- United States

- /

- Software

- /

- NasdaqGS:FTNT

How FortiGate on NVIDIA DPUs Could Redefine AI Data Center Security for Fortinet (FTNT) Investors

Reviewed by Sasha Jovanovic

- Earlier this week, Fortinet announced that its FortiGate VM virtual firewall now runs directly on NVIDIA’s BlueField-3 DPU, offloading core security functions like firewalling, segmentation, and zero-trust controls from host CPUs to secure high-performance AI and private-cloud environments without degrading workload performance.

- This move embeds security into the data center fabric itself, positioning Fortinet’s platform as a way to handle AI-scale traffic while maintaining consistent protection and operational simplicity across multitenant, cloud, and edge deployments.

- We’ll now examine how embedding FortiGate VM on NVIDIA BlueField-3 DPUs could reshape Fortinet’s investment narrative amid rising platform-competition concerns.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

Fortinet Investment Narrative Recap

To own Fortinet, you need to believe its integrated networking and security platform can stay relevant as customers consolidate vendors and shift toward AI and cloud-centric architectures. The BlueField-3 DPU integration speaks directly to that concern, but it does not immediately change the biggest near term swing factor, which is how well Fortinet converts today’s firewall refresh and AI data center interest into higher margin recurring services while managing competitive pressure and slowing service growth.

The most closely related announcement is Fortinet’s Secure AI Data Center solution with Arista Networks, which also targets AI infrastructure with high performance, zero trust security. Together with the NVIDIA BlueField-3 DPU move, it reinforces Fortinet’s push to make its platform central to AI factories and large private clouds, a key catalyst if it can deepen enterprise adoption rather than relying mainly on existing firewall customers.

Yet even as AI data center wins grab attention, investors should be aware that once the current firewall refresh cycle fades...

Read the full narrative on Fortinet (it's free!)

Fortinet's narrative projects $9.2 billion revenue and $2.4 billion earnings by 2028.

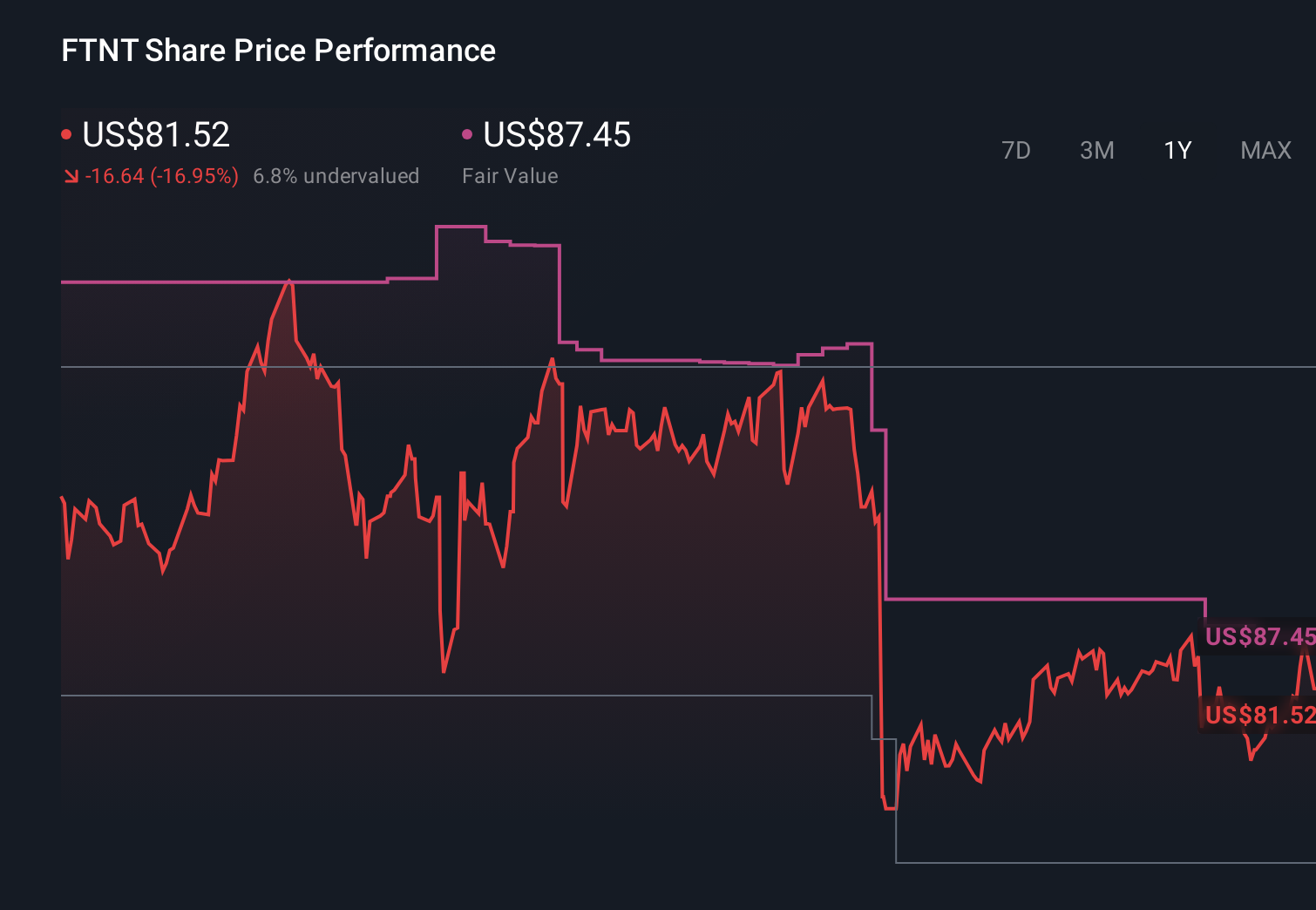

Uncover how Fortinet's forecasts yield a $87.45 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Twenty six Simply Wall St Community fair value estimates span roughly US$82 to US$110 per share, underscoring how differently individual investors view Fortinet. Against that wide range, the central question is whether Fortinet’s AI focused platform moves can truly counteract mounting platform consolidation risk and its potential impact on long term growth.

Explore 26 other fair value estimates on Fortinet - why the stock might be worth just $82.39!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion