- United States

- /

- Software

- /

- NasdaqCM:MITK

Mitek Systems (MITK) EPS Rebound and 4.9% Margin Bolster Bullish Profitability Narrative

Reviewed by Simply Wall St

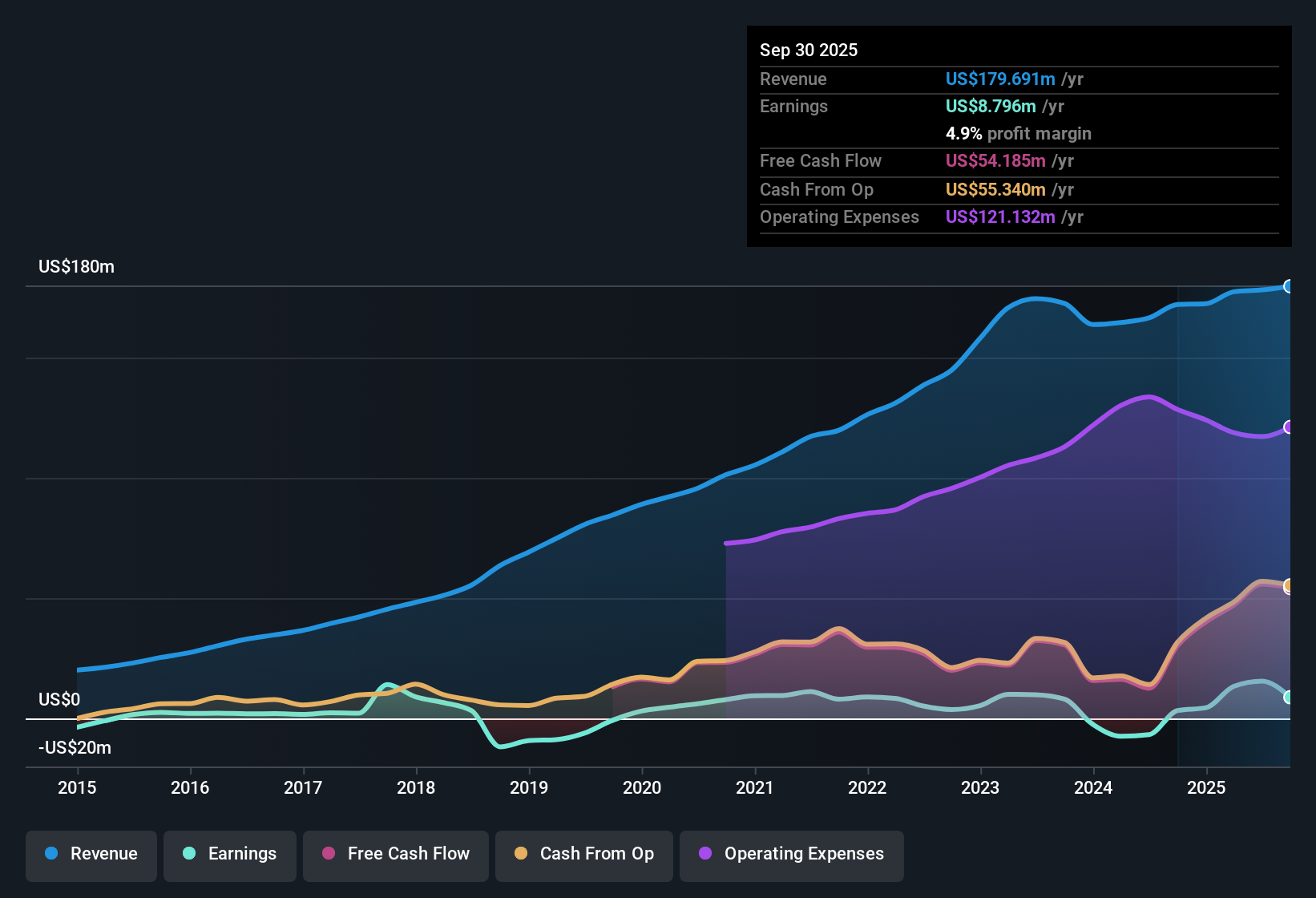

Mitek Systems (MITK) closed out FY 2025 with Q4 revenue of about $44.8 million, basic EPS of roughly $0.04, and net income of $1.9 million, capping a year in which trailing EPS climbed 168.3% year over year and net margin stepped up from 1.9% to 4.9% on a $179.7 million revenue base. The company has seen quarterly revenue move from $43.2 million and EPS of about $0.19 in Q4 2024 to a $51.9 million revenue high and EPS of roughly $0.20 in Q2 2025 before easing back in Q3 and Q4. This sets up a picture of recovering profitability that investors will now weigh against the promise of mid 20s % earnings growth and modest top line expansion.

See our full analysis for Mitek Systems.With the latest results on the table, the next step is to set these numbers against the prevailing narratives around Mitek to see which storylines hold up and which ones the new margin profile starts to challenge.

See what the community is saying about Mitek Systems

Margins Rebound to 4.9% Despite Choppy Quarters

- On a trailing basis, net income reached about 8.8 million on 179.7 million of revenue in FY 2025, taking net margin to 4.9% versus 1.9% a year earlier, even though quarterly EPS swung from roughly 0.20 in Q2 to about 0.04 in Q4.

- Consensus narrative leans bullish on Mitek’s operating leverage, and the numbers partly back that up while also showing some bumps:

- Profitability looked strongest when quarterly revenue peaked at about 51.9 million in Q2 2025, with EPS near 0.20, but Q1 still showed a loss with EPS around negative 0.10 on 37.3 million of revenue.

- Over the last 12 months, the move from 3.3 million to roughly 8.8 million of trailing net income supports the idea of better margin potential, yet the quarter to quarter volatility means that scaling to the levels discussed for fiscal 2026 and beyond is not a straight line.

EPS Surge Meets Weak Five Year Trend

- Trailing EPS has climbed to about 0.19, a 168.3% year over year jump, while the five year earnings trend still shows an annualized decline of 8.6% even after this rebound.

- Bulls highlight the strong one year earnings growth and forecasts of about 25.5% annual EPS expansion, and the trailing data gives them real, but not unqualified, support:

- On the positive side, trailing EPS moved from roughly 0.07 to 0.19 and trailing net income rose from about 3.3 million to 8.8 million, which aligns with the idea that earnings can compound faster than revenue.

- At the same time, quarterly figures still range from a loss of about 4.6 million in Q1 2025 to 9.2 million of net income in Q2 2025, so the longer term decline of 8.6% per year in five year earnings remains a clear counterpoint to the bullish growth story.

Rich 52.2x P/E Versus DCF Upside

- At a share price of 10.06, the stock trades on a 52.2x P/E, above the US Software industry at 32.7x and peers at 19.8x. However, compared with a DCF fair value of about 18.55 and an analyst target of 13.00, the price still sits meaningfully below both valuation reference points.

- Bears focus on the high multiple and slower 6.3% forecast revenue growth, and the data gives them several concrete sticking points:

- With earnings expected to grow around 25.5% per year but revenue modeled at only 6.3% per year, skeptics question whether margin gains can keep stretching enough to justify paying a premium P/E multiple versus the sector.

- The combination of a 52.2x P/E and a trailing net margin of just 4.9% means any stumble back toward the weaker five year earnings trend could pressure the share price even if the DCF fair value and the 13.00 analyst target currently point to upside from 10.06.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mitek Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test that view against the full dataset and turn it into your own narrative: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mitek Systems.

Explore Alternatives

Mitek’s rich valuation, uneven quarterly earnings, and modest revenue growth leave little room for error if margin gains stall or reverse.

If that trade off feels too tight, use our stable growth stocks screener (2103 results) to quickly focus on companies already showing steadier earnings and revenue momentum through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MITK

Mitek Systems

Provides digital identity verification and fraud prevention solutions worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)