- United States

- /

- Software

- /

- NasdaqGS:IDCC

InterDigital (IDCC): Evaluating Valuation After New Government Contract and Expanded Samsung Licensing Deal

Reviewed by Kshitija Bhandaru

InterDigital shares have been on the move after the company secured a new U.S. government contract for advanced spectrum coexistence research. This complements its ongoing licensing momentum with leading tech firms like Samsung and Apple.

See our latest analysis for InterDigital.

InterDigital’s share price has climbed sharply this year, with a 51% gain in the past three months and a 73% year-to-date share price return as investors warm to the company’s reinforced licensing deals and new government contract wins. The ongoing momentum is fueling fresh optimism, with long-term total shareholder return now standing at 121% for the past year and over 500% across five years.

If InterDigital’s fast run-up has you curious about other breakout opportunities, this is a great moment to expand your radar and discover fast growing stocks with high insider ownership

Yet with such a powerful rally already in the rearview mirror, the key question for investors is whether InterDigital’s recent successes leave the stock undervalued or if the market has already accounted for future growth potential.

Most Popular Narrative: 5% Overvalued

With InterDigital's fair value set at $323.75 versus a last close of $339.90, the most widely followed narrative suggests the stock may have moved ahead of its growth fundamentals. Investors are watching closely to see if future licensing wins can justify the current premium.

The company is making rapid progress expanding into Consumer Electronics and IoT markets, exemplified by a recent HP agreement (now over 50% of the PC market under license) and a 175% increase in CE and IoT program revenue in Q2. This points to successful diversification and a growing addressable market, supporting topline growth and reducing cyclicality.

Want to know the growth blueprint behind this high valuation? The narrative hinges on aggressive expansion into new markets and a bold future earnings shift. Which surprising projections underpin these assumptions? The real calculation may surprise you. See what’s brewing inside this popular narrative.

Result: Fair Value of $323.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a new eight-year Samsung agreement and expanding recurring revenue from major device makers could challenge the overvaluation narrative and support stronger future growth.

Find out about the key risks to this InterDigital narrative.

Another View: A Look Through Different Lenses

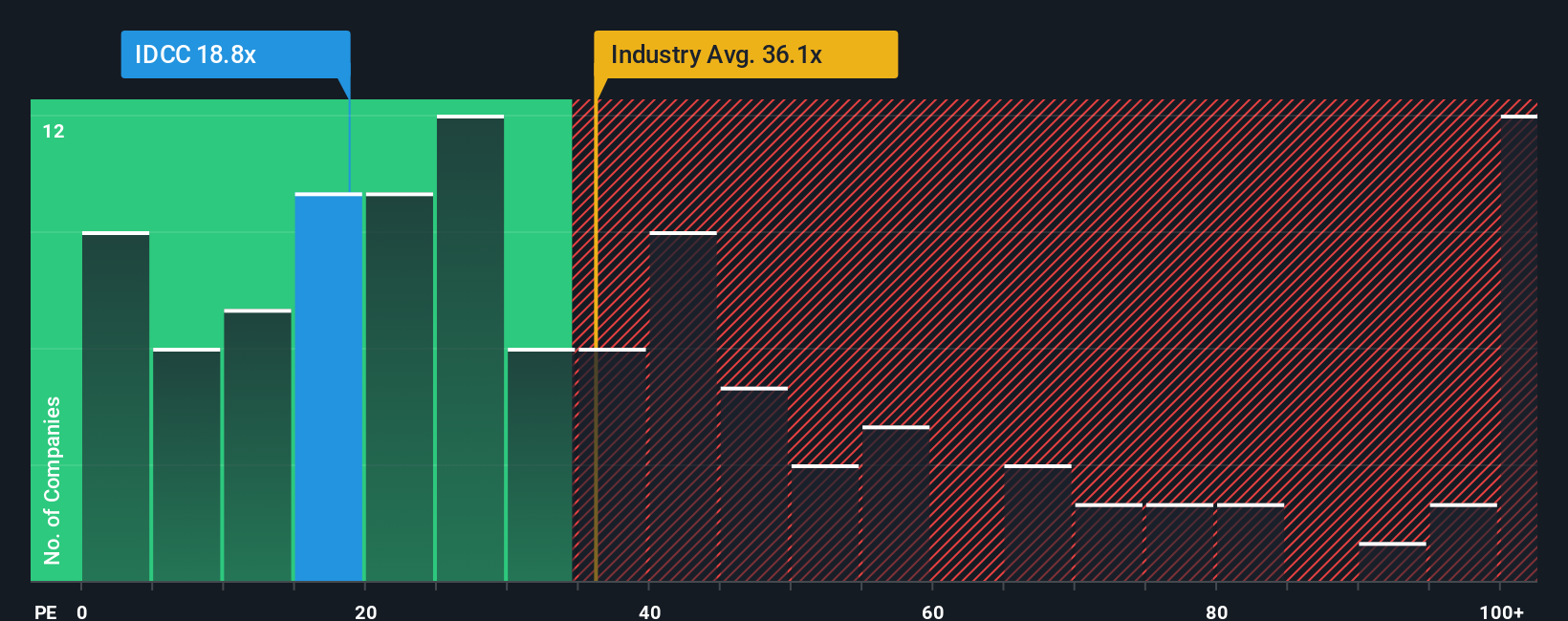

Despite the overvaluation flagged by fair value estimates, InterDigital’s price-to-earnings ratio tells a more optimistic story. At 18.9x, it is far lower than the peer average of 39.4x and the US Software industry’s 35.8x, although above the fair ratio of 14.9x. Does this discount signal a hidden opportunity, or does it merely mask risks embedded in the recent price run-up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InterDigital Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own view and narrative, so why not Do it your way

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Your next winning idea could be one bold step away. Don't watch from the sidelines—expand your portfolio with hand-picked stocks tailored to unexpected trends and untapped value.

- Maximize your income potential by targeting steady payers with these 19 dividend stocks with yields > 3% offering attractive yields and consistent performance in changing markets.

- Accelerate your growth strategy and ride the AI innovation wave by picking from these 24 AI penny stocks making headlines with transformative technologies.

- Seize your advantage early by targeting future disruptors among these 26 quantum computing stocks developing breakthroughs at the front lines of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Best bet on Rare Earth - Currently priced to perfection, invest if thesis holds at $35-40

Undervalued Key Player in Magnets/Rare Earth

Swiped Left by Wall Street: The BMBL Rebound Trade

Popular Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).