- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (INTU): Evaluating Current Valuation After Recent Muted Share Price Movements

See our latest analysis for Intuit.

Looking beyond the recent pause, Intuit’s stock has quietly delivered a steady 12% one-year total shareholder return, even as quarterly market momentum has briefly slowed. That blend of resilience and long-term growth potential helps explain why the company continues to hold investor interest, despite a muted few weeks.

If you find software’s steady hand appealing, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading about 20% below analyst targets and solid double-digit growth still in the picture, the question remains: is Intuit a hidden bargain for patient investors, or is all that promise already priced in?

Most Popular Narrative: 17.1% Undervalued

With Intuit’s last close at $679.94 and the prevailing narrative pointing to a fair value near $820, anticipation is building around its future earnings power and profit margins. The valuation hinges on whether this anticipated growth can be realized within the next few years.

The accelerating adoption of Intuit's AI-driven all-in-one platform, including virtual teams of AI agents and human experts, positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers. This supports higher average revenue per customer (ARPC) and net margin expansion over time. Intuit's rapid penetration into the fast-growing mid-market segment (serving customers with $2.5M to $100M in revenue and tapping into an $89B to $90B TAM), bolstered by quarterly product innovations and expanding partnerships with top accounting firms, sets up a durable multi-year revenue growth vector through new customer acquisition and cross-sell opportunities.

Curious what’s really fueling this ambitious price target? The most widely followed narrative is anchored on bold assumptions about Intuit’s future revenue, margin expansion, and dominance in emerging markets. Find out which critical forecasts, projections, and sector breakthroughs are moving the valuation needle to discover the surprising levers that could set Intuit apart from the software pack.

Result: Fair Value of $820 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish Mailchimp growth and international market hurdles could challenge Intuit’s impressive momentum. These factors serve as key risks to this bullish outlook.

Find out about the key risks to this Intuit narrative.

Another View: What Do Market Multiples Say?

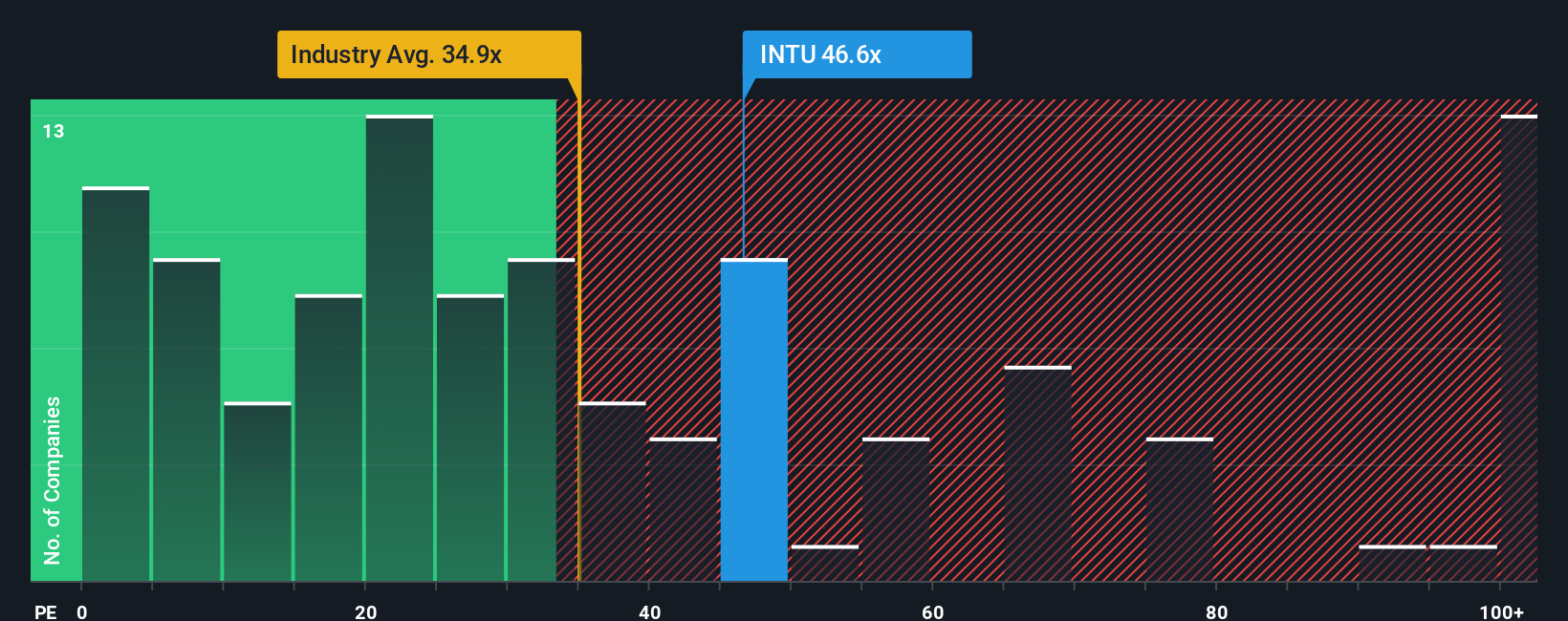

Looking at how Intuit’s price-to-earnings ratio compares, the company trades at 49x earnings, above the US Software industry average of 35.7x and its own fair ratio of 43.7x. This signals a premium price. Does this suggest risk of a valuation pullback, or is the market still optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuit Narrative

If you see things differently or want to analyze Intuit's story your own way, you can dive into the numbers and craft a personal view in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intuit.

Looking for more investment ideas?

Serious about beating the market? You owe it to yourself to check out these exciting stock opportunities, each handpicked to help you grow and diversify your portfolio.

- Target robust income streams by reviewing these 19 dividend stocks with yields > 3%. These consistently deliver yields above 3% for investors seeking steady returns.

- Uncover tomorrow’s disruptors by evaluating these 24 AI penny stocks. These have explosive potential in artificial intelligence and automation-driven growth sectors.

- Capitalize on value investment strategies when you assess these 893 undervalued stocks based on cash flows, pinpointing companies trading at attractive prices based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

High-Tech Precision Play

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

TSMC will drive future growth with CoWoS packaging and N2 rollout

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.