- United States

- /

- Software

- /

- NasdaqGS:GEN

How Investors Are Reacting To Gen Digital (GEN) Expanding Cybersecurity Tools for Small Businesses Amid Rising Threats

Reviewed by Simply Wall St

- Earlier this month, Norton announced enhancements to its Small Business offering, introducing expanded Dark Web Monitoring and new Social Media Monitoring features that provide rapid alerts on compromised business data and social platform threats.

- This update comes as industry data shows breach attacks on small businesses rose by over 50% in 2025, reflecting a critical need for proactive cyber protection tools tailored to smaller enterprises.

- We'll explore how the launch of advanced monitoring tools for small businesses could influence Gen Digital's outlook and market position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Gen Digital Investment Narrative Recap

The story for Gen Digital centers on harnessing rising cyber risk and digitization trends by rolling out new, integrated security tools that boost recurring subscription revenue. The recent Norton Small Business enhancements reflect this strategy, addressing a key short-term catalyst: growing demand for advanced digital protection among small enterprises. However, while this move positions the company to capture incremental market share, it does not fundamentally shift the most pressing risk, intensifying price competition and platform bundling by larger ecosystem players, that could pressure margins and limit pricing power over time.

Among recent developments, the July launch of AI-powered deepfake protection in the Norton Genie AI Assistant is especially relevant. Like the small business feature expansion, it broadens Gen Digital’s differentiated platform capabilities, aiming to keep pace with evolving cyber threats and support future upsell and cross-sell opportunities, a core focus for sustaining revenue and ARPU growth.

Yet, in contrast to product momentum, investors should pay close attention to how heightened competition from embedded device security may eventually...

Read the full narrative on Gen Digital (it's free!)

Gen Digital's narrative projects $5.3 billion in revenue and $1.2 billion in earnings by 2028. This requires 7.7% yearly revenue growth and a $603 million earnings increase from the current $597 million.

Uncover how Gen Digital's forecasts yield a $34.64 fair value, a 19% upside to its current price.

Exploring Other Perspectives

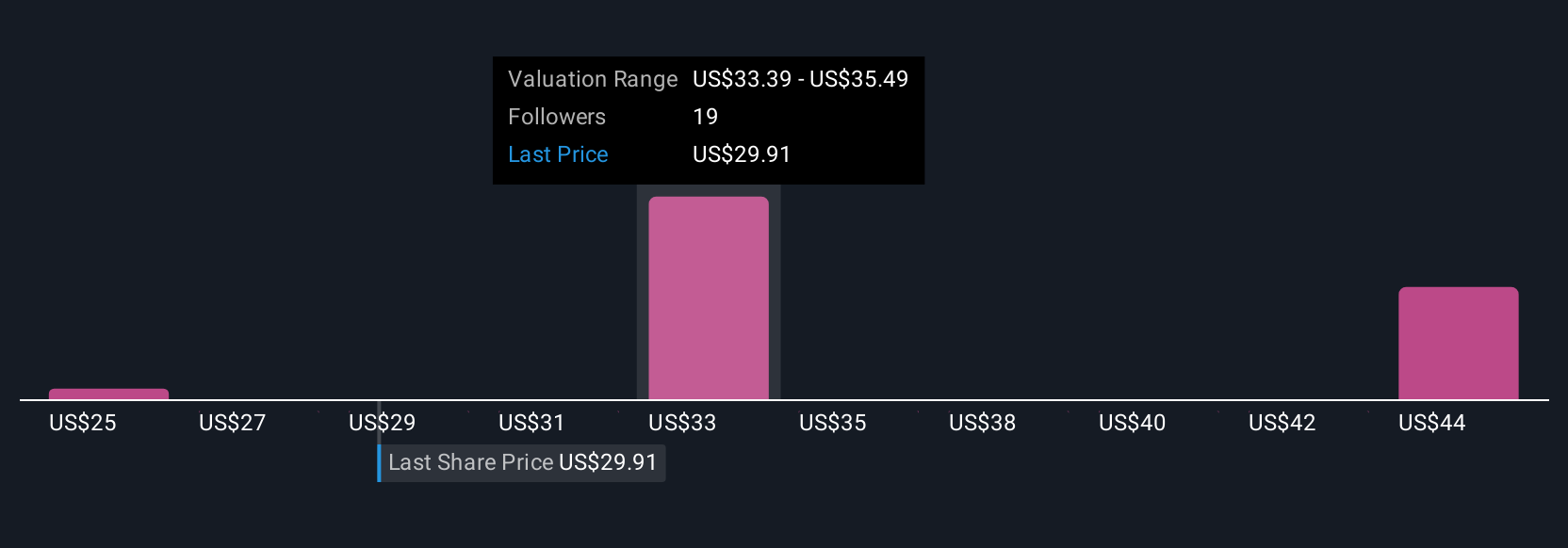

Five distinct fair value estimates from the Simply Wall St Community put Gen Digital’s worth between US$25 and US$45.34 per share. While the company’s enhanced feature set appeals to shifting customer needs, the risk remains if embedded security from device makers starts eroding the third party opportunity, prompting investors to weigh several plausible outlooks.

Explore 5 other fair value estimates on Gen Digital - why the stock might be worth as much as 56% more than the current price!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives