- United States

- /

- Software

- /

- NasdaqGS:GTLB

GitLab (GTLB): Reassessing Valuation After Q3 Beat and Raised Full-Year Profit Outlook Restores Investor Confidence

Reviewed by Simply Wall St

GitLab (GTLB) just reminded investors why earnings season matters, with shares climbing after traders took a second look at its third quarter beat and raised full year profit outlook, despite lingering growth concerns.

See our latest analysis for GitLab.

Even after the earnings pop, GitLab’s latest share price of $39.52 leaves its year to date share price return at about minus 30 percent, and its one year total shareholder return around minus 33 percent. This suggests that sentiment is still cautious, even as investors warm back up to the stronger guidance and incoming CFO.

If GitLab’s rebound has you rethinking your tech exposure, this could be a good moment to scout other high growth tech and AI names using high growth tech and AI stocks.

With shares still well below last year’s levels and trading at a sizable discount to analyst targets, the key question now is whether GitLab is quietly undervalued or if the market is already discounting its future growth.

Most Popular Narrative: 26.4% Undervalued

With GitLab’s last close at $39.52 versus a narrative fair value of about $53.67, the story leans firmly toward upside and strategic optionality.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools, potentially accelerating revenue growth and expanding margins as high-value features command premium pricing and upsell opportunities.

Curious how faster growth, richer margins and a lofty future earnings multiple can all coexist in one model? The full narrative explains the assumptions driving that gap between price and fair value.

Result: Fair Value of $53.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and uncertain execution around GitLab's evolving AI centric pricing model could derail the narrative if growth or monetization disappoints.

Find out about the key risks to this GitLab narrative.

Another Way to Look at Value

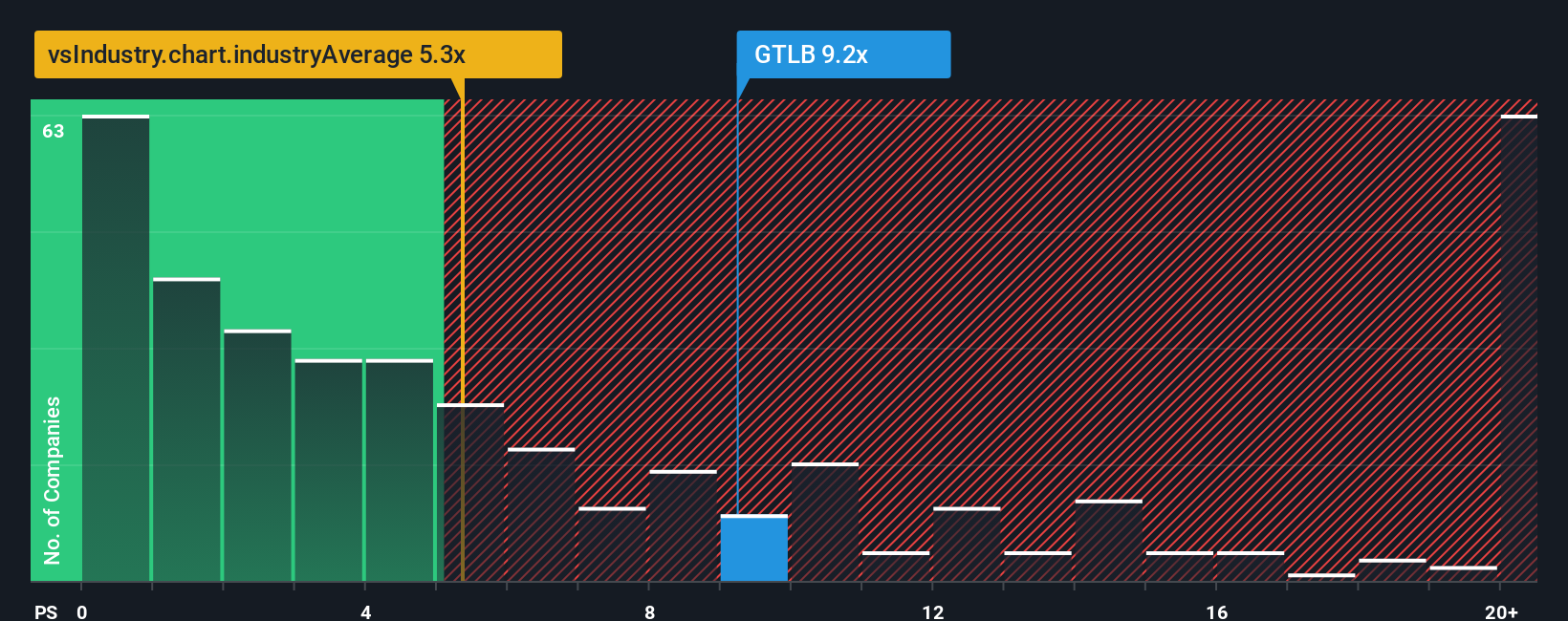

GitLab screens as good value on a price to sales basis at 7.3 times, below both peers at 8.6 times and a fair ratio of 8.4 times. That discount hints at upside, but it also signals the market is wary about execution and long term profitability. Which side of that trade do you believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If this view does not quite fit your perspective, or you prefer digging into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one stock. Use the Simply Wall Street Screener to uncover focused, data backed opportunities.

- Explore income potential by evaluating companies in these 13 dividend stocks with yields > 3% that aim to sustain attractive yields while balancing payout safety and growth.

- Review structural shifts by assessing innovators across these 26 AI penny stocks that are working to reshape industries with automation and intelligent software.

- Investigate valuation gaps by reviewing these 908 undervalued stocks based on cash flows where prices may not yet reflect the strength of underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)