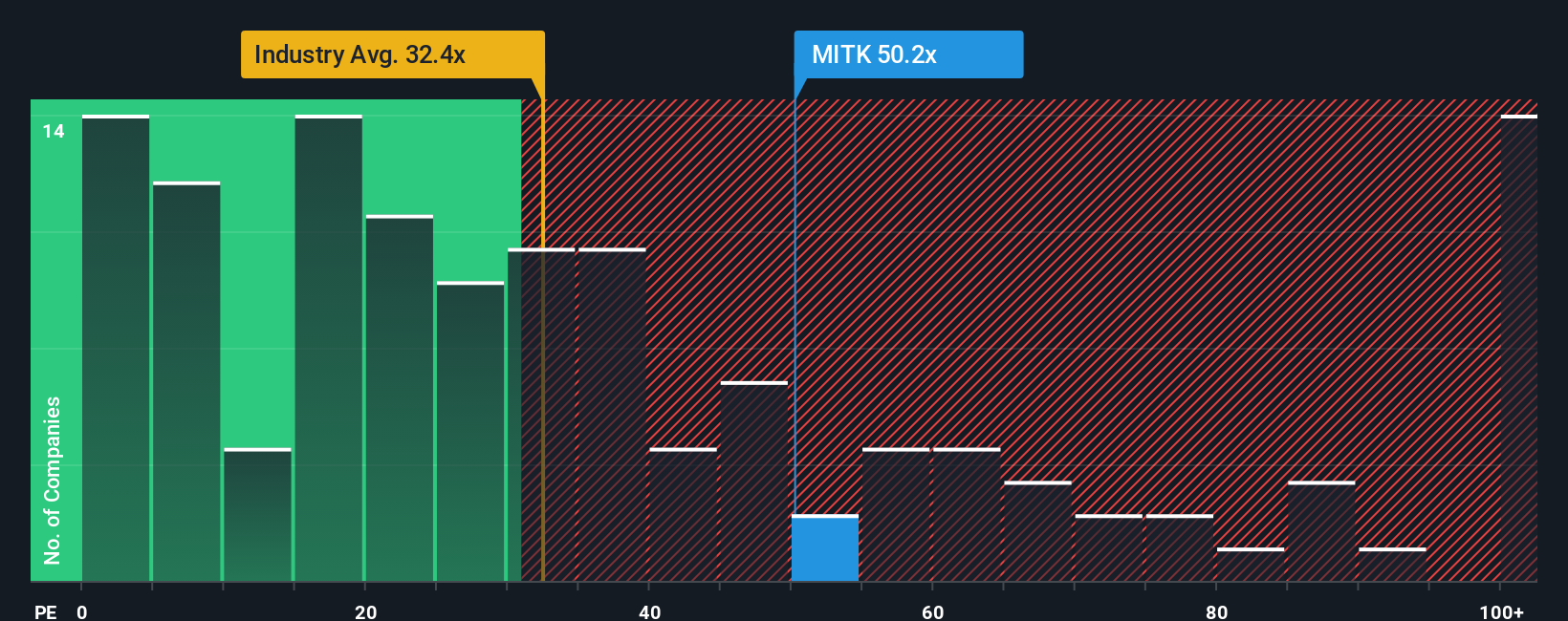

While the narrative suggests Mitek is 22.6% undervalued, our ratio based view tells a different story. At a 52.3x price to earnings, the stock trades well above the US software sector on 32.9x and peers around 19.8x, and even above a 28.5x fair ratio that the market could drift toward, which would mean painful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitek Systems Narrative

If your view differs or you prefer digging into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mitek Systems.

Looking for more investment ideas?

Before you move on, lock in your next moves with targeted stock ideas from the Simply Wall Street Screener, so you are not chasing opportunities after they run.

- Capitalize on fast moving market inefficiencies by scanning these 908 undervalued stocks based on cash flows where solid fundamentals and attractive prices still align.

- Ride powerful innovation trends by zeroing in on these 26 AI penny stocks that harness automation, data, and machine learning to accelerate growth.

- Strengthen your income strategy by filtering for these 13 dividend stocks with yields > 3% that can potentially support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MITK

Mitek Systems

Provides digital identity verification and fraud prevention solutions worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)