- United States

- /

- Software

- /

- NasdaqGS:GTLB

GitLab (GTLB): Assessing Valuation After New Analyst Caution on Sales Strategy and Growth Outlook

Reviewed by Kshitija Bhandaru

GitLab (GTLB) stock slipped after Wells Fargo started coverage with a cautious outlook, highlighting uncertainties around the company’s new sales approach and upcoming guidance. These factors have kept investors watching for clearer growth signals.

See our latest analysis for GitLab.

GitLab’s stock has struggled for clear upward momentum, with the latest leadership change and cautious analyst sentiment contributing to an already mixed picture. Over the past year, the total shareholder return has slipped by 7.3%, indicating that recent improvements in fundamentals and new product features have yet to translate into sustained market confidence.

If you’re curious what else is gaining traction beyond the usual names, it could be the perfect moment to discover See the full list for free..

This raises the big question for investors: Is GitLab’s current price offering a window of opportunity, or is the market already factoring in all the expected growth ahead?

Most Popular Narrative: 20.7% Undervalued

With GitLab trading at $46.49 and the most widely followed narrative assigning a fair value of $58.64, the current price sits well below consensus projections. The gap between where the market sees GitLab now and what this narrative projects sets up a compelling debate over what is priced in.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools. This could potentially accelerate revenue growth and expand margins as high-value features command premium pricing and upsell opportunities.

How does this story expect GitLab to reach such a bullish valuation? There is one big assumption hiding under the surface, key to justifying the gap. Want to discover the bold financial leap and core driver that could shift expectations? Click to reveal what powers this forward-looking price target.

Result: Fair Value of $58.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from established platforms and persistent challenges in acquiring new customers could dampen GitLab's growth trajectory sooner than analysts expect.

Find out about the key risks to this GitLab narrative.

Another View: What Do Revenue Multiples Reveal?

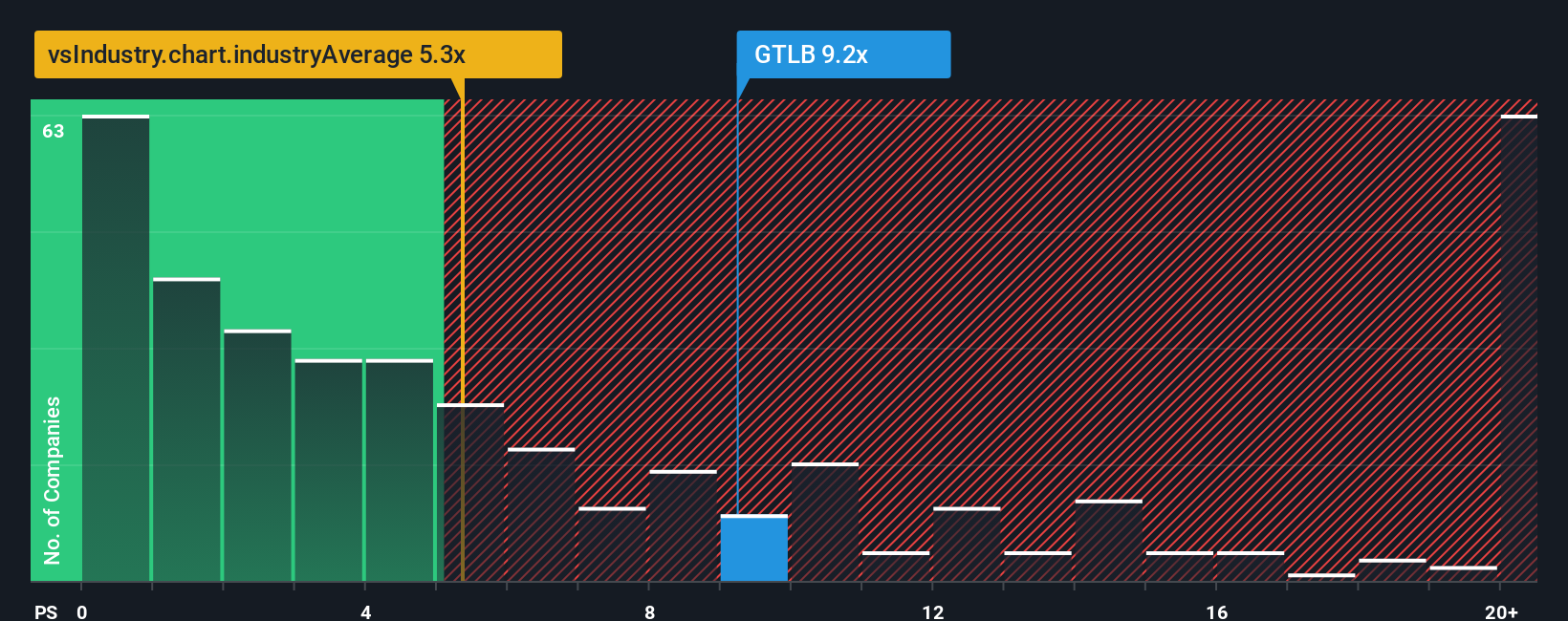

Looking at how GitLab is valued relative to sales, some see a different risk. The company trades at 9 times sales, well above the US Software industry average of 5.3 times and its peer average of 8.7 times. While the fair ratio sits at 10.1, this elevated price means investors are paying a premium. Any stumble in growth could weigh more heavily on the stock.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If the consensus views do not align with your outlook, you can dive into the numbers and shape your own conclusions in just a few minutes. Do it your way.

A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by checking out handpicked lists built to spark your next move. Trusted filters help you instantly spot potential that may otherwise go under the radar.

- Unlock inflation-beating income opportunities when you check out these 19 dividend stocks with yields > 3%, offering yields above 3% for steady, reliable returns.

- Get ahead of the curve in artificial intelligence by browsing these 23 AI penny stocks, packed with companies at the forefront of game-changing tech.

- Seize the chance to buy quality at a discount with these 914 undervalued stocks based on cash flows, which could offer significant upside based on real cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives