- United States

- /

- Software

- /

- NasdaqGS:MANH

A Look at Manhattan Associates (MANH) Valuation Following Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Manhattan Associates.

Taking a step back, Manhattan Associates’ share price has retreated sharply this year, with a year-to-date decline of 25 percent and a 12-month total shareholder return of negative 33 percent. While recent volatility reflects shifting expectations post-earnings, the stock’s long-term momentum remains visible. The share price is up over 100 percent across five years, even as near-term sentiment cools.

If you’re interested in finding where fresh momentum and growth could emerge, now’s a perfect time to broaden your investing lens and discover fast growing stocks with high insider ownership

With shares now nearly 8 percent below analyst targets and the stock trading more than 25 percent off its highs, the question remains: is Manhattan Associates undervalued at this level, or is the market correctly factoring in its future growth prospects?

Most Popular Narrative: 13% Undervalued

Compared to Manhattan Associates’ last close at $200.53, the most popular narrative places fair value at $231.64, suggesting room for upside if the narrative proves accurate. The price target grounds its optimism in clear technology and contractual catalysts, which are highlighted below.

Enhanced investments in AI, automation, and unified product development (such as Agentic AI and the Manhattan Active Agent Foundry) position Manhattan to capture increasing customer demand for real-time analytics and next-generation supply chain automation. This could potentially drive new bookings, average contract value, and expansion into underpenetrated markets, supportive of sustainable double-digit top-line growth.

This valuation is built on aggressive projections for cloud migration, margin expansion, and a future profit multiple typically seen with dominant tech disruptors. Want to know what pivotal assumptions drive such a high bar? Dive in and uncover the bold bets behind the headline figure.

Result: Fair Value of $231.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing delays in customer cloud migration and persistent volatility in services revenue could quickly challenge even the most optimistic growth forecasts in the period ahead.

Find out about the key risks to this Manhattan Associates narrative.

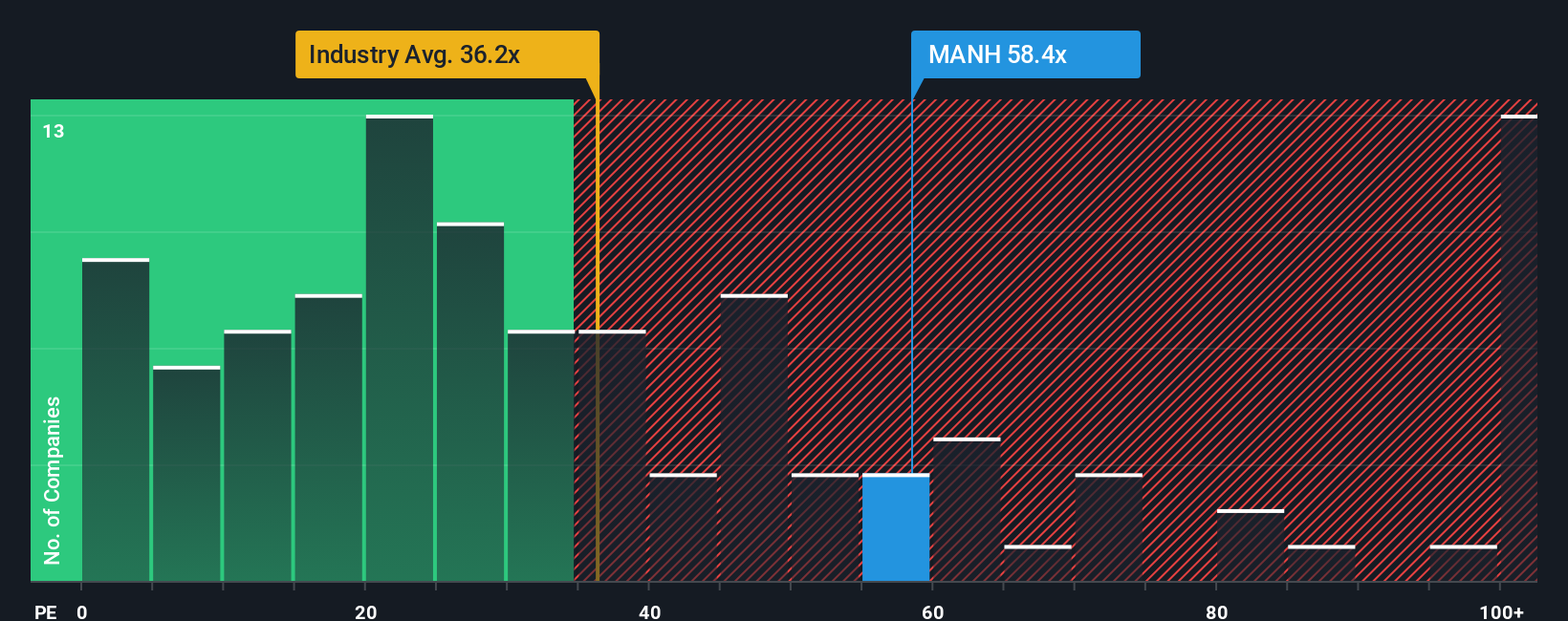

Another View: Valuation by Earnings Multiple

While the most popular narrative sees Manhattan Associates as undervalued, our model based on its price-to-earnings ratio tells a more cautious story. The current ratio stands at 54.8 times earnings, which is markedly higher than both the US Software industry average of 35.4 and the peer group average of 36. This elevated multiple also far exceeds the “fair ratio” our analysis suggests of 32.1, underscoring the risk that the share price could drift lower if the market loses confidence or growth slows.

So, is this premium justified for future growth, or does it signal a need for extra caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Manhattan Associates Narrative

If this perspective doesn't quite fit your approach, you can always dive into the facts and shape your own conclusions. Craft a personalized assessment of Manhattan Associates in just a few minutes. Do it your way

A great starting point for your Manhattan Associates research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investment strategy and unlock fresh opportunities with Simply Wall St’s pre-screened lists. These unique stock ideas could give you an edge. Don’t let your next favorite company slip through your fingers.

- Tap into the wave of tech innovation by checking out these 25 AI penny stocks. Here, companies are transforming industries with artificial intelligence and automation.

- Boost your income strategy and stability by digging into these 18 dividend stocks with yields > 3%. This highlights businesses offering yields over 3% for consistent cash flow.

- Position yourself at the forefront of digital change by pursuing these 79 cryptocurrency and blockchain stocks, featuring stocks powering the evolution of cryptocurrency and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives