- United States

- /

- Software

- /

- NasdaqGS:GTLB

A Look at GitLab (GTLB) Valuation Following Earnings Beat and Fresh Analyst Updates

Reviewed by Kshitija Bhandaru

GitLab (GTLB) grabbed attention after its latest quarterly results came in with revenue growth above expectations, but the company’s forward guidance came in just below what the market was hoping for. Recent analyst commentary spotlighted ongoing questions around the company’s prospects as AI continues to reshape software development.

See our latest analysis for GitLab.

GitLab’s share price has lost momentum lately, closing at $46.86 and posting a total shareholder return of -13.8% over the past year. Although the stock enjoyed a strong 11.5% share price return in the last 90 days, recent dips reflect a mix of market optimism following its revenue beat, along with uncertainty around AI’s impact on its growth model.

If GitLab's AI-driven story has you thinking bigger, now’s the perfect opportunity to discover See the full list for free.

With diverging analyst opinions and GitLab’s recent price swings, the central question for investors is whether shares are trading below intrinsic value or if the company’s future growth is already fully reflected in the current price.

Most Popular Narrative: 20% Undervalued

With GitLab's fair value pegged at $58.64, which is well above the last close of $46.86, the dominant narrative spotlights a meaningful upside from current levels. The stage is set to reveal what’s driving this optimistic consensus.

Strong strategic partnerships with leading AI providers (Amazon, OpenAI, Google, Anthropic, Cursor) and native integration with leading AI development tools enhance the platform's open-ecosystem advantage and toolchain consolidation. This may drive further market share gains and reinforce GitLab's position as the unified platform of choice, positively impacting long-term growth and profitability.

Curious what’s underpinning this bullish outlook? One pillar of the narrative is a bold set of long-range growth forecasts, with impressive revenue expansion and margin gains anticipated. Don’t miss the surprising assumptions that fuel the fair value calculation. Discover the full growth story inside.

Result: Fair Value of $58.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition from established players and GitLab's recent slowdown in new customer acquisition could challenge the optimistic growth assumptions that support the current fair value.

Find out about the key risks to this GitLab narrative.

Another View: Market Ratios Raise Questions

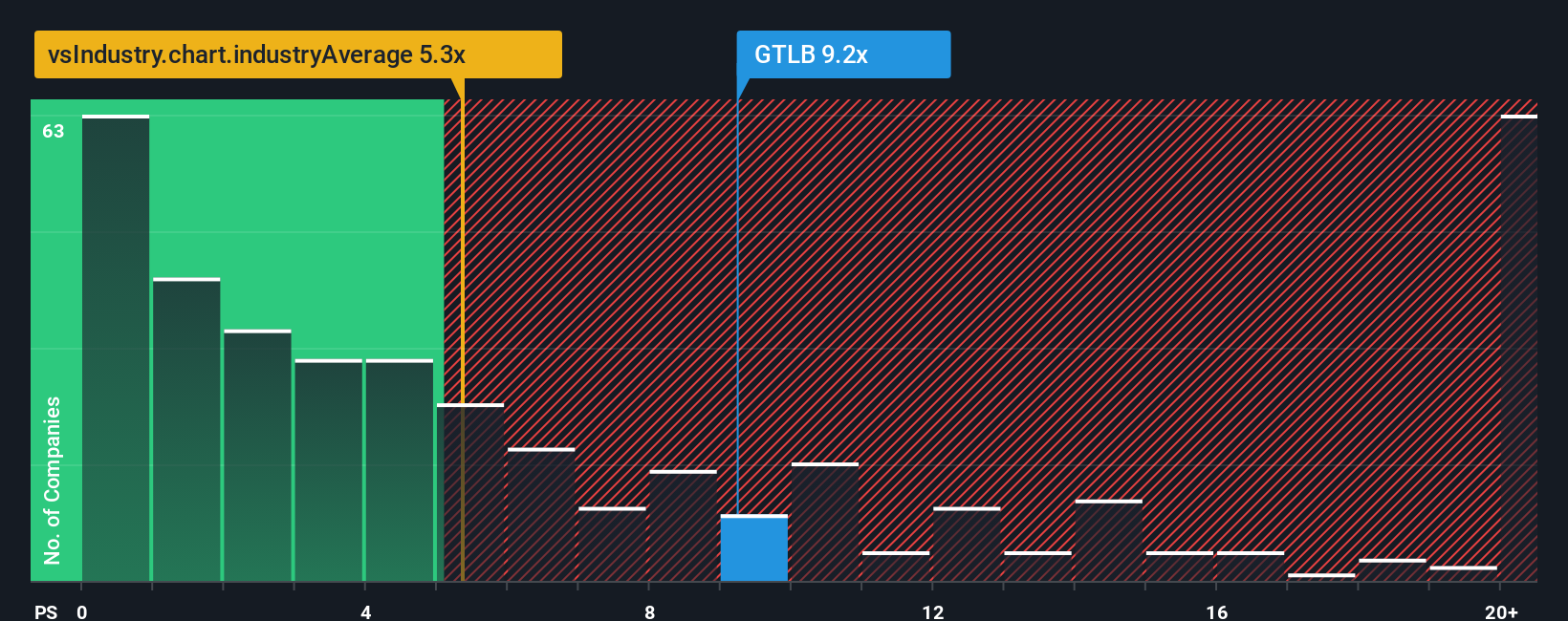

While the fair value estimate points to GitLab being undervalued, looking at price-to-sales reveals a challenge. GitLab trades at a 9.1x sales ratio, noticeably higher than the US software industry’s 5.2x and peer average of 7.4x. The fair ratio is 10x. This suggests the market still sees potential, but this premium carries risk if future growth stumbles. Could investors be getting ahead of themselves, or is the upside worth the extra price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If you see things differently or want to dig into the numbers on your own, you can build your personal thesis in just a few minutes. Do it your way

A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Opportunities?

Don’t limit your portfolio to a single story when you could spot game-changing potential all across the market. Let Simply Wall Street’s tools help you seize new ideas before they trend.

- Snap up consistent income by tapping into these 18 dividend stocks with yields > 3%, which offers attractive yields above 3%. This option is ideal for building your wealth steadily.

- Ride the technology wave by checking out these 25 AI penny stocks, a selection of companies powering the future of artificial intelligence innovation.

- Uncover promising gems trading below fair value with these 889 undervalued stocks based on cash flows to target companies that may be primed for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives