- United States

- /

- Software

- /

- NasdaqGS:HUT

A Look at Hut 8 (NasdaqGS:HUT) Valuation After $25M WLFI Token Reserve Acquisition

Reviewed by Kshitija Bhandaru

Hut 8 (NasdaqGS:HUT) made headlines by acquiring 100 million WLFI tokens from World Liberty Financial for $25 million. The company paid a 25% premium and chose to keep these tokens as a long-term reserve asset.

See our latest analysis for Hut 8.

It has been quite a ride for Hut 8 recently, with the stock showing powerful momentum. The company posted a 64.4% share price return over the past month and surged nearly 97% in the last 90 days. Despite some headline-grabbing events, like the WLFI token acquisition and legal investigations following the US Bitcoin Corp. merger, long-term investors have enjoyed a one-year total shareholder return of 268%, highlighting resilience in both sentiment and performance.

If you're interested in discovering what else could be gaining traction, now is a great time to broaden your search and uncover fast growing stocks with high insider ownership

With shares climbing and bold moves such as the WLFI token acquisition, the big question remains: is Hut 8’s current momentum a sign that the stock is still undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 28% Overvalued

Hut 8’s last close at $41.73 sits well above the narrative's fair value estimate of $32.53, suggesting significant optimism is reflected in the current price. The latest most widely followed narrative considers the impact of Hut 8's recent platform expansion, flexible power strategies, and AI aspirations, giving investors much to weigh as they assess whether the premium is warranted.

The Power First strategy, featuring sizable pipeline origination (10.8 GW under diligence, 3.1 GW under exclusivity) and dual-purpose sites for both Bitcoin mining and AI compute, provides scalability and flexibility to benefit from rising institutional adoption of digital assets and accelerating demand for clean energy-powered blockchain infrastructure. This approach supports future revenue and earnings growth.

Curious how hot infrastructure, ambitious energy contracts, and a bold leap into AI help justify this price? There is a master plan, and it is built on some unconventional growth assumptions and a profit trajectory that may surprise most investors. Want to know the numbers driving this fair value? Dive in and see what is really lifting Hut 8’s valuation sky high.

Result: Fair Value of $32.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Bitcoin prices and exposure to regulatory changes in natural gas could still undermine Hut 8's earnings growth outlook.

Find out about the key risks to this Hut 8 narrative.

Another View: Multiples Paint a Different Picture

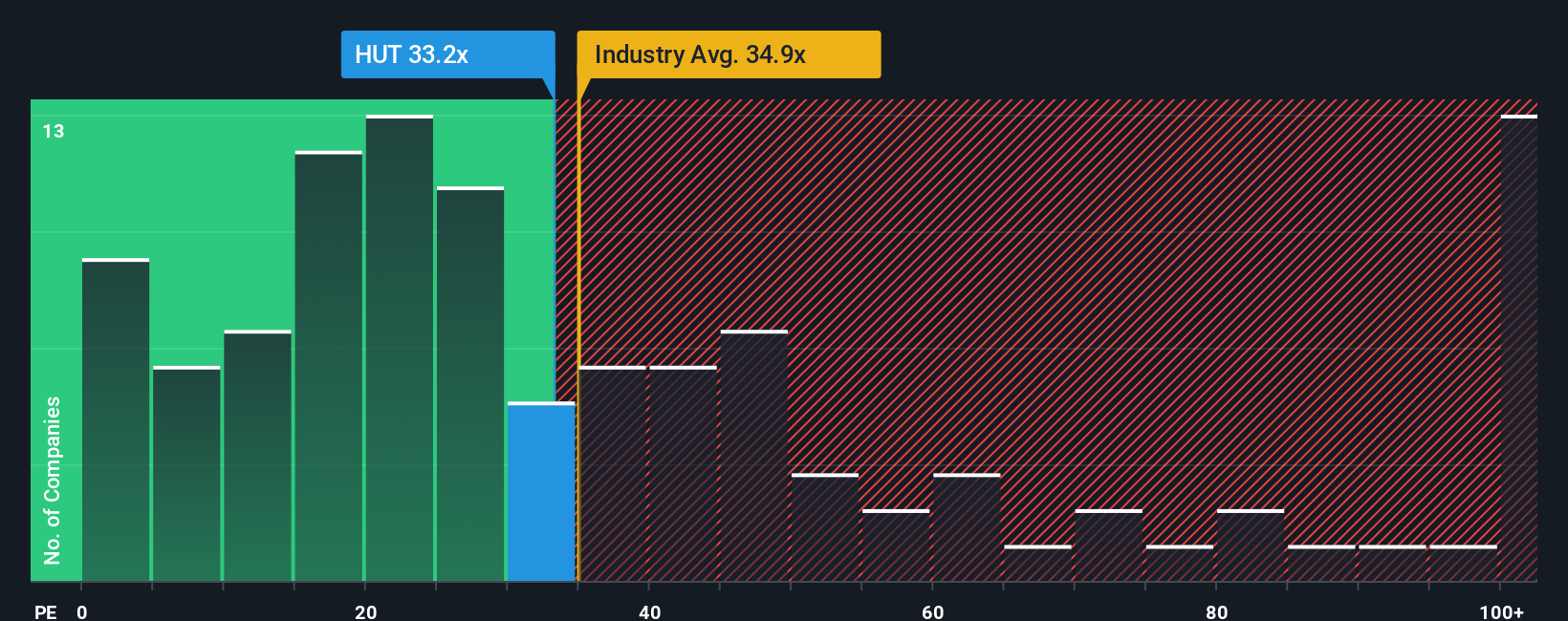

Looking at valuation through the lens of the price-to-earnings ratio, Hut 8 trades at 28.6 times earnings. This is lower than the US Software industry’s average of 35.6x, but well above both peer average ratios and the fair ratio of 17.7x. The gap highlights a valuation risk if market sentiment shifts and raises a key question for investors: is current optimism justified, or could the stock revert toward its fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hut 8 Narrative

If you see the data differently or want to dig deeper yourself, it’s easy to analyze the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Hut 8 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t sit on the sidelines when smarter investing opportunities could be within your reach. Power up your watchlist with ambition and uncover what others might miss using these flexible strategies:

- Uncover serious income potential by checking out these 19 dividend stocks with yields > 3% with yields above 3% and reliable cash flows.

- Catalyze growth in your portfolio by examining these 25 AI penny stocks involved in advances in automation, machine learning, and digital innovation.

- Capture value now with these 897 undervalued stocks based on cash flows that meet stringent cash flow criteria and stand out as hidden bargains in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives