- United States

- /

- Software

- /

- OTCPK:LDTC.F

LeddarTech Holdings Third Quarter 2024 Earnings: Beats Expectations

LeddarTech Holdings (NASDAQ:LDTC) Third Quarter 2024 Results

Key Financial Results

- Revenue: CA$1.42m (flat on 3Q 2023).

- Net loss: CA$7.45m (loss widened by 92% from 3Q 2023).

- CA$0.25 loss per share.

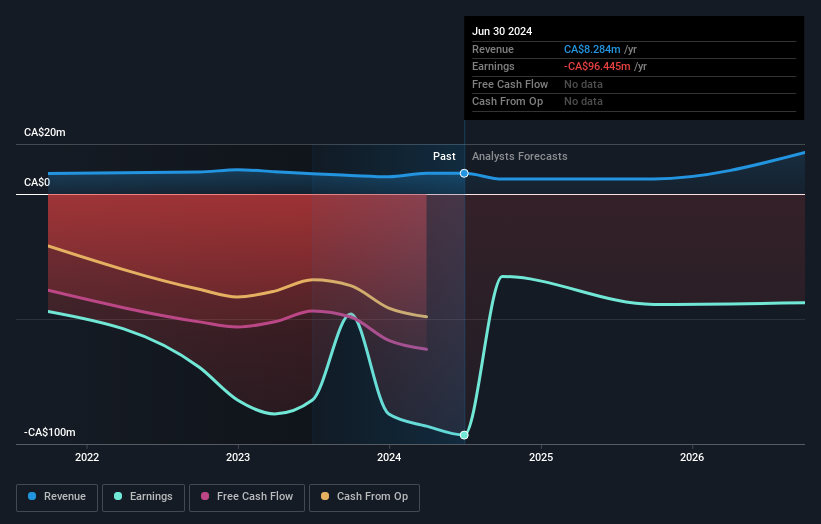

All figures shown in the chart above are for the trailing 12 month (TTM) period

LeddarTech Holdings Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 74%. Earnings per share (EPS) also surpassed analyst estimates by 11%.

Looking ahead, revenue is forecast to grow 55% p.a. on average during the next 3 years, compared to a 12% growth forecast for the Software industry in the US.

Performance of the American Software industry.

The company's shares are down 4.5% from a week ago.

Risk Analysis

It is worth noting though that we have found 5 warning signs for LeddarTech Holdings (3 are a bit concerning!) that you need to take into consideration.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:LDTC.F

LeddarTech Holdings

Provides AI-based fusion and perception software solutions for advanced driver assistance system, autonomous driving, and parking applications in Canada.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026