- United States

- /

- Software

- /

- NasdaqCM:MARA

Does MARA Holdings' Paris Move Signal a New Era for Its Global Energy Ambitions (MARA)?

Reviewed by Simply Wall St

- In August 2025, MARA Holdings, Inc. announced the establishment of its new European headquarters in Paris, France as part of its expansion into Europe.

- This move positions the company within the core of Europe’s energy sector, signaling increased ambition to play a major role in international energy innovation.

- We'll explore how MARA's decision to base its European headquarters in Paris could influence its evolving investment narrative and growth prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

MARA Holdings Investment Narrative Recap

To be a MARA Holdings shareholder right now, you need to believe in the company’s capacity to evolve beyond bitcoin mining and generate growth from energy innovation and digital infrastructure. The launch of a European headquarters in Paris bolsters MARA’s access to new partnerships and markets, but does not immediately reduce its core dependence on bitcoin price volatility, the main short-term catalyst and ongoing risk to the business.

Among recent updates, MARA’s Q2 2025 earnings release stands out: sales surged to US$238.49 million and net income jumped to US$808.24 million, signaling operational momentum. While Paris could offer more opportunities for diversification, near-term results will still hinge on MARA’s performance in bitcoin mining and its ability to manage related financial pressures.

However, investors should also be alert to the potential for greater regulatory scrutiny in new markets, especially as MARA’s global exposure increases…

Read the full narrative on MARA Holdings (it's free!)

MARA Holdings' outlook anticipates $1.1 billion in revenue and $45.1 million in earnings by 2028. This assumes a 12.4% annual revenue growth rate, but earnings are expected to decrease by $633.7 million from current earnings of $678.8 million.

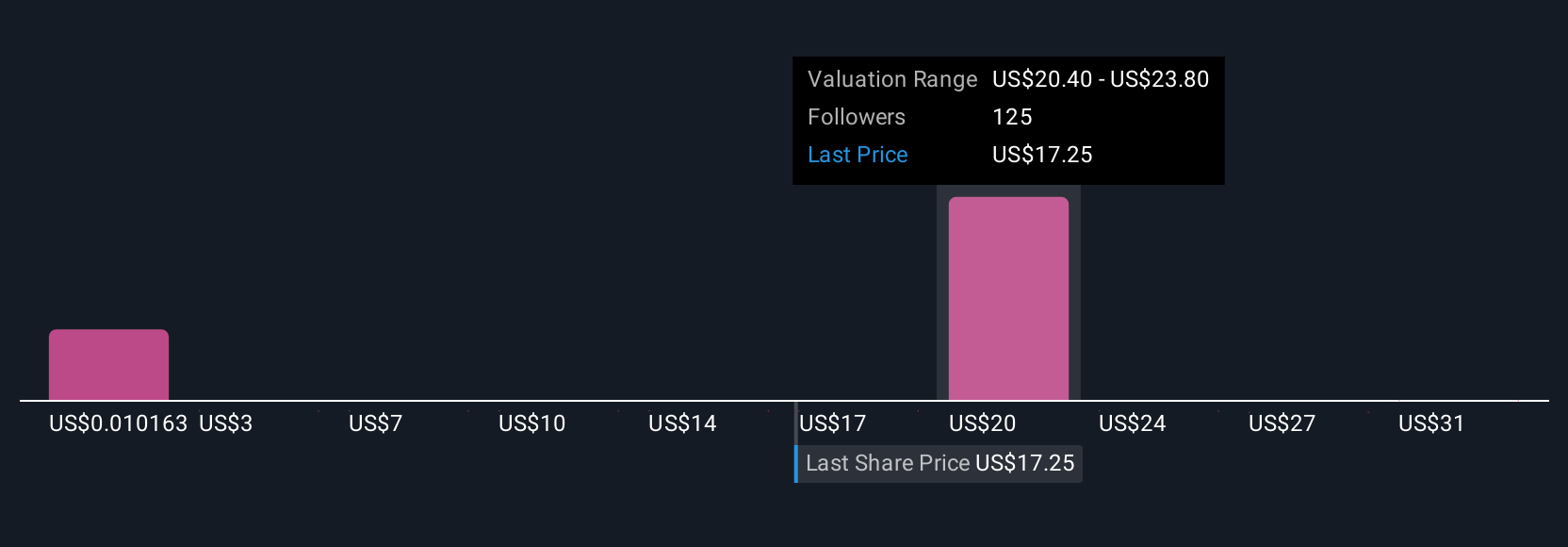

Uncover how MARA Holdings' forecasts yield a $23.87 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Nine retail investors in the Simply Wall St Community shared fair value estimates for MARA ranging from US$18 to US$74.42 per share. With bitcoin’s volatility still central to MARA’s fortunes, you can see why views on future prospects span such a broad spectrum and why comparing these viewpoints may matter.

Explore 9 other fair value estimates on MARA Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives