- United States

- /

- Software

- /

- NasdaqGS:INTA

Intapp's AI-Powered Time Horizon Launch and Share Buyback Could Be a Game Changer for INTA

Reviewed by Simply Wall St

- Intapp, Inc. recently announced fourth quarter and full-year earnings, highlighted by year-over-year revenue gains to US$135.04 million and US$504.12 million, respectively, alongside a share repurchase program of up to €150 million and the launch of the Intapp Time Horizon release with advanced AI features.

- These developments reflect Intapp's focus on AI-driven innovation and returning value to shareholders, with the new product launch strengthening its position in serving professional services firms through enhanced automation and compliance tools.

- We’ll examine how the launch of Intapp Time Horizon with generative AI could influence Intapp’s investment narrative and growth outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Intapp Investment Narrative Recap

To be a shareholder in Intapp, you need to believe in the company’s ability to convert AI-driven innovation and cloud adoption into long-term, profitable growth for verticalized professional services markets. Recent results, including Intapp’s Horizon release and updated guidance, support the central catalyst of expanding cloud SaaS revenues, but the biggest immediate risk remains whether this wave of product differentiation is truly compelling enough to sustain contract wins, client retention, and improved margins; for now, the impact seems aligned rather than transformative.

Among recent announcements, the Intapp Time Horizon release stands out, offering generative AI-driven improvements to timekeeping across law, accounting, and consulting clients. Its potential to drive greater cloud product usage ties directly to the key catalyst of deeper client engagement and accelerated software-driven revenue, but ongoing client migration risks still bear close watching as transitions scale up.

In contrast, investors should be aware of the challenges that can arise if Intapp’s AI and cloud developments do not translate into enough market differentiation or sustained contract expansion...

Read the full narrative on Intapp (it's free!)

Intapp's narrative projects $701.6 million revenue and $34.2 million earnings by 2028. This requires 13.2% yearly revenue growth and a $52.5 million earnings increase from -$18.3 million today.

Uncover how Intapp's forecasts yield a $64.75 fair value, a 51% upside to its current price.

Exploring Other Perspectives

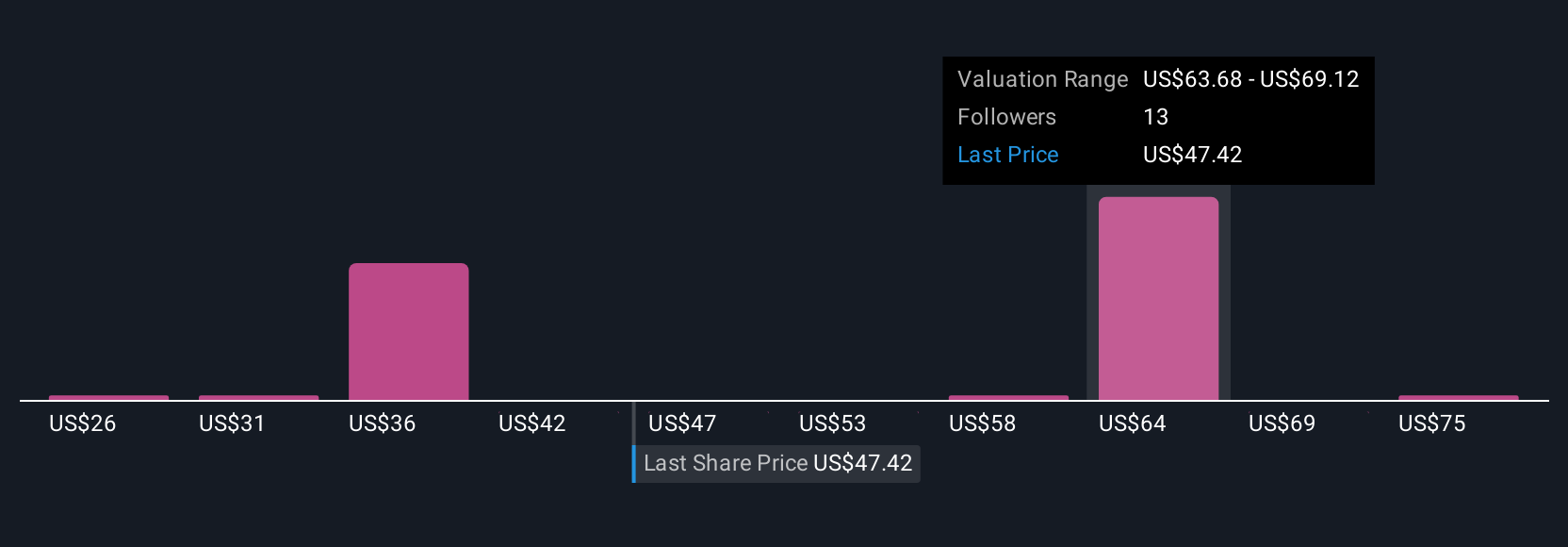

Seven Simply Wall St Community fair value estimates for Intapp range widely from US$25.60 to US$80, highlighting broad investor divergence. The path to profitable growth amid ongoing client cloud migrations is still a key variable for the company's future, so consider these viewpoints as you assess the possible outcomes.

Explore 7 other fair value estimates on Intapp - why the stock might be worth as much as 87% more than the current price!

Build Your Own Intapp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intapp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Intapp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intapp's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives