- United States

- /

- Software

- /

- NasdaqGS:MGIC

Magic Software Enterprises (MGIC) Is Up 7.4% After Earnings Beat and Dividend Reveal Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, Magic Software Enterprises reported quarterly earnings per share above analyst expectations and announced a semi-annual dividend to be paid on October 22, available to shareholders of record as of October 6.

- This combination of earnings outperformance and dividend news provided fresh evidence of the company’s operational momentum and shareholder return focus.

- We'll now explore how the above-consensus earnings serve to reinforce Magic Software Enterprises' investment narrative and analyst outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Magic Software Enterprises Investment Narrative Recap

To be a shareholder in Magic Software Enterprises, you need to believe that the company’s ability to consistently grow revenue, supported by strength in cloud and AI services, expanding partnerships, and resilient results from key geographies, can deliver solid earnings and reliable shareholder returns. The recent earnings beat and dividend confirmation reinforce confidence in the short-term momentum but do not meaningfully alter the significance of the proposed Matrix merger as the main near-term catalyst, nor the ongoing risk from SEC filing delays.

Among the latest corporate actions, the announcement of a higher semi-annual dividend is most relevant, signaling ongoing management commitment to returning profits directly to shareholders. However, while this can reinforce positive sentiment, investors continue to watch for updates on the Matrix acquisition, which remains central to expectations for future scale and operational leverage.

On the other hand, unresolved delays in SEC filings remain a critical detail that investors should be aware of...

Read the full narrative on Magic Software Enterprises (it's free!)

Magic Software Enterprises' outlook forecasts $708.7 million in revenue and $64.8 million in earnings by 2028. This is based on a projected 6.6% annual revenue growth rate and an earnings increase of $26.4 million from the current earnings of $38.4 million.

Uncover how Magic Software Enterprises' forecasts yield a $18.00 fair value, a 13% downside to its current price.

Exploring Other Perspectives

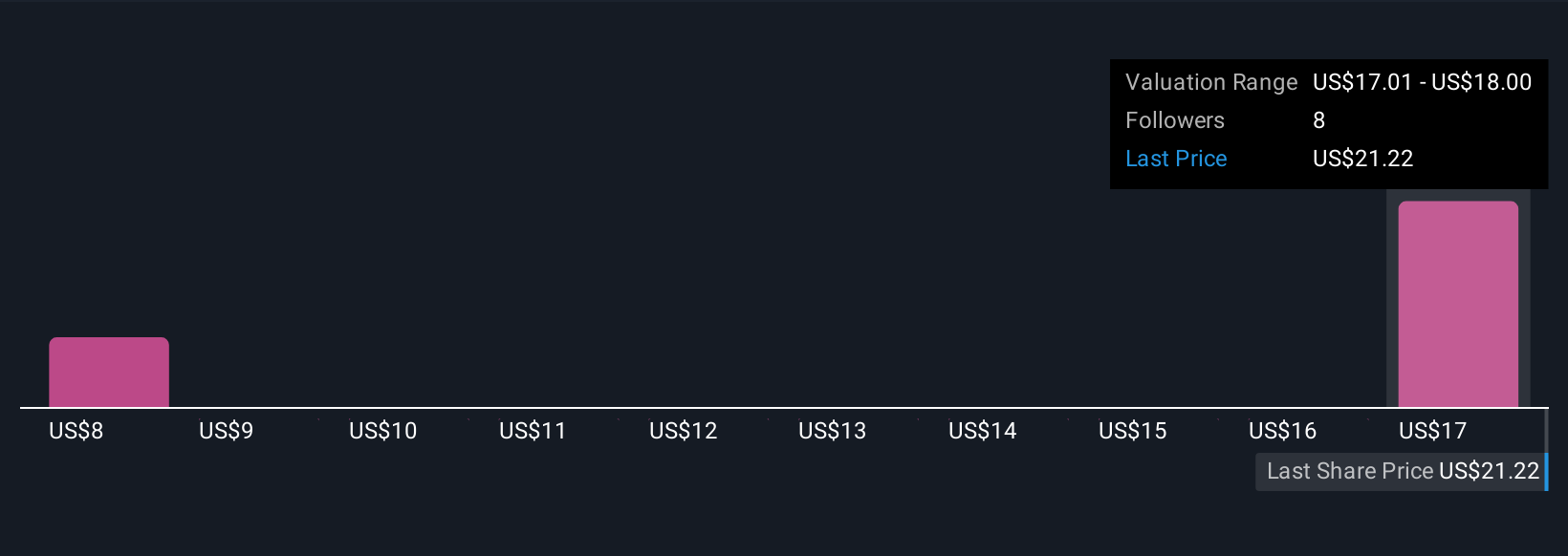

Two community members on Simply Wall St see fair value for Magic Software Enterprises as spread between US$8.00 and US$18.00 per share. While optimism centers on merger-driven potential, you will find a wide spread of investor forecasts, all grounded in their own revenue and earnings assumptions.

Explore 2 other fair value estimates on Magic Software Enterprises - why the stock might be worth less than half the current price!

Build Your Own Magic Software Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magic Software Enterprises research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magic Software Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magic Software Enterprises' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives