- United States

- /

- Software

- /

- NasdaqGS:INTU

Does Intuit’s Latest Earnings Beat Signal Room for Growth in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Intuit stock right now? You are not alone. With its shares closing at $661.39 and up 3.1% over the past week, investors are once again weighing the company's relentless growth against whether it is still a bargain. Over the past five years, Intuit has soared by 104.1% and has more than doubled in just three years. This performance is a testament to how powerful its brand and ecosystem have become. Even so, the last 30 days saw Intuit dip 0.2%, showing that the ride is rarely smooth and investor sentiment can shift as market priorities and risk assessments change.

This year's gains of 6.2% and a 1-year return of 8.6% might not seem spectacular compared to the years before, but they underscore resilience in a market that has been anything but predictable. Recent surges in tech stocks and shifts in how investors value steady recurring revenues like Intuit’s have both played a part in these moves, rewarding patient holders but also keeping everyone guessing about what comes next.

When it comes to valuation, the picture gets even more intriguing. Intuit lands right in the middle of the pack with a value score of 3. This means it is considered undervalued in 3 out of 6 common checks. Some investors would say this signals balance, while others might see overlooked potential or emerging risks. So, how are these valuation methods calculated, and what can they tell us about your next move? Let us break down the approaches first, then we will introduce a smarter way to look at value that ties it all together.

Why Intuit is lagging behind its peers

Approach 1: Intuit Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to their present value. This provides a snapshot of what the business is worth today based on expected performance. For Intuit, this process uses a two-stage Free Cash Flow to Equity methodology, taking detailed analyst forecasts for the next five years and then extrapolating further growth based on industry trends and company history.

At present, Intuit generates $5.97 Billion in Free Cash Flow. Analyst estimates suggest this figure will climb steadily, reaching $8.65 Billion by 2028, and $11.66 Billion by 2030. Beyond these expert forecasts, extended projections predict cash flows growing towards $15.99 Billion by 2035. This long-term growth trajectory reflects ongoing confidence in Intuit’s ability to expand its core business and grow profits.

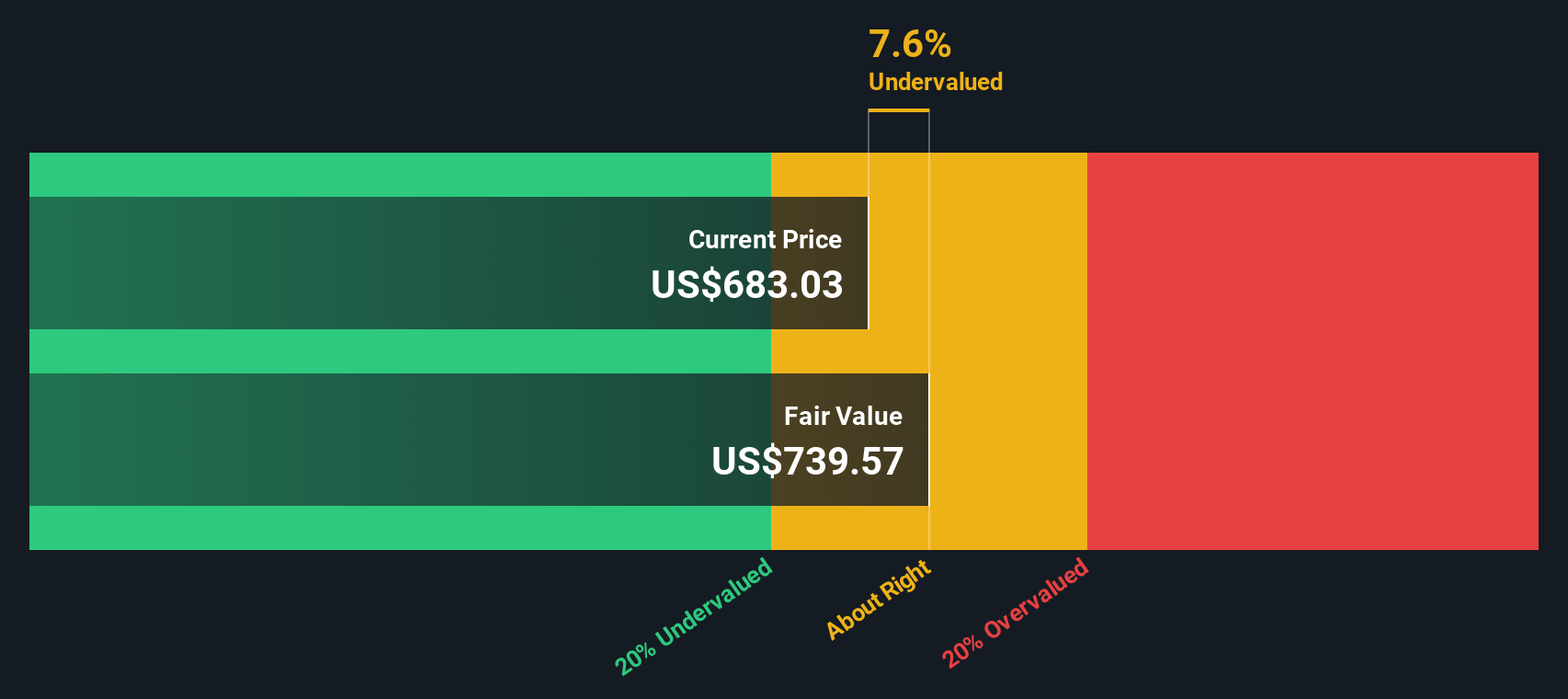

Based on these underlying numbers, the DCF model calculates an intrinsic value for Intuit’s stock at $735.63 per share. With the current market price at $661.39, this represents a 10.1% discount to fair value and suggests the stock is undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuit is undervalued by 10.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Intuit Price vs Earnings (PE Ratio)

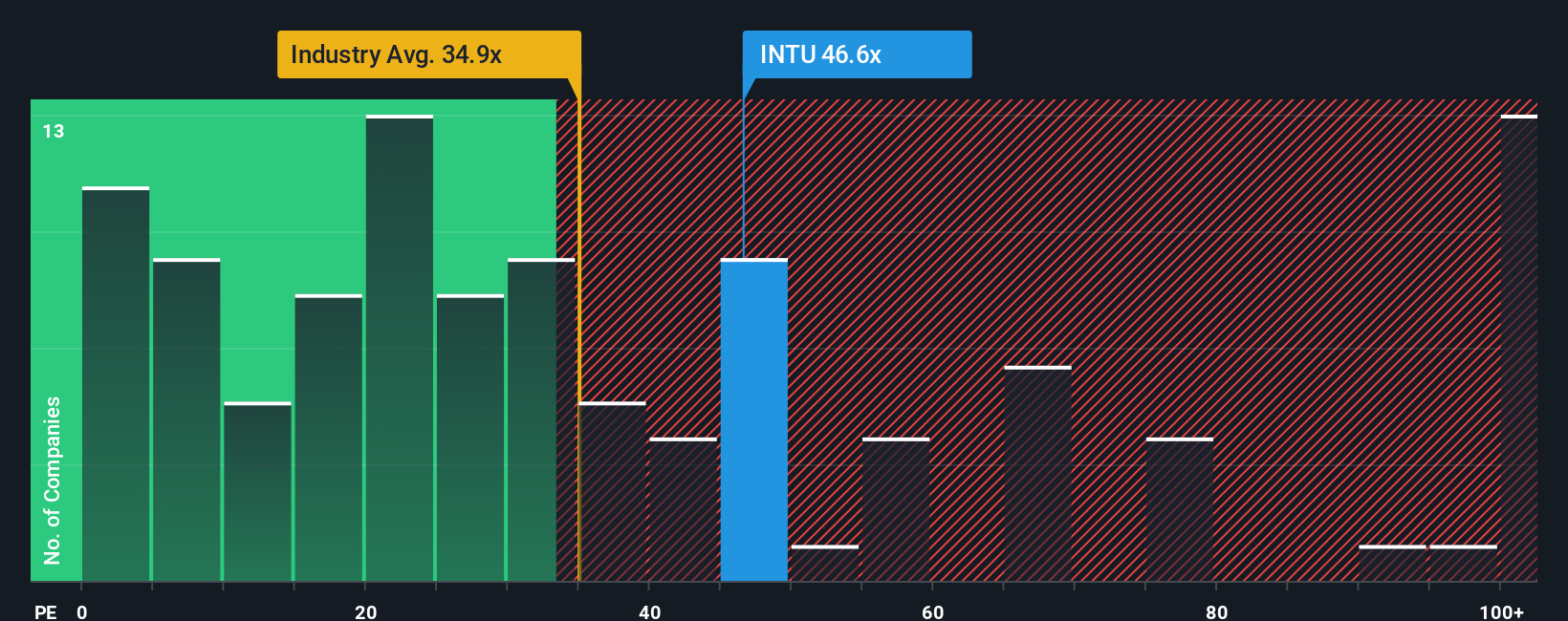

The Price-to-Earnings (PE) ratio is widely considered the most relevant valuation metric for established, profitable companies like Intuit because it relates what investors are willing to pay for each dollar of earnings. Companies with consistent profitability and steady earnings growth tend to be more reliably priced using the PE ratio, as it gives a direct sense of how optimistic the market is about their future.

However, the definition of a “fair” PE ratio is not fixed. It depends on factors like earnings growth expectations, profitability, and risks to the business. Companies that are growing faster or are perceived as lower risk typically justify higher PE ratios, while slower-growing or riskier firms tend to trade at a discount to peers.

Right now, Intuit trades at a PE ratio of 47.66x, notably above the software industry average of 34.88x, but below the peer average of 55.81x. These benchmarks provide a useful starting point, but they do not account for Intuit’s specific growth profile and risk. That is where Simply Wall St’s “Fair Ratio” comes in, a composite figure reflecting not just company growth, but also profitability, risk, industry outlook, and size. For Intuit, this Fair Ratio is calculated at 43.50x.

By comparing Intuit’s current PE ratio to its Fair Ratio, investors get a more nuanced view of valuation than they would using raw industry or peer numbers alone. Intuit’s actual PE of 47.66x is only slightly above its Fair Ratio, close enough that the stock appears to be fairly valued given its current fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuit Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter and more dynamic tool available to anyone on Simply Wall St’s Community page. A Narrative is your personal investment story: it connects what you know or believe about Intuit (like new product launches or evolving industry trends) directly to a set of future forecasts and a fair value based on those assumptions. Narratives let you see not just what Intuit’s financial numbers are today, but what they could become, and most importantly, why. This approach lets you compare your assumptions side by side with the current market price, helping you decide if it’s time to buy, sell, or simply watch. What makes Narratives uniquely powerful is that they update automatically as new earnings, news, or industry events emerge, keeping your analysis fresh with zero effort. For example, some investors see Intuit reaching $971.0 per share as AI and cloud integration accelerate growth and margins, while more cautious forecasts land as low as $600.0, factoring in execution or segment risks. Narratives help you choose which story and fair value fits you best.

Do you think there's more to the story for Intuit? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion