- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet’s Valuation in Focus After New AI-Powered Security Product Launch

Reviewed by Bailey Pemberton

Thinking about what to do with Fortinet stock right now? You are not alone. With all the buzz around cybersecurity and the constant stream of headlines, it is fair to wonder if the company’s best days are already baked into its price or if this is an opportunity others are missing.

Let’s look at the numbers for a moment. Fortinet just closed at $84.92. In the past week, the stock moved up 1.0%, and it has seen a solid 7.7% gain over the last 30 days. That is not bad, especially given that its year-to-date return is down 10.4%. If you zoom out a little further, the story changes: over the last year, Fortinet is up 9.2%, and in the past five years it has delivered a remarkable 225.1% return. Those long-term gains underscore the market’s belief in cybersecurity as a driver of future growth, despite any bumps along the way. Some of this recent optimism may relate to broader market developments, including renewed focus on digital protection as companies expand their remote networks and regulations push organizations to strengthen security.

If you are looking for a quick snapshot, Fortinet currently has a valuation score of 4 out of 6 possible checks for being undervalued. That means it clears the bar in most of the key assessments analysts use. But what does that really mean in the context of today’s market, and is it enough to justify making a move now? Up next, let’s dig into the major valuation methods and, later on, explore a smarter way to cut through the noise to decide if Fortinet belongs in your portfolio.

Why Fortinet is lagging behind its peers

Approach 1: Fortinet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting Fortinet’s future free cash flows and discounting them back to what they would be worth in today’s dollars. This approach is useful for figuring out the true, intrinsic value of a company, based on its expected ability to generate cash over time.

Currently, Fortinet’s free cash flow stands at $2.05 Billion. Analysts estimate that free cash flow could rise to $3.54 Billion by 2029. While analysts provide detailed estimates out to five years, projections further out are extrapolated based on trends. Over the next decade, free cash flows are expected to see healthy growth, which supports the robustness of the company’s business model in software and cybersecurity.

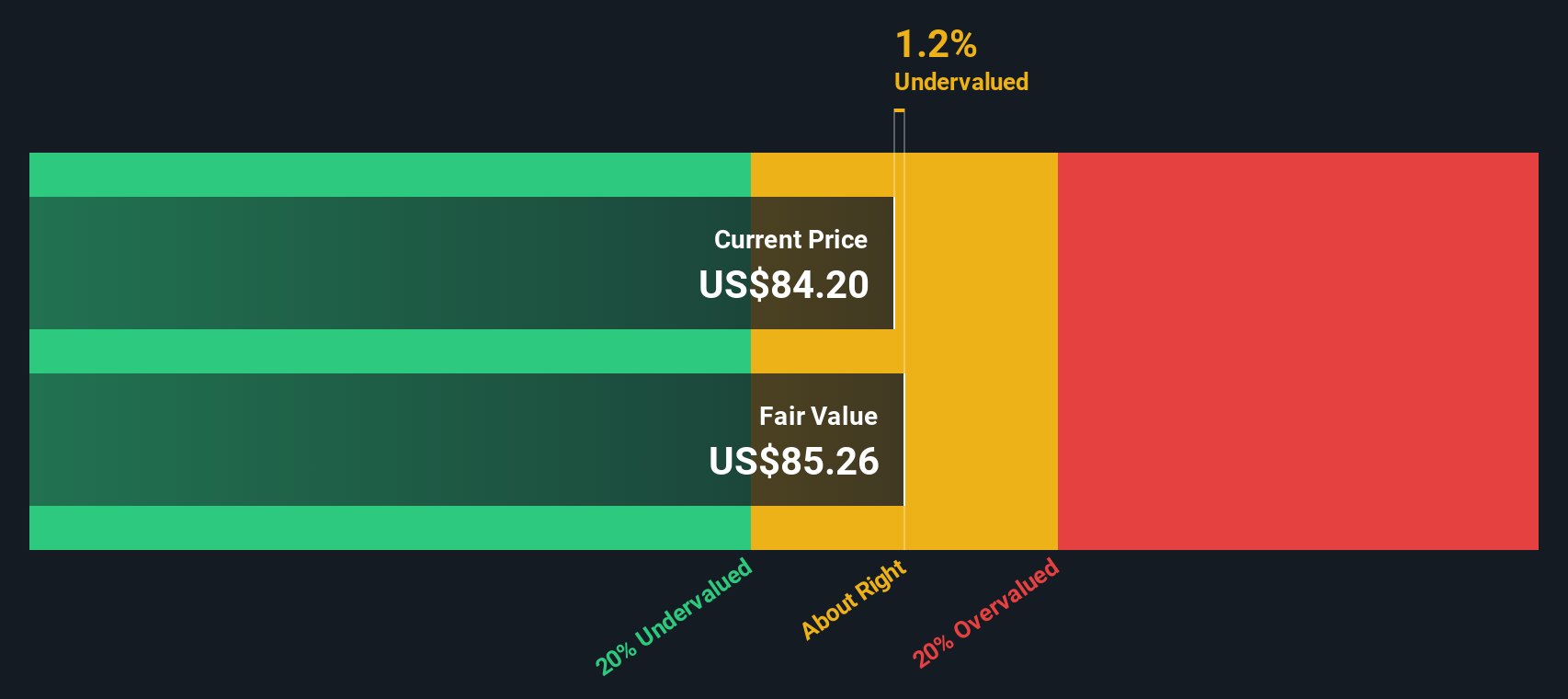

The result of this DCF analysis is an estimated intrinsic value of $85.12 per share. That figure is almost exactly in line with Fortinet’s current closing price of $84.92. According to the DCF, the stock trades at a 0.2% discount to its inherent value, suggesting it is fairly priced relative to its future cash flow expectations.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Fortinet's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Fortinet Price vs Earnings

For profitable companies like Fortinet, the price-to-earnings (PE) ratio is one of the most widely used valuation metrics. The PE ratio shows how much investors are willing to pay for $1 of the company’s earnings, which makes it a straightforward way to assess whether the stock appears expensive or cheap compared to others in the market.

Expectations for future growth and a company’s risk profile play a crucial role in determining what a "normal" or fair PE ratio should be. High-growth and lower-risk businesses usually command higher PE multiples, reflecting hopes for rising profits and stability.

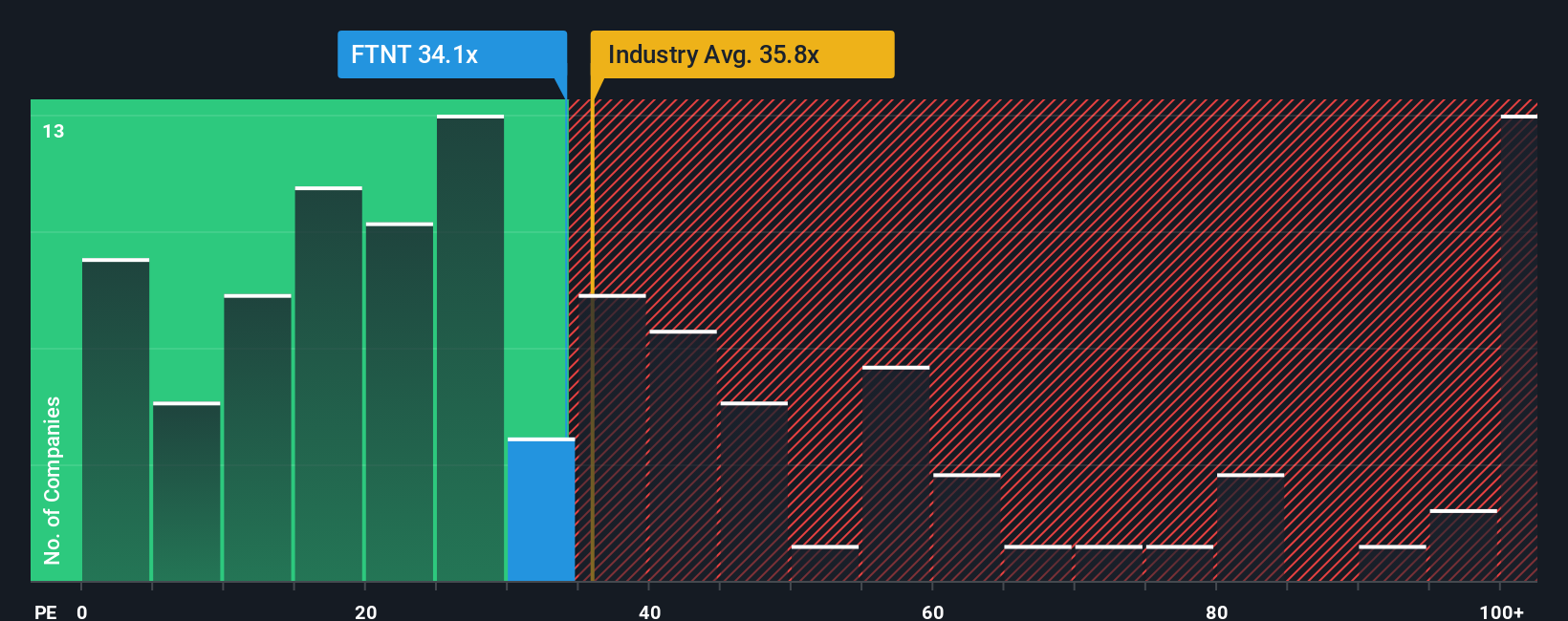

Fortinet currently trades at a PE ratio of 33.5x. That sits just under the software industry’s average PE of 35.6x and well below the average of its peer group at 72.7x. On the face of it, the stock does not look especially expensive or cheap when compared to broad sector benchmarks.

To get a more tailored perspective, we can look at Simply Wall St’s proprietary “Fair Ratio” for Fortinet, which factors in unique aspects like earnings growth, profit margins, industry positioning, company size, and risks. This “Fair Ratio” assigns Fortinet a multiple of 35.9x, slightly above its current PE. Because the Fair Ratio uses a holistic approach, it is more insightful than simply comparing against industry or peer averages, which may overlook important company-specific details.

With Fortinet’s current PE ratio of 33.5x just below its Fair Ratio of 35.9x, the stock appears to be valued about right by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortinet Narrative

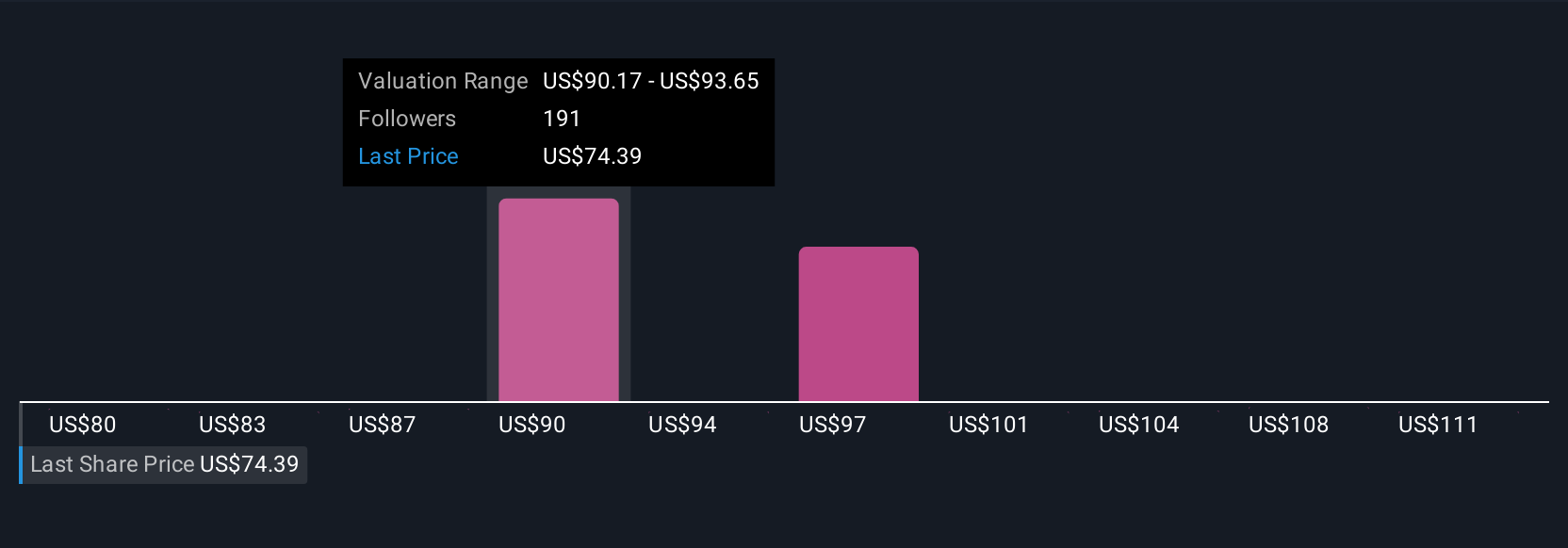

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just financial data; it is the story and logic you believe about a company, made tangible by your assumptions around future revenue, earnings, and margins. Narratives connect your view of Fortinet’s business direction to specific financial forecasts and, ultimately, to an estimated fair value.

On Simply Wall St’s Community page, Narratives are easy to create and compare, making investing more accessible for everyone. They let you see at a glance whether your view (or any other investor’s) suggests the stock is undervalued or overvalued by lining up Fair Value with today’s Price. Since Narratives are dynamic, they update as soon as new news, earnings, or forecasts are released.

For example, some investors expect robust recurring growth and see Fortinet’s Fair Value as high as $120, while others are more cautious and estimate only $67. Narratives empower you to understand why perspectives differ and make better, more confident decisions about when to buy, hold, or sell.

Do you think there's more to the story for Fortinet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion