- United States

- /

- Software

- /

- NasdaqGS:IREN

IREN (NasdaqGS:IREN) Shares Dip 16% As Company Returns To Profitability In Q2 Earnings

Reviewed by Simply Wall St

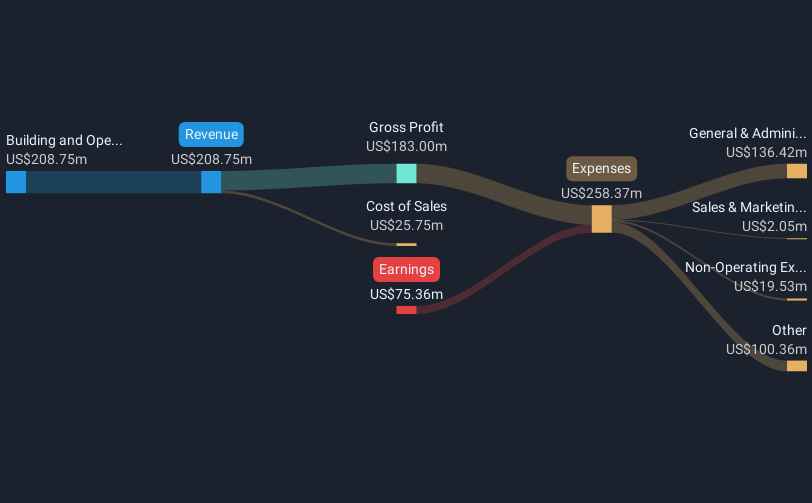

Following the recent announcement of its second-quarter earnings, IREN (NasdaqGS:IREN) reported impressive growth in sales and a return to profitability, contrasting with a net loss in the previous year. This positive financial news comes amid a broader market downturn, including a monthly stock market decline of 3.6% and turbulent trading conditions attributed to economic uncertainty and upcoming tariffs. Despite these gains, shares of IREN fell 15.77% over the last month, possibly influenced by continued six-month net losses and broader sector sentiment, particularly in technology stocks facing headwinds. Concurrently, the mixed performance of major indices, with declining tech stocks like Nvidia and Tesla, further exemplifies the challenging backdrop against which IREN's stock movement occurred. Additionally, considering its ongoing operations in Bitcoin mining during a period of fluctuating Bitcoin prices may have also impacted its perception in financial markets.

Dig deeper into the specifics of IREN here with our thorough analysis report.

Over the last year, IREN achieved a total shareholder return of 43.90%, notably surpassing the US Software industry’s 7.9% return and the broader US market’s 16.9% return. Key factors include a series of quarterly revenue gains, prominently highlighted by its Q2 earnings, which reported sales of US$113.48 million and net income of US$18.88 million. This fiscal recovery underscores the company's resilience amidst sector challenges.

In contrast to positive financial outcomes, the past year featured a class action lawsuit filed in October 2024, alleging business misrepresentation and operational overstatements. Despite such challenges, IREN’s operational expansion with an additional 150MW capacity at its Childress site in July 2024 potentially enhanced investor confidence. Furthermore, after withdrawing a US$500 million shelf registration, a new expanded offering was filed in January 2025. Shareholder dilution, however, marked the year, impacting shareholder sentiment even as the company laid groundwork for future growth.

- See how IREN measures up with our analysis of its intrinsic value versus market price.

- Gain insight into the risks facing IREN and how they might influence its performance—click here to read more.

- Already own IREN? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IREN

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives