- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (NasdaqGS:INTU) Expands IDEAS Accelerator Program Nationally With Veteran Focus

Reviewed by Simply Wall St

Intuit (NasdaqGS:INTU) recently announced the national expansion of its IDEAS accelerator program, a move aimed at supporting diverse entrepreneurs, including veterans and military spouses, across nine U.S. cities. This announcement follows a strong quarterly performance where the company reported a revenue jump and raised full-year revenue guidance. The introduction of AI-driven QuickBooks and enhanced GenOS capabilities were other significant developments. Intuit's share price surged 31% over the last quarter, outperforming the broader market, which experienced a modest increase, despite ongoing uncertainties surrounding U.S. trade policy and macroeconomic factors.

We've spotted 1 weakness for Intuit you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The national expansion of Intuit's IDEAS accelerator program is likely to enhance the company's narrative that emphasizes AI-driven services and automation to boost efficiency and customer satisfaction. This commitment to supporting diverse entrepreneurs aligns with their ongoing strategic initiatives. The recent announcement may further consolidate Intuit's market position, potentially increasing both customer base and service adoption rates, which could positively impact future revenue and earnings forecasts.

Over the past five years, Intuit's total shareholder return reached 182.18%. In the past year alone, Intuit has matched the US Software industry, which returned 20.2%. This longer-term performance showcases strong company growth, outpacing the broader market, which had more modest increases. The increase in Intuit's share price over the last year underscores the company's strength and the market's confidence in its strategic direction.

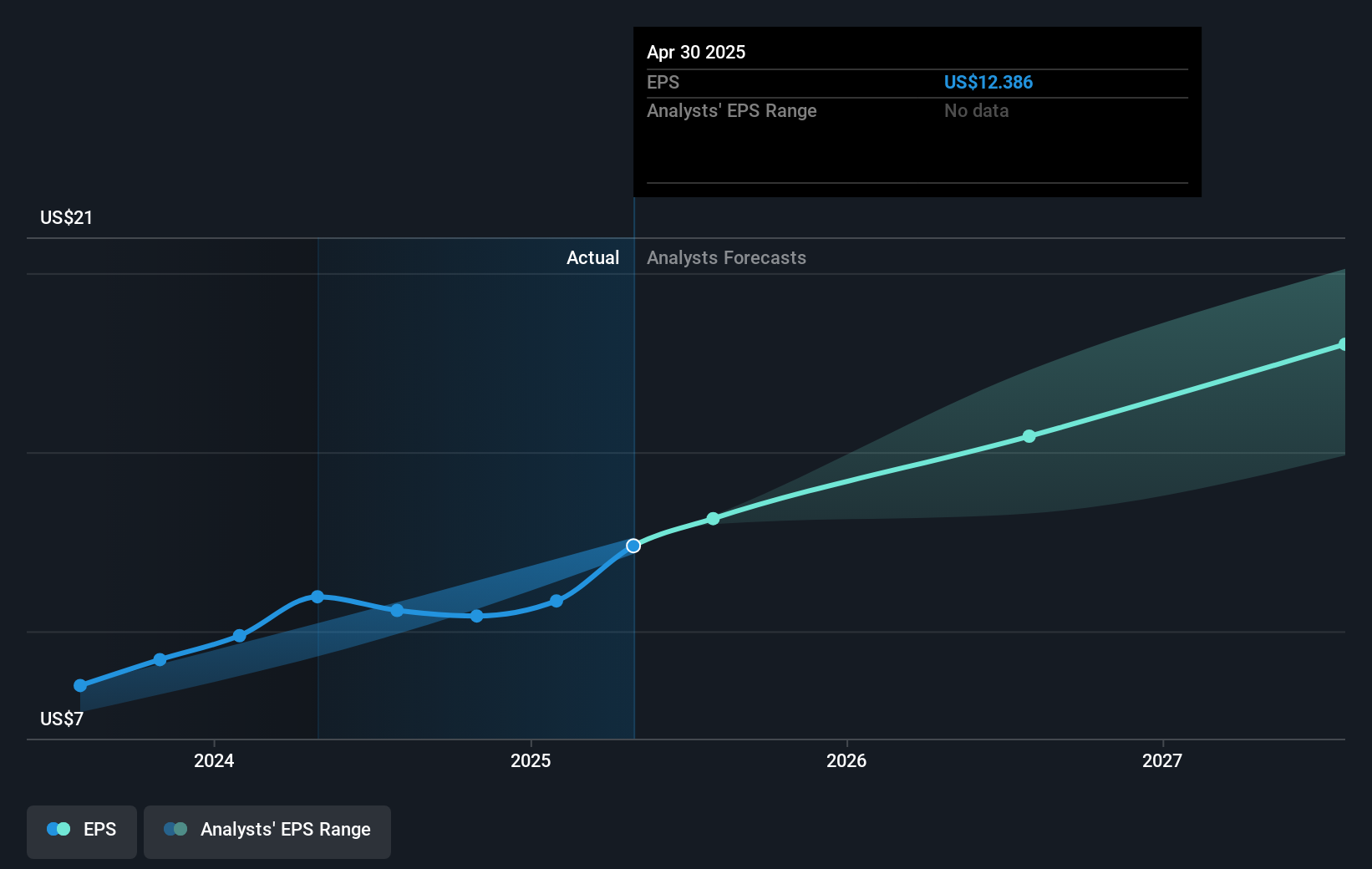

The current share price of US$626.55 shows it is trading close to the analyst consensus price target of US$697.18, indicating a potential upside of approximately 10.1%. Analysts forecast that revenue and earnings growth might be further accelerated by AI-enhancements and operational efficiency improvements, though challenges in implementation and adoption could pose risks. The firm’s long-term vision alongside its recent performance could continue to drive positive shareholder returns.

Learn about Intuit's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives