- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Magic Software Enterprises And 2 Other Dividend Stocks To Consider

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 2.8% in the last 7 days and achieving a 9.3% increase over the past year, with earnings projected to grow by 14% annually in the coming years. In this environment, dividend stocks like Magic Software Enterprises offer potential stability and income growth opportunities for investors seeking to balance risk and reward.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.81% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.08% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.15% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.95% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.56% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.94% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.94% | ★★★★★☆ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.86% | ★★★★★☆ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.26% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.15% | ★★★★★☆ |

Click here to see the full list of 150 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services in Israel and internationally with a market cap of $698.68 million.

Operations: Magic Software Enterprises Ltd. generates revenue through its proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings across both domestic and international markets.

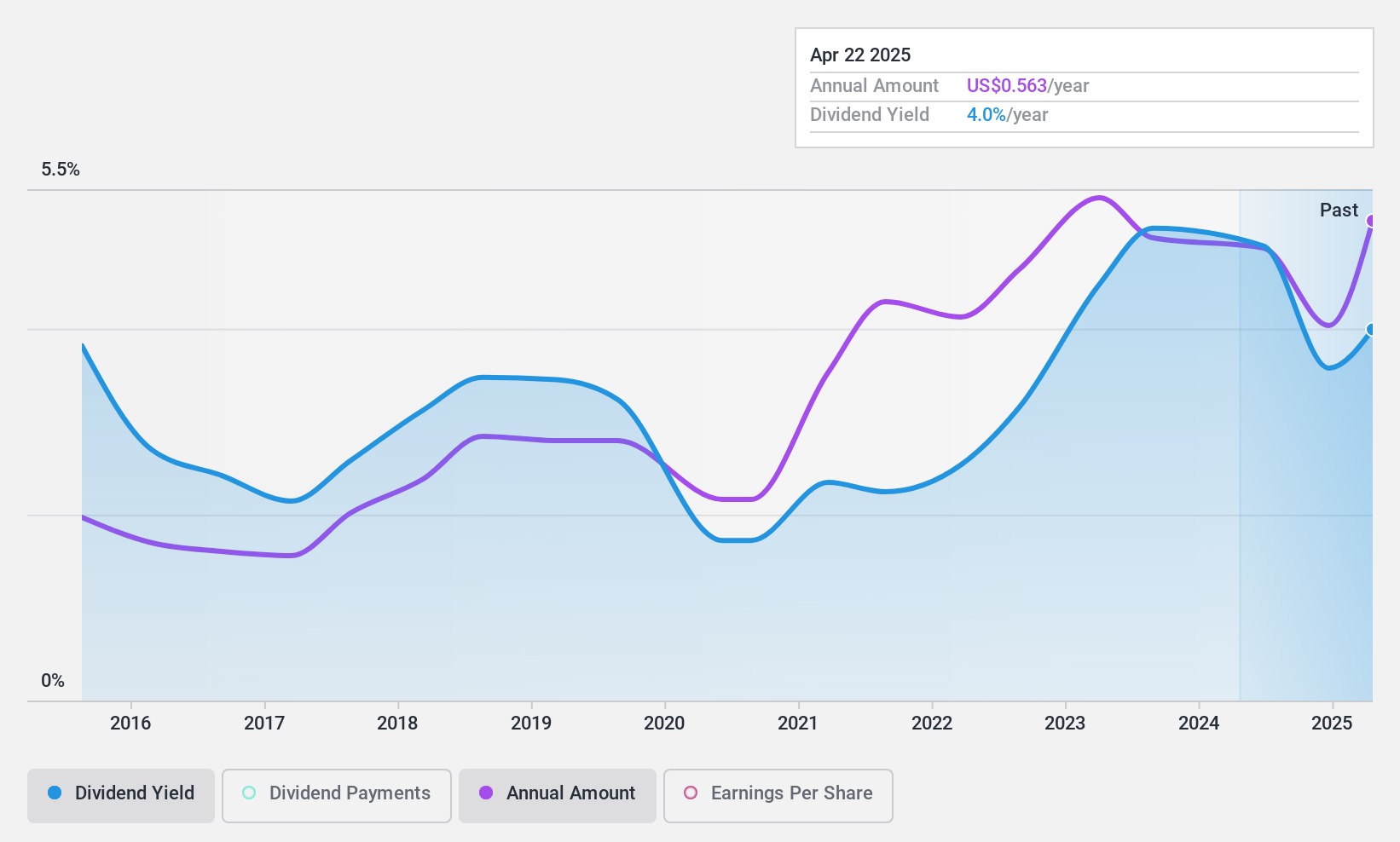

Dividend Yield: 4%

Magic Software Enterprises has shown a commitment to dividend payouts, recently declaring a semi-annual cash dividend totaling US$16.1 million. While its dividends are well-covered by both earnings and cash flows, the company's track record is unstable, with volatile payments over the past decade. The stock trades at 30% below fair value estimates but faces uncertainty due to delayed SEC filings and an impending merger with Matrix I.T Ltd., which may affect its future as a public entity.

- Click to explore a detailed breakdown of our findings in Magic Software Enterprises' dividend report.

- Our valuation report unveils the possibility Magic Software Enterprises' shares may be trading at a discount.

Spok Holdings (NasdaqGS:SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., operating through its subsidiary Spok, Inc., offers healthcare communication solutions across multiple regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of $334.30 million.

Operations: Spok Holdings, Inc. generates revenue primarily from its Clinical Communication and Collaboration Business, which accounted for $139.04 million.

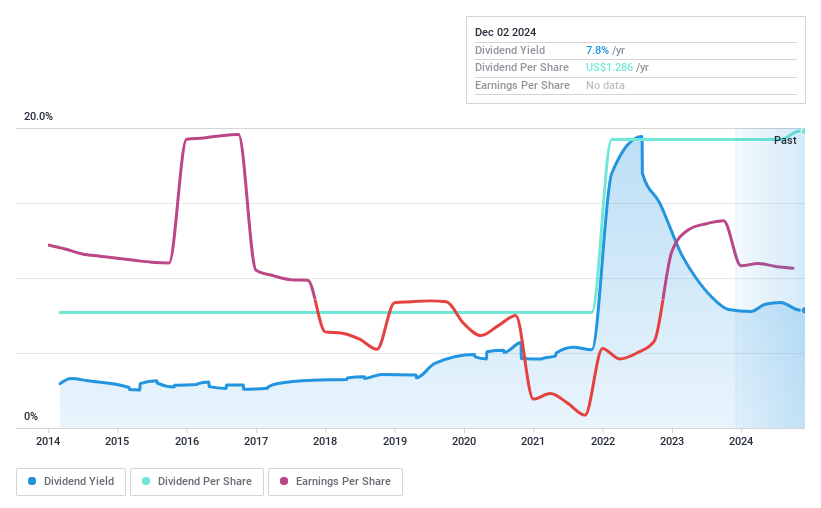

Dividend Yield: 7.7%

Spok Holdings declared a quarterly dividend of US$0.3125 per share, maintaining stability in its payouts over the past decade. However, with a high payout ratio of 159.4% and cash payout ratio of 98.5%, dividends are not well-covered by earnings or cash flows, raising sustainability concerns despite being among the top 25% dividend payers in the US market. Recent earnings showed modest growth with Q1 revenue at US$36.29 million compared to US$34.91 million last year.

- Click here to discover the nuances of Spok Holdings with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Spok Holdings is trading behind its estimated value.

Costamare (NYSE:CMRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Costamare Inc. owns and operates containerships and dry bulk vessels globally, with a market cap of approximately $1.15 billion.

Operations: Costamare Inc.'s revenue is primarily derived from its Container Vessels segment, generating $864.55 million, and its Dry Bulk Vessels segment, contributing $197.71 million.

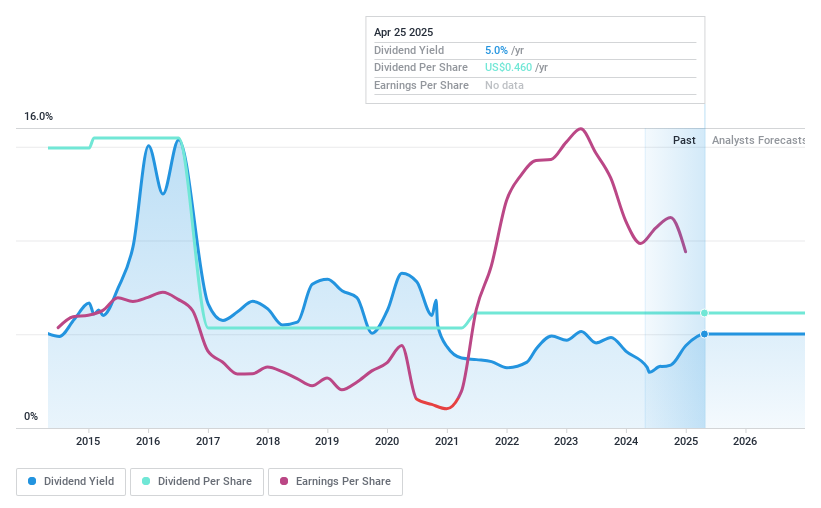

Dividend Yield: 4.8%

Costamare's dividend yield is among the top 25% in the US market, supported by low payout ratios of 18.9% for earnings and 21.5% for cash flows, indicating solid coverage. However, its dividends have been volatile over the past decade. The company recently announced a spin-off of its dry bulk business into Costamare Bulkers Holdings Limited, with shares distributed to existing shareholders on May 6, 2025. Despite lower profit margins compared to last year, revenue increased significantly to US$2.08 billion in 2024 from US$1.51 billion in the previous year.

- Navigate through the intricacies of Costamare with our comprehensive dividend report here.

- According our valuation report, there's an indication that Costamare's share price might be on the cheaper side.

Turning Ideas Into Actions

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 147 more companies for you to explore.Click here to unveil our expertly curated list of 150 Top US Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives