- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (NasdaqGS:FTNT) Announces Partnership With Liquid Networx For Enhanced Data Security

Reviewed by Simply Wall St

Fortinet (NasdaqGS:FTNT) has seen a significant price increase of 15% over the past week, a notable shift that coincides with its recent partnership announcement with Liquid Networx. This collaboration focuses on deploying FortiDLP solutions to bolster data security for a major global retail enterprise. In a market that has risen 5% over the same period, Fortinet’s strong performance stands out, potentially driven by the strategic importance of this alliance in enhancing its cybersecurity offerings. While no market-wide events directly influenced this move, aligning with market trends, the partnership likely added momentum to Fortinet’s stock performance.

Buy, Hold or Sell Fortinet? View our complete analysis and fair value estimate and you decide.

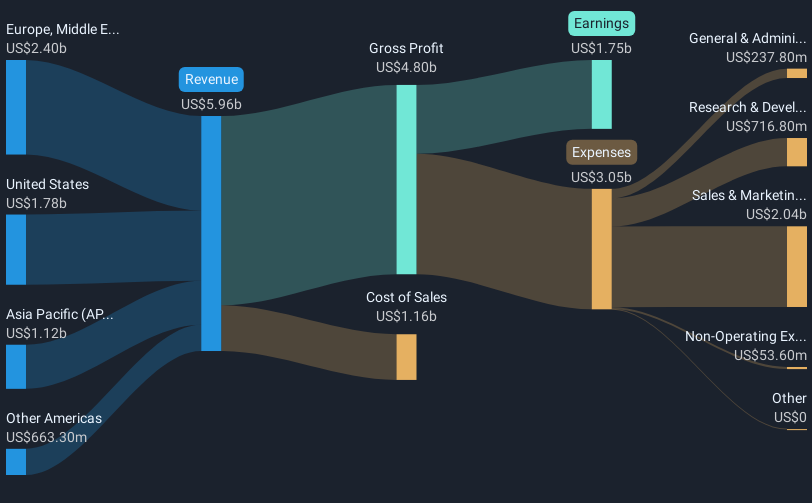

Fortinet's recent partnership with Liquid Networx, focusing on enhanced cybersecurity solutions, aligns well with its strategic narrative centered on Unified SASE and AI-driven security operations. This collaboration could potentially bolster revenue forecasts by enhancing Fortinet's appeal to both large enterprises and small to medium businesses, especially through targeted upsell opportunities in cybersecurity and firewall solutions. Analysts are optimistic, projecting that revenue might increase due to these enhanced offerings, supporting their price target for the coming years.

Over the past five years, Fortinet has delivered a substantial total return to shareholders of 332.59%, showcasing impressive growth beyond short-term fluctuations. This long-term performance starkly contrasts with recent one-year results, where Fortinet exceeded the US Software industry, which saw a 1.1% decline, validating the resilience of its growth strategy.

In the context of the recent price movement, Fortinet's current share price, when set against a consensus price target of US$114.46, reflects a potential upside of approximately 23.1%. The partnership with Liquid Networx brings a fresh perspective to the company's future growth prospects and could influence earnings estimates, potentially bridging the gap to the projected valuation set by analysts. This forward outlook underscores the importance of execution on growth strategies, especially as Fortinet seeks to expand its footprint in a competitive cybersecurity landscape.

Explore historical data to track Fortinet's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives