- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (NasdaqCM:MARA) Reports Q1 2025 US$533 Million Net Loss

Reviewed by Simply Wall St

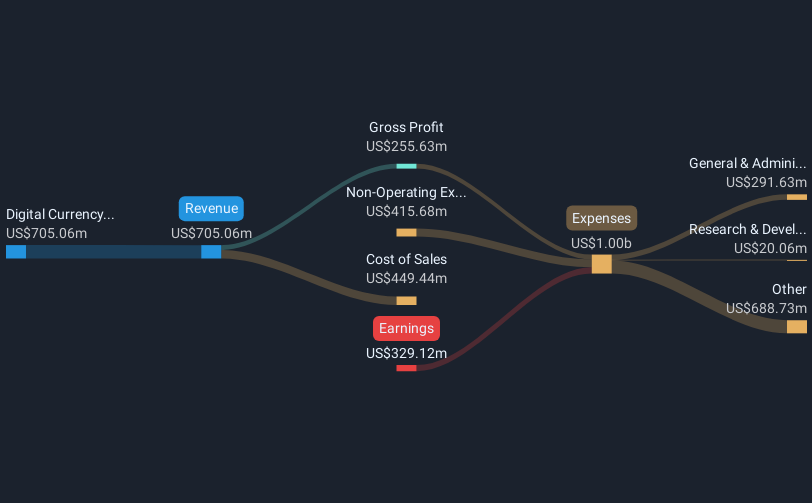

MARA Holdings (NasdaqCM:MARA) reported its Q1 2025 earnings, highlighting sales growth to $214 million from $165 million a year ago, but a steep net loss of $533 million marked a downturn from the previous year's net income. Despite a production decline in the number of BTC produced in April, the company's stock rose by nearly 31% over the past month. This increase aligns with broader market trends, as major indices like the Nasdaq have been rallying due to easing US-China trade tensions and tech sector gains, indicating that the company's stock performance was likely buoyed by overall positive market sentiment.

We've discovered 3 weaknesses for MARA Holdings that you should be aware of before investing here.

The recent news surrounding MARA Holdings, including the substantial Q1 sales growth despite a large net loss and a production decline in Bitcoin, has potential implications for the company's ongoing transformation and strategic goals. This dual outcome—rising sales but worsening net income—reflects the challenges MARA faces as it expands into AI and energy solutions to bolster profitability and diversify revenue streams. The recent 31% stock price increase over the past month aligns with broader market rallies and may indicate investor confidence in these initiatives, yet there's caution due to the evident short-term financial strains.

Over the past five years, MARA Holdings recorded a very large total return on its shares, including dividends. In contrast, the company's one-year performance was weaker compared to both the US Software industry and the broader US market, which achieved 18.2% and 11.5% returns respectively. The strong longer-term performance stands out amidst the recent volatility.

The implications of the intro news on revenue and earnings forecasts remain substantial. The expansion efforts to reduce costs through energy asset ownership are expected to shape future growth trajectories. Analysts forecast revenue growth at 15.3% per year, though profitability remains elusive in the foreseeable future. The current share price of US$13.15, still below the consensus target of US$19.46, suggests analysts see untapped potential, but investor sentiment may hinge on MARA's ability to mitigate associated risks and achieve projected efficiencies and market expansions.

Assess MARA Holdings' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Low and overvalued.

Similar Companies

Market Insights

Community Narratives