- United States

- /

- Software

- /

- NasdaqGS:GTLB

Is GitLab Set for a Rebound After 8% Monthly Climb in 2025?

Reviewed by Simply Wall St

Deciding whether to hold onto, buy, or sell GitLab stock? You are definitely not alone. This has been a tricky name for many investors to figure out, especially as its price keeps bouncing around. Over the past month, GitLab’s share price has seen a healthy climb of 8.1%, but that comes after a tougher year overall with the stock down 13.3% year-to-date and 8.0% over the last twelve months. Even looking back three years, the journey has not been smooth, with GitLab down 3.3%, reflecting both shifting market sentiment and some uncertainty about sustained growth.

From a big-picture perspective, these moves came as the broader software sector adapted to new market dynamics, including changing expectations for tech growth and a renewed focus on profitability. For GitLab, the action hints at both cautious optimism and lingering risk aversion among investors, especially in times when software names have been reassessed through the lens of operational efficiency.

So where does that leave us in terms of GitLab’s value? Out of six major checks for undervaluation, GitLab currently scores a 3. That puts it squarely in the “mixed” camp. The stock is not screamingly cheap, but may potentially offer pockets of value for the right investor. Next up, we will break down these valuation approaches to see what is really driving this score, and after that, look at a framework for weighing the stock’s true worth.

Why GitLab is lagging behind its peersApproach 1: GitLab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting those amounts back to their present value. This method aims to capture what GitLab’s future profitability is worth today, based on current and expected performance.

For GitLab, analysts estimate that its current free cash flow stands at $33.5 million. Looking ahead, this figure is anticipated to rise substantially, with analyst estimates and extended projections suggesting free cash flow could reach around $526.7 million by 2030. The first five years use analyst forecasts, and anything beyond that relies on advanced extrapolation from third-party models. These assumptions underpin a two-stage Free Cash Flow to Equity DCF model, reflecting evolving growth rates over time.

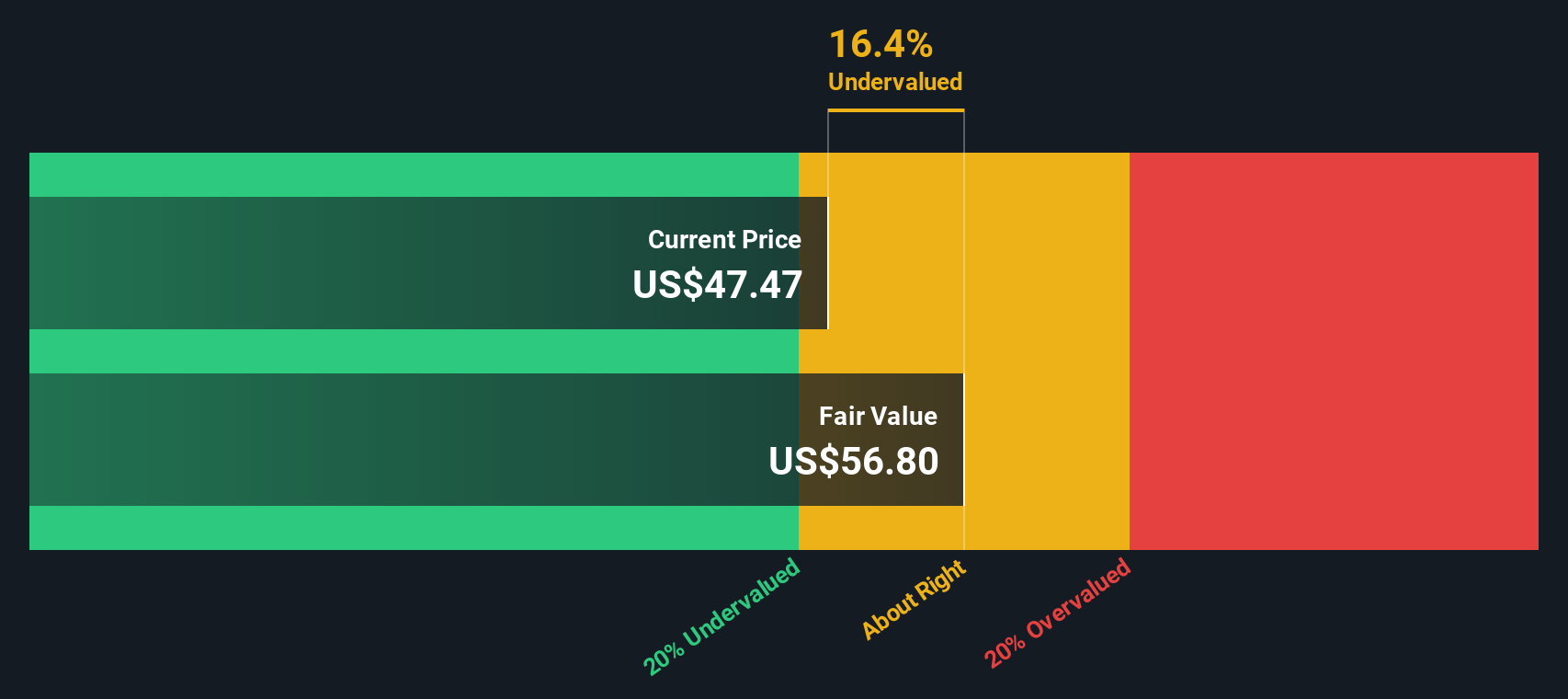

Crunching these projections, the DCF model calculates GitLab’s intrinsic value at $56.65 per share. Given the current market price, this implies GitLab stock is trading at a 13.8% discount to its estimated fair value, suggesting room for upside.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for GitLab.

Approach 2: GitLab Price vs Sales

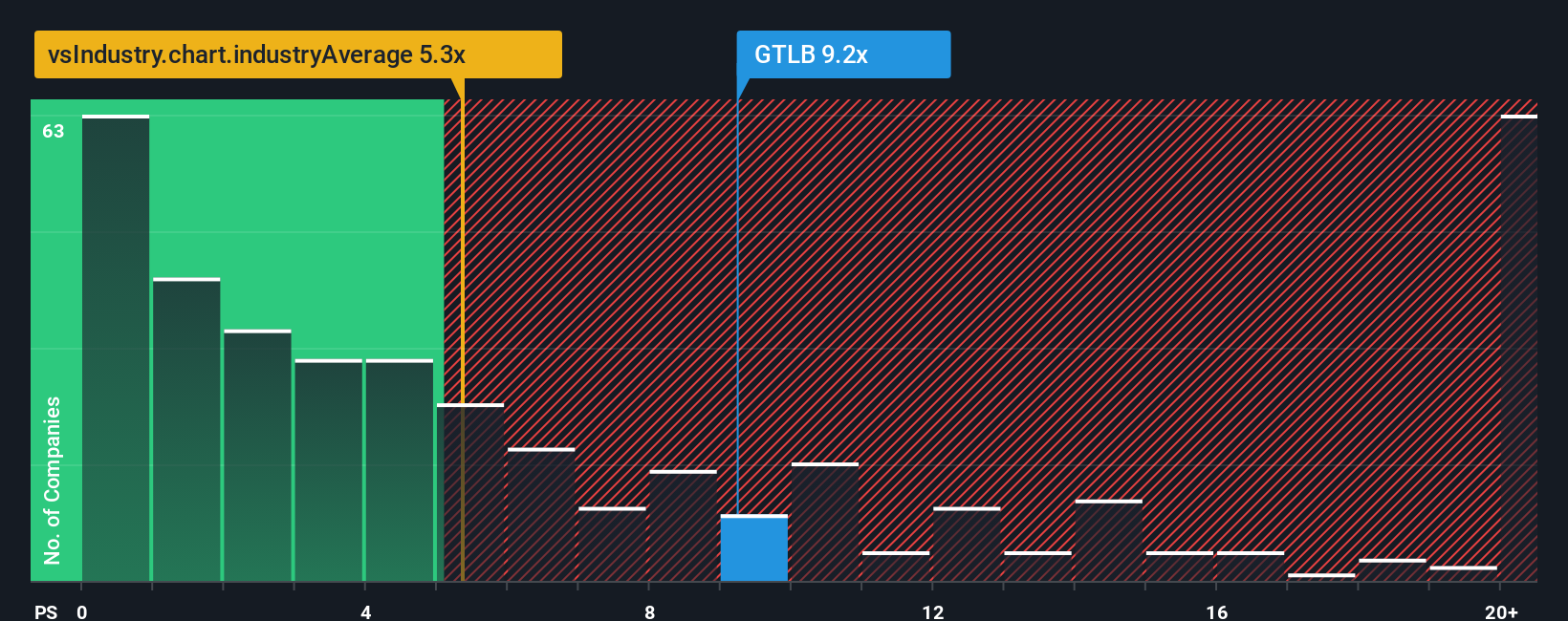

For companies like GitLab that are not yet profitable but continue to post steady revenue growth, the Price-to-Sales (P/S) ratio offers a practical way to gauge valuation. This metric looks at how much investors are paying for each dollar of revenue, which is especially helpful for fast-growing software businesses where earnings are not a meaningful yardstick yet.

It is important to remember that the "right" P/S ratio depends on a mix of expectations for future growth and perceived risk. High-growth companies typically command higher multiples, while greater uncertainty can hold these numbers back. GitLab currently trades at a P/S ratio of 9.49x. That is just above the peer group average of 9.34x and well above the broader software industry average of 5.51x, highlighting GitLab’s premium positioning in the market.

To refine this analysis, Simply Wall St’s proprietary "Fair Ratio" incorporates not just industry and peer multiples, but also GitLab’s unique profile, including its revenue growth, profitability trends, risk factors, market cap, and margins. This comprehensive approach means the Fair Ratio (calculated here as 10.39x) provides a more tailored benchmark than broad comparisons. Since GitLab’s current P/S of 9.49x is quite close to its Fair Ratio, the stock’s valuation appears reasonable at today’s levels.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your GitLab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, approachable tool that lets any investor describe their own story or perspective on a company, such as their assumed fair value or estimates for future revenue, earnings, and margins, giving meaning and context to the numbers.

A Narrative ties together a company’s unique story, a forward-looking financial forecast, and a resulting fair value to help you make more grounded investment decisions. Narratives are designed to be easy to create and update, and are available right now to millions of users on Simply Wall St’s Community page.

With Narratives, you can quickly see how your view of GitLab’s outlook compares to the current market price. When your calculated fair value exceeds the price, the stock could look attractive, and vice versa. Narratives also react dynamically to breaking news and fresh earnings, giving you a continuously updated view of the company’s prospects.

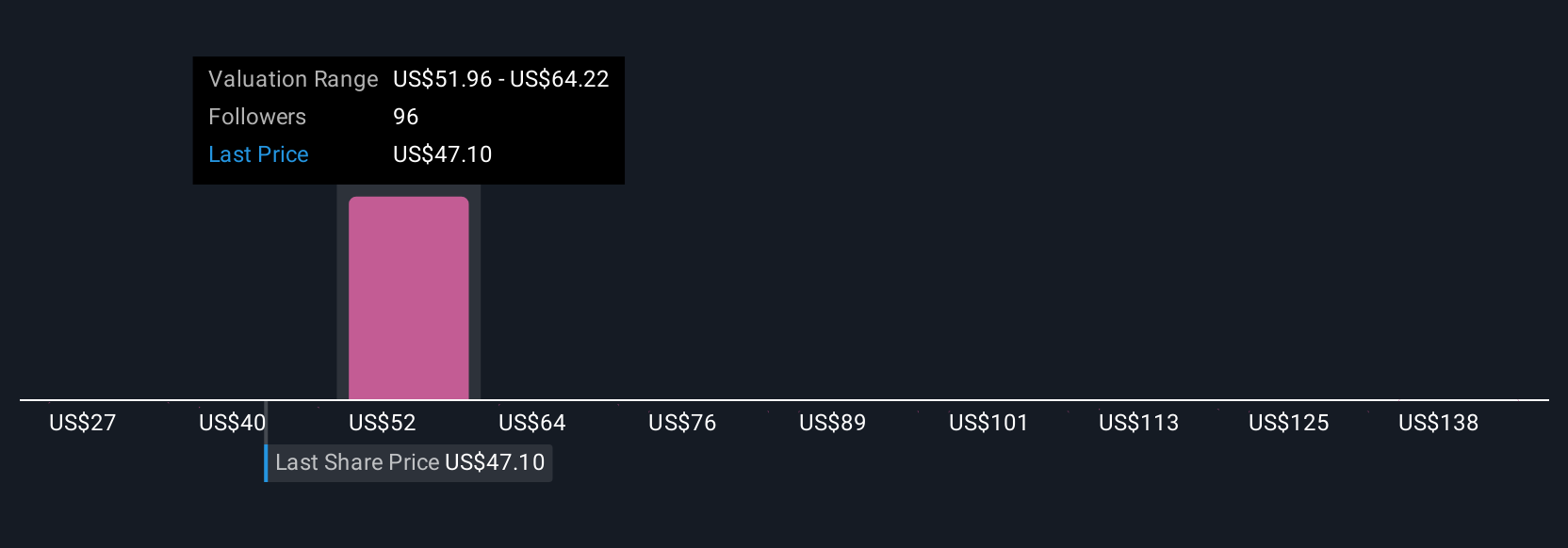

For example, investors holding the most optimistic view may believe GitLab’s deep AI integrations will drive earnings far above consensus and assign a fair value near $85.00, while the most cautious see downside toward $46.00 if competitive threats or execution risks materialize.

Do you think there's more to the story for GitLab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives