- United States

- /

- IT

- /

- NasdaqGM:MDB

MongoDB (MDB): Evaluating Valuation After Q2 Earnings Beat and Raised Growth Outlook

Reviewed by Simply Wall St

MongoDB (MDB) just released its second quarter financial results, and there is plenty for investors to unpack. Not only did the company post strong revenue growth compared to last year, but it also trimmed its net loss, which is always a positive sign for a high-growth tech name. Management followed up the results with fresh guidance for the next quarter and the full year, signaling they see the growth story continuing. With the earnings report out, all eyes are now on how the market will interpret these updates.

These updates come after a stretch where MongoDB’s stock has already moved up 13% over the past year and over 32% since January, reflecting solid momentum. Even more recently, shares rose more than 54% in the past month, a sign that optimism has picked up in anticipation of or in response to the latest earnings and guidance. The company has also completed a $200 million share buyback, and management has been active on the conference circuit, positioning MongoDB at the center of tech sector conversations as investors weigh its potential.

So after this run and another quarter of double-digit revenue growth, is MongoDB’s valuation still justified, or are investors now pricing in every bit of future upside?

Most Popular Narrative: 2% Overvalued

The most widely followed narrative views MongoDB as modestly overvalued at current prices, driven by strong growth expectations but offset by future risks and a high implied earnings multiple. This narrative synthesizes analyst projections, future revenue assumptions, and the company's ability to sustain performance in a fast-evolving sector.

The exponential growth of data from digital transformation and AI initiatives is increasing demand for MongoDB's scalable, flexible platform, as evidenced by strong customer uptake among large enterprises and new AI-native companies. This suggests continued revenue growth opportunities.

Want to see what’s fueling this price tag? One big assumption underpins the narrative: analysts are betting on fierce revenue momentum, bold margin expansion, and a future profit multiple that only true market disruptors command. Want to know just how aggressive these financial forecasts get and what makes them so controversial? The driving forces behind this valuation might surprise you.

Result: Fair Value of $317.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressure from cloud competitors and the possibility of slowing enterprise growth could challenge even the most optimistic projections for MongoDB.

Find out about the key risks to this MongoDB narrative.Another View: Discounted Cash Flow Tells a Different Story

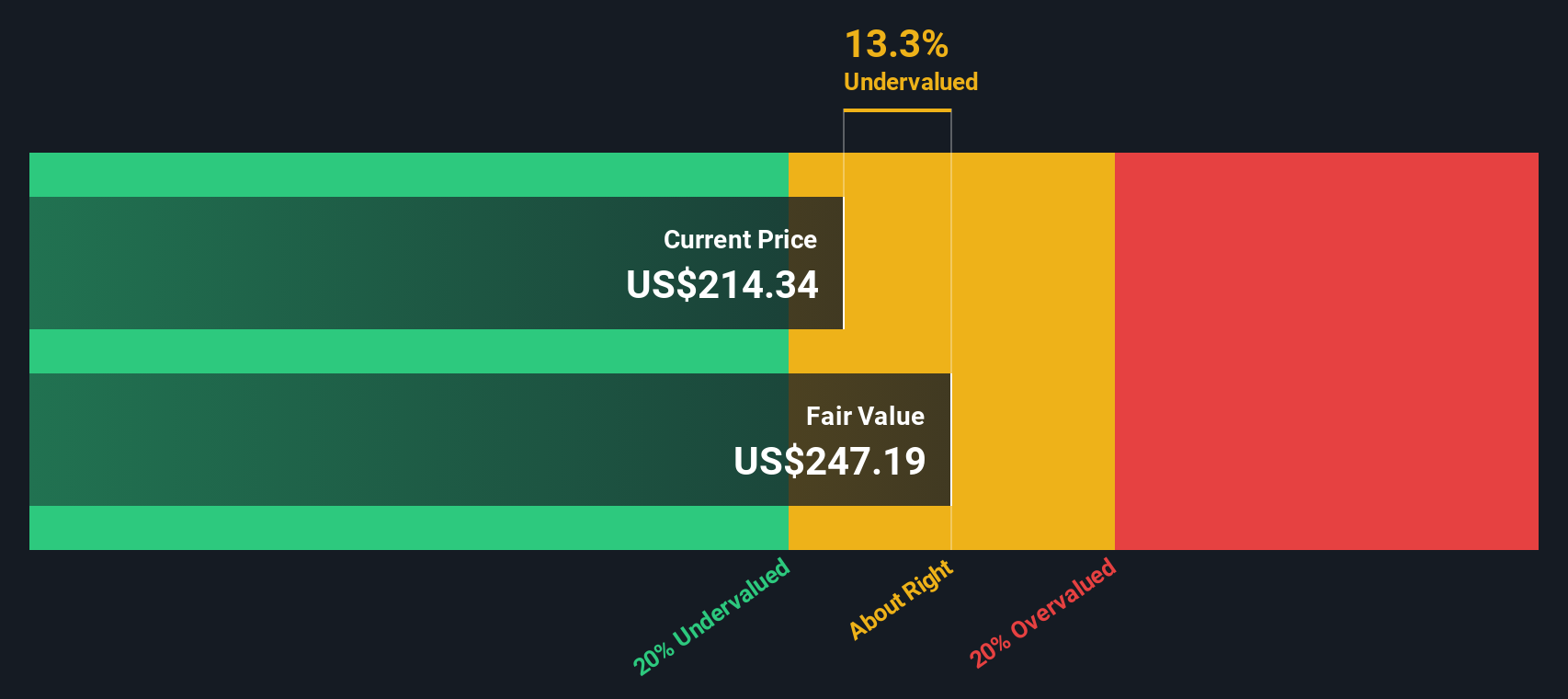

While analysts' consensus suggests MongoDB is slightly overvalued based on growth expectations, our DCF model points to an even higher valuation gap. Could the market be overstating future earnings quality, or is there upside others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MongoDB for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MongoDB Narrative

Of course, if this view does not align with your own or you want to dive deeper into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next big opportunity slip away. Use the Simply Wall Street Screener to instantly connect with powerful investment themes across different markets and technologies.

- Uncover untapped value by checking out undervalued stocks based on cash flows to find stocks the market may be overlooking right now.

- Ride the wave of artificial intelligence growth by scanning for innovation standouts with AI penny stocks.

- Seize potential with high-yield choices using dividend stocks with yields > 3% and target companies offering compelling income streams above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion