- United States

- /

- Software

- /

- NasdaqGS:CCCS

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite recently retreated from record highs amid a deluge of earnings reports, investors are closely watching how major tech stocks will perform in this dynamic environment. In such a climate, identifying high-growth tech stocks involves looking for companies with strong earnings potential and innovative capabilities that can thrive despite broader market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| Circle Internet Group | 30.97% | 60.79% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 24.07% | 59.30% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.33% | 105.07% | ★★★★★★ |

Click here to see the full list of 221 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

BitFuFu (FUFU)

Simply Wall St Growth Rating: ★★★★★☆

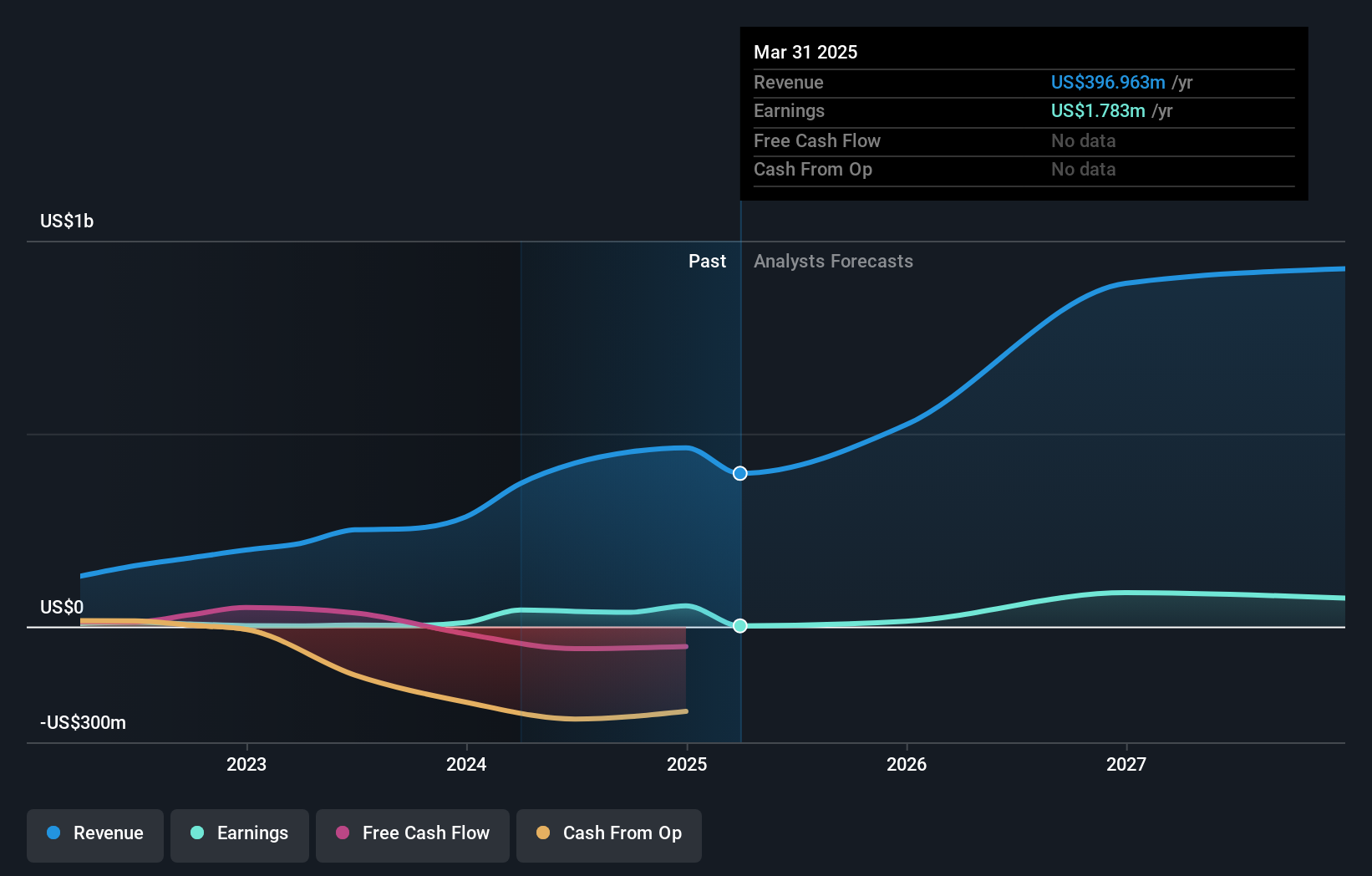

Overview: BitFuFu Inc. offers digital asset mining solutions across North America, Asia, Europe, and globally with a market capitalization of approximately $699.73 million.

Operations: BitFuFu Inc. generates revenue primarily from its Internet Software & Services segment, reporting $396.96 million in this area. The company operates internationally, providing digital asset mining solutions across multiple regions.

BitFuFu showcases a robust trajectory in the tech sector, with its revenue forecast to surge by 31.4% annually, significantly outpacing the US market average of 9%. This growth is underpinned by a remarkable expected annual earnings increase of 72.3%, highlighting its potential in an expanding industry. Despite recent challenges, including a significant one-off loss of $8.1 million affecting past results, BitFuFu continues to innovate and expand its operations as evidenced by recent increases in Bitcoin production and hashrate management. These developments suggest resilience and adaptability in a volatile market, positioning BitFuFu as a noteworthy entity in high-growth tech discussions.

- Click here and access our complete health analysis report to understand the dynamics of BitFuFu.

Explore historical data to track BitFuFu's performance over time in our Past section.

CCC Intelligent Solutions Holdings (CCCS)

Simply Wall St Growth Rating: ★★★★☆☆

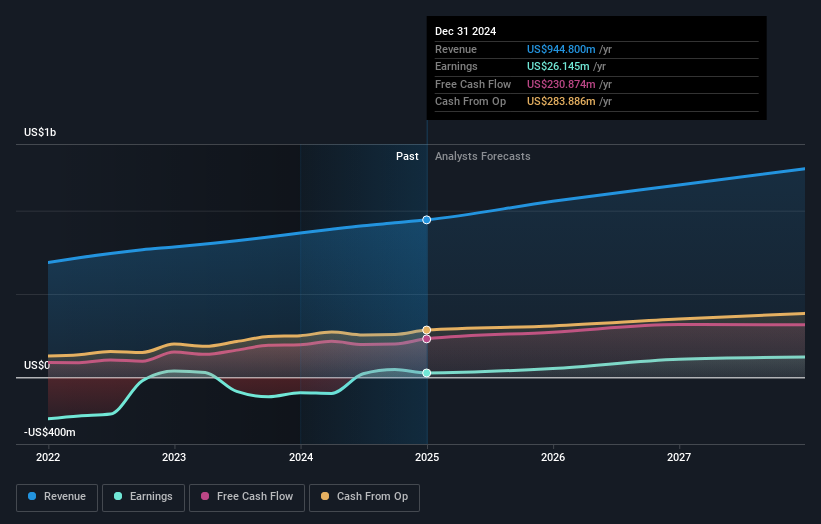

Overview: CCC Intelligent Solutions Holdings Inc. operates as a software as a service (SaaS) company serving the property and casualty insurance sectors in the United States and China, with a market cap of $6.43 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $969.13 million. It operates within the property and casualty insurance industry across the United States and China.

CCC Intelligent Solutions Holdings Inc. (CCC) is navigating a transformative path in the tech landscape, marked by a promising 75.6% forecasted annual earnings growth, significantly outstripping the US market's average of 14.7%. Despite facing challenges such as a substantial one-off loss of $16.1 million that skewed recent financial results, CCC's strategic initiatives—including the launch of innovative products like CCC® Pay Workflow—demonstrate its commitment to enhancing operational efficiency and customer engagement in the collision repair sector. The recent board appointment of Barak Eilam, with his extensive background in AI and enterprise software, further positions CCC to capitalize on growth opportunities within tech-driven customer solutions, reinforcing its potential amidst competitive industry dynamics.

Integral Ad Science Holding (IAS)

Simply Wall St Growth Rating: ★★★★☆☆

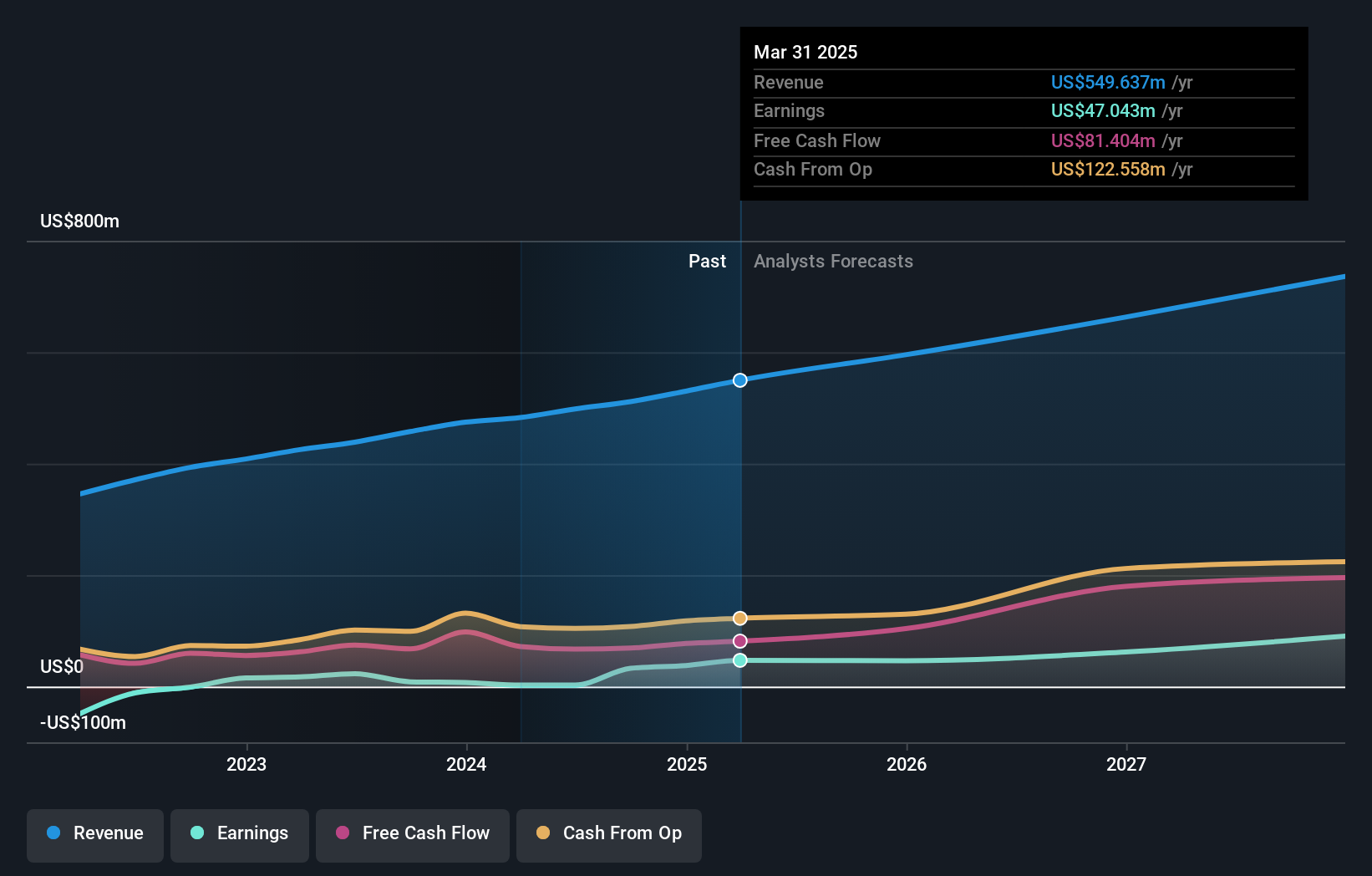

Overview: Integral Ad Science Holding Corp. is a digital advertising verification company with operations across multiple countries, including the United States and several in Europe and Asia, and has a market cap of approximately $1.36 billion.

Operations: IAS generates revenue primarily from its Internet Software & Services segment, amounting to approximately $549.64 million. The company operates in various regions, including the US, Europe, and Asia.

Integral Ad Science Holding Corp. (IAS) is making significant strides in the tech sector, particularly with its recent strategic alliances and product innovations. The company's partnership with Snap Inc. to introduce a customized attention measurement tool on Snapchat exemplifies its commitment to enhancing ad measurement technologies, a move that could reshape advertising strategies across social platforms. Additionally, IAS's inclusion in multiple Russell 2000 indexes underscores its growing influence and stability within the market. Financially, IAS reported a robust annual earnings growth of 21%, outpacing the US market average of 14.7%, alongside a healthy revenue increase of 9.9% per year, indicating sustained operational success and market confidence.

- Unlock comprehensive insights into our analysis of Integral Ad Science Holding stock in this health report.

Understand Integral Ad Science Holding's track record by examining our Past report.

Seize The Opportunity

- Click this link to deep-dive into the 221 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives