- United States

- /

- Software

- /

- NasdaqCM:GRRR

Gorilla Technology Group (NasdaqCM:GRRR) Surges 350% As Revenue Boost Predicted For 2025

Reviewed by Simply Wall St

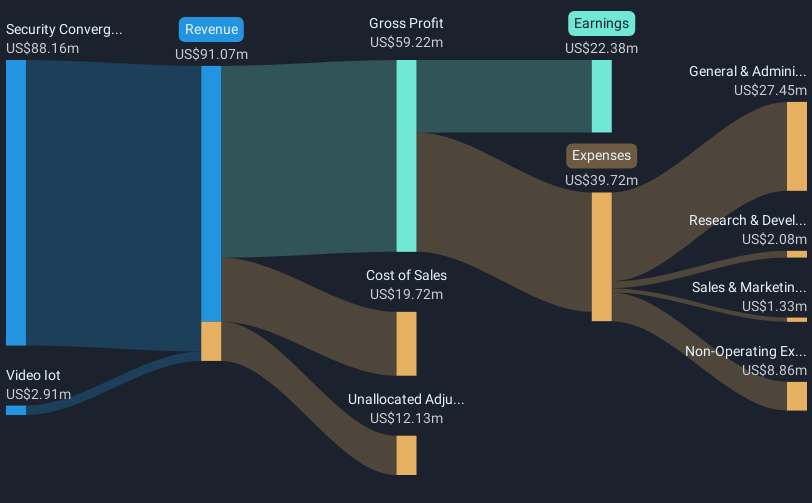

Gorilla Technology Group (NasdaqCM:GRRR) has experienced a remarkable 350% increase in its stock price over the past quarter, likely impacted by several of the company's recent strategic moves. The appointment of Thomas Sennhauser to its Board of Directors, a seasoned expert in AI and IoT from Intel, strengthens the company's governance and strategic direction. Additionally, Gorilla's recent earnings guidance predicting a revenue boost for 2025 underscores investor confidence. The focus on AI and IoT innovations, discussed in the special calls on February 7, emphasizes its commitment to industry transformation, potentially boosting investor interest. Meanwhile, broader market dynamics saw a mixed performance with key indexes experiencing fluctuations and Nvidia sliding after earnings. While the broader tech sector faced pressures from news on tariffs, Gorilla Technology Group seems to have bucked the trend, suggesting that its internal developments provided significant impetus for its impressive price rise.

Click here to discover the nuances of Gorilla Technology Group with our detailed analytical report.

Over the past year, Gorilla Technology Group's total shareholder returns reached 159.91%. This significantly surpasses both the US Software industry return of 6.7% and the general US market return of 16.7%. Several key developments may have supported this performance. The company announced a major profit turnaround, with net income reaching US$19.94 million for the year ended December 31, 2023. This marked an improvement from a significant net loss the previous year. Additionally, the partnership with SINTRONES Technology Corp aims to bolster Gorilla's smart city solutions, reflecting strategic industry expansion.

Executive enhancements, including the appointment of Keith Levy to the Board, and new CFO Bruce Bower, emphasized financial and governance improvements. The company's initiation of a share repurchase program worth up to US$6 million also highlighted a commitment to enhancing shareholder value. These transformative steps have solidified Gorilla Technology Group's position in the eyes of investors, contributing to the impressive total shareholder return achieved over the past year.

- Learn how Gorilla Technology Group's intrinsic value compares to its market price with our detailed valuation report.

- Analyze the downside risks for Gorilla Technology Group and understand their potential impact—click to learn more.

- Got skin in the game with Gorilla Technology Group? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in the Asia Pacific region, the Americas, Cayman Islands, and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives