- United States

- /

- IT

- /

- NasdaqGM:GDS

GDS Holdings (GDS) Projects 2025 Revenues Between RMB 11,290 Million And RMB 11,590 Million

Reviewed by Simply Wall St

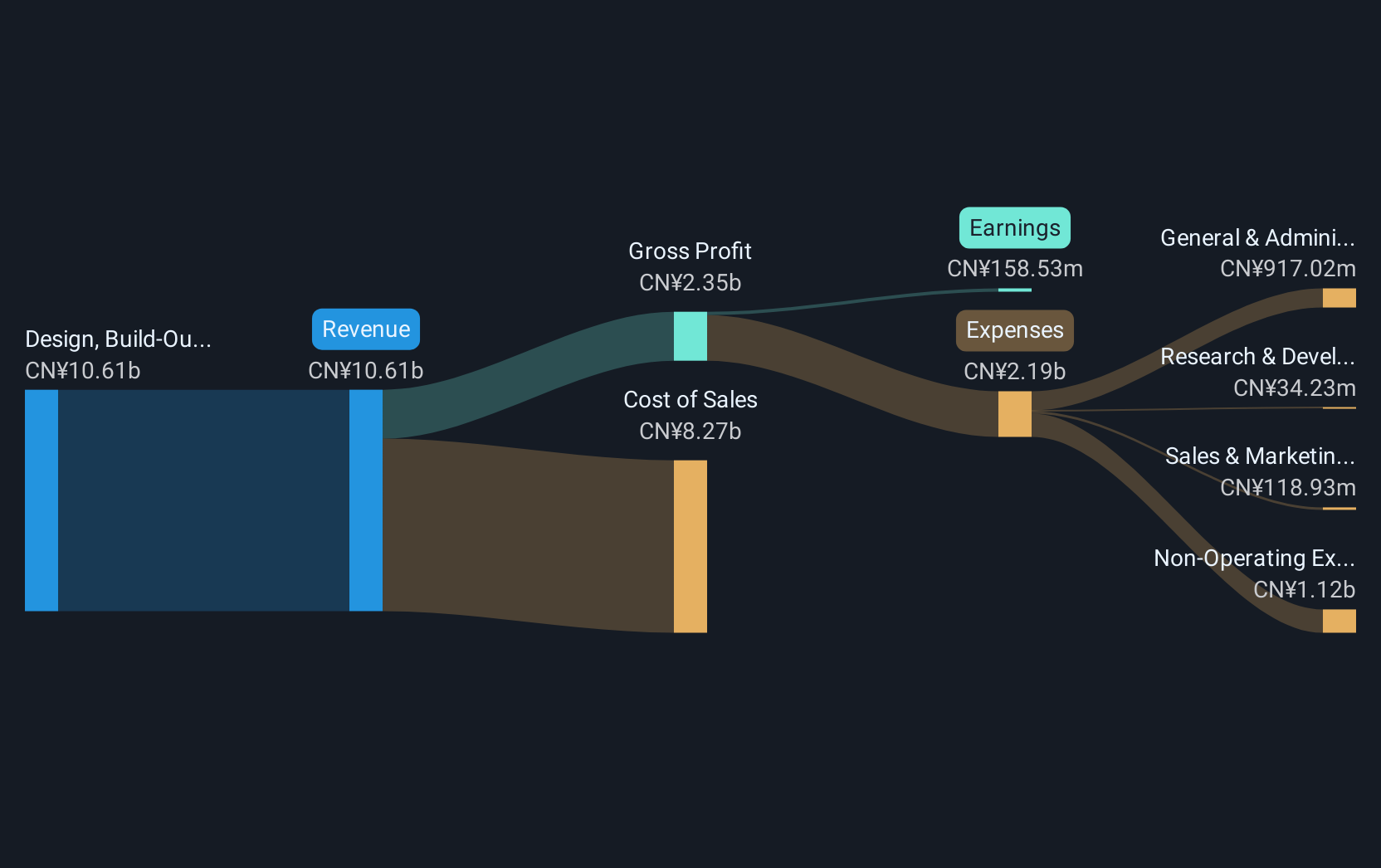

GDS Holdings (GDS) has recently confirmed its earnings guidance for 2025, projecting revenues between RMB 11,290 million and RMB 11,590 million. This aligns with its Q2 results where revenue increased significantly, and net loss contracted. Contributing to its 49% price rise last quarter are M&A rumors and robust financial performance, reflecting heightened interest in the data center sector, buoyed by the AI surge. The market's broader positive trend, with indices reaching record highs, likely supported GDS's momentum, despite the Dow's slight downturn. As the company's market value hovers around USD 7.4 billion, these developments collectively bolster investor confidence.

The recent confirmation of GDS Holdings' earnings guidance for 2025, combined with its Q2 results showing significant revenue increase and a contraction in net loss, may further reinforce analysts’ positive outlook on the company's future performance. The recent news could boost confidence in the projected revenue range of RMB 11,290 million to RMB 11,590 million, potentially aligning with analysts’ forecasts of a 14.1% annual growth over the next three years. This could support expectations of earnings reaching CN¥734.2 million by September 2028. However, risks like margin pressure and high leverage remain factors that could impact these forecasts.

Over the last year, GDS Holdings’ total return, including share price appreciation and dividends, was 138.17%, reflecting a very large increase over the period. In comparison, the company's share price has also exceeded the US Market's return of 19.1% while outperforming the 17.1% return of the US IT industry over the same timeframe. This robust performance underscores investor interest and confidence in GDS Holdings, echoing the excitement surrounding its potential in the data center sector amid the AI boom.

With the current share price at US$38.50, nearing the consensus analyst price target of US$47.44, there is a potential 23.5% upside. The market's optimism could sustain this momentum if GDS Holdings continues to leverage its strategic positioning and overcome ongoing challenges like asset sales dependency and customer concentration. These developments will be crucial in achieving or surpassing the revenue and earnings expectations that support the analyst price targets.

Take a closer look at GDS Holdings' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Low risk with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)