- United States

- /

- Software

- /

- NasdaqGS:FTNT

Do Recent Analyst Downgrades and Insider Sales Hint at Shifting Confidence in Fortinet’s (FTNT) Growth Story?

Reviewed by Simply Wall St

- In recent days, Fortinet faced multiple analyst downgrades and the initiation of a legal investigation following disappointing second-quarter 2025 results, with specific concerns raised about the sustainability of its firewall refresh cycle.

- An interesting insight is that insider and congressional sales of Fortinet shares have increased, highlighting greater caution among key stakeholders during this period of heightened scrutiny.

- We'll now explore how these analyst actions and legal developments could reshape confidence in Fortinet's business outlook and growth narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Fortinet Investment Narrative Recap

To own Fortinet stock, an investor needs to be confident in the company’s ability to sustain growth beyond the current hardware firewall refresh cycle, while expanding into cloud and Security-as-a-Service markets. Recent analyst downgrades and a legal investigation sparked by second-quarter results have increased focus on this short-term catalyst, and concerns about a potential post-refresh slowdown are now more material than before.

One recent announcement that speaks directly to these concerns is the August buyback plan increase, pushing total authorization to US$9.25 billion. This move may signal management’s belief in long-term value, but it doesn’t directly offset risk around delayed product cycles or slower new customer adoption.

However, investors should know that while many focus on product innovation, the risk that Fortinet’s hardware refresh cycle fades before new products gain traction should not be underestimated...

Read the full narrative on Fortinet (it's free!)

Fortinet's narrative projects $9.2 billion in revenue and $2.4 billion in earnings by 2028. This requires a 13.1% yearly revenue growth and an increase of $0.5 billion in earnings from $1.9 billion today.

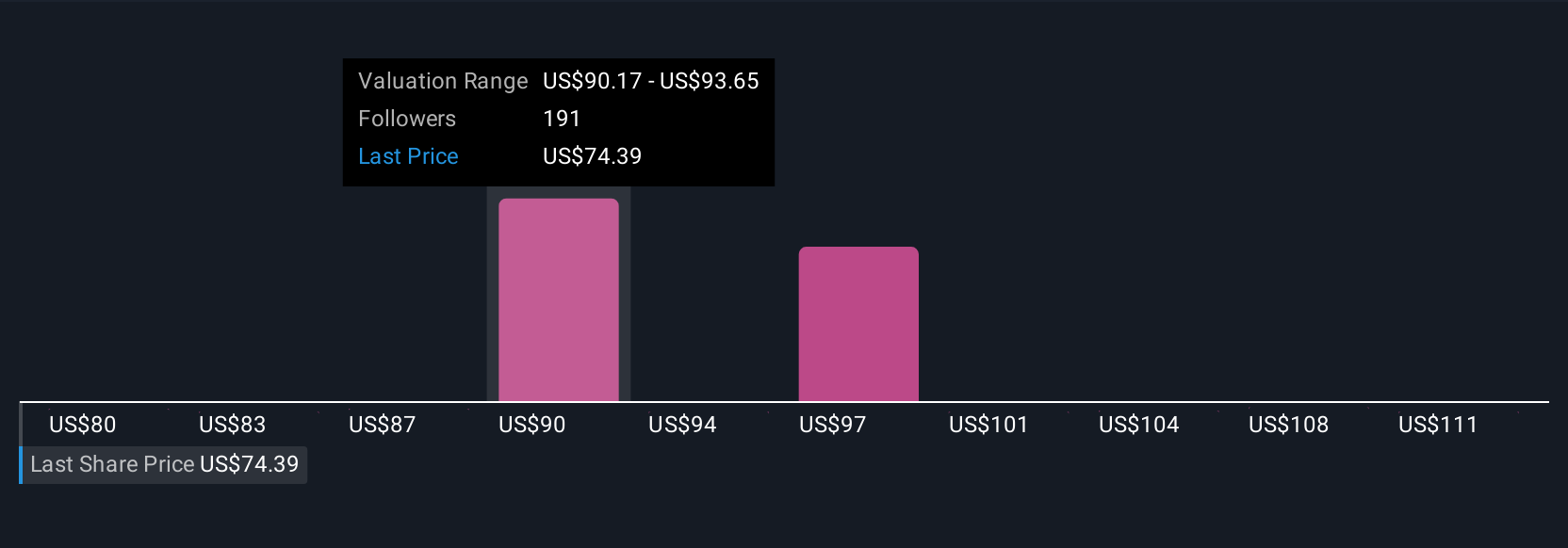

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Thirty-one members of the Simply Wall St Community have shared fair value estimates for Fortinet ranging from US$76.28 to US$110.52 per share. While opinions vary, the major question remains whether Fortinet can convert its current upgrade-driven momentum into durable long-term growth.

Explore 31 other fair value estimates on Fortinet - why the stock might be worth just $76.28!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

No Opportunity In Fortinet?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives