- United States

- /

- Software

- /

- NasdaqGS:LPSN

LivePerson, Inc. (NASDAQ:LPSN) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Those holding LivePerson, Inc. (NASDAQ:LPSN) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 78% share price drop in the last twelve months.

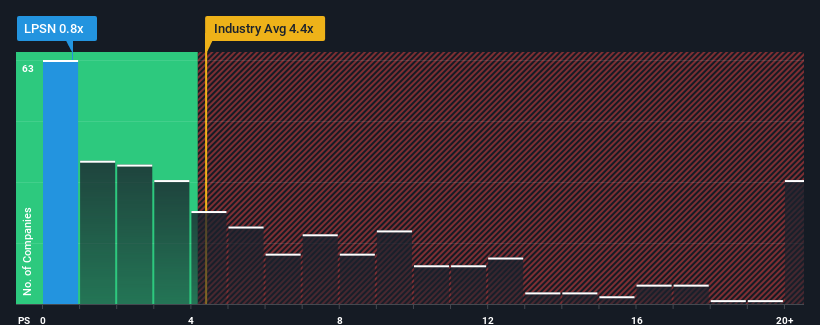

Even after such a large jump in price, LivePerson may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.4x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for LivePerson

What Does LivePerson's P/S Mean For Shareholders?

LivePerson could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on LivePerson will help you uncover what's on the horizon.How Is LivePerson's Revenue Growth Trending?

In order to justify its P/S ratio, LivePerson would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.6%. The latest three year period has also seen an excellent 77% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 3.2% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the broader industry is forecast to expand by 13% per year, which paints a poor picture.

With this information, we are not surprised that LivePerson is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

LivePerson's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of LivePerson's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for LivePerson (1 is a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on LivePerson, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LPSN

Slight and fair value.