- United States

- /

- Software

- /

- NasdaqGS:FROG

JFrog (FROG): Evaluating Valuation After Strong 2024 Share Price Performance

Reviewed by Kshitija Bhandaru

JFrog (FROG) shares have been catching the attention of investors, especially given their strong performance in recent months. The company’s stock is up over 20% in the past 3 months and more than 55% year-to-date, sparking discussion about what is driving these gains.

See our latest analysis for JFrog.

JFrog’s rally in 2024 has been striking, with a 55.9% year-to-date share price return and strong momentum building over the past quarter. Investors seem increasingly optimistic after several new product releases. The company’s 61% total return over the past year puts it well ahead of many in the software sector and hints at sustained growth potential.

If JFrog’s performance has you curious about other fast-moving opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With such strong gains already this year, the key question now is whether JFrog’s stock remains undervalued or if the market has already baked in expectations for future growth, leaving little room for further upside.

Most Popular Narrative: 14.3% Undervalued

With JFrog’s narrative fair value pegged at $55.81, the gap to the last close of $47.85 has investors eyeing near double-digit upside if growth projections hold true.

Accelerating adoption of AI and machine learning across enterprises is driving increased demand for trusted, scalable artifact and AI model management. JFrog's position as the system of record for binaries and rapid traction as a model registry (including strategic wins with NVIDIA and AI industry leaders) supports strong expansion in data consumption, customer commitments, and revenue growth.

Want to know the secrets behind this eye-catching valuation? The big narrative leans on a chunky growth target, bold margin assumptions, and confidence in JFrog’s ability to dominate new AI-driven markets. The price tag might look ambitious, but the underlying financial story will surprise you. What are analysts really baking into this forecast? Dive in and challenge the assumptions yourself.

Result: Fair Value of $55.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in security and slower enterprise adoption of hybrid cloud could dampen JFrog’s pace. This could challenge the bullish outlook if industry trends shift unexpectedly.

Find out about the key risks to this JFrog narrative.

Another View: Looking at Multiples

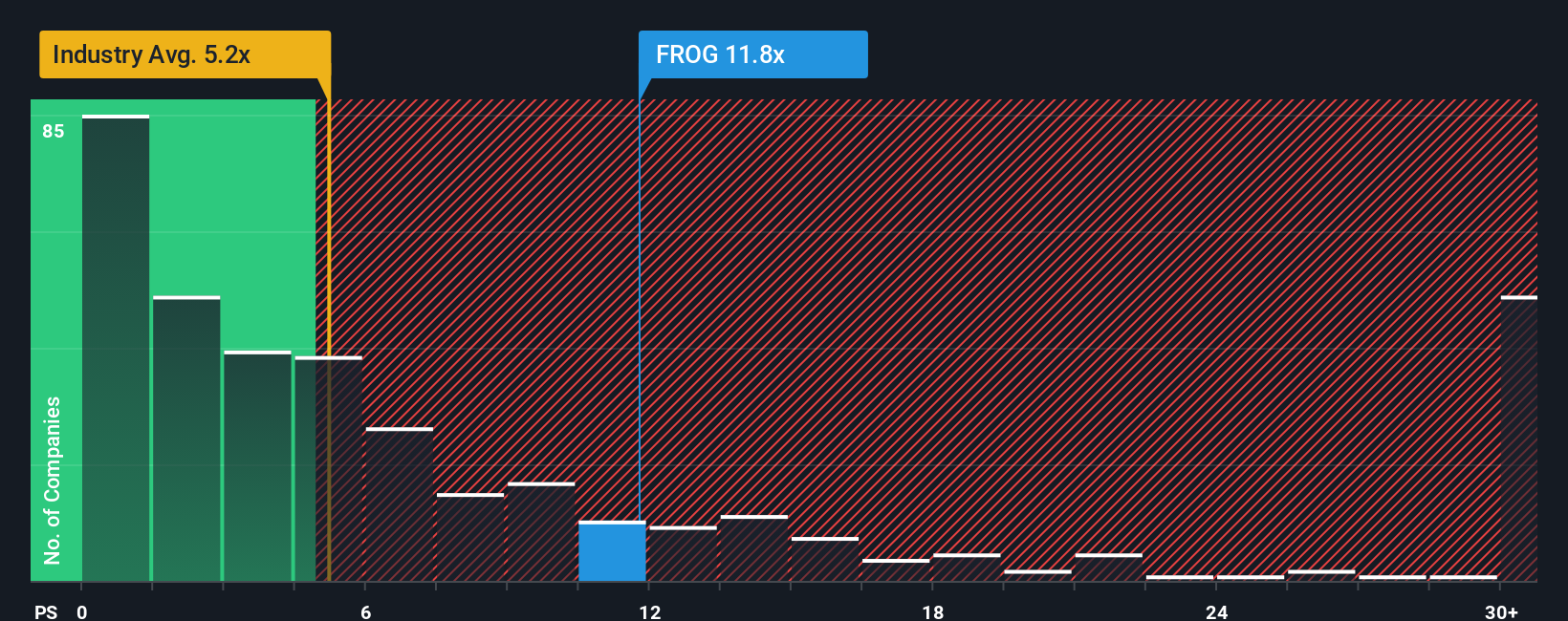

While JFrog’s narrative fair value suggests the stock is undervalued, its price-to-sales ratio tells a different story. JFrog trades at 11.8× sales, which is much steeper than the US software industry average of 5.3× and the peer average of 8.1×. Even the fair ratio is just 6.9× sales. This steep premium signals that investors might be paying up for expected growth. However, what happens if that growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JFrog Narrative

If this perspective doesn't match your outlook or you're keen to follow your own trail of research, you can shape your own narrative in just a few minutes. After all, sometimes the best story is the one you build yourself. Do it your way

A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the best opportunities can pass you by if you aren’t looking for them. Make your next move count and check out these screeners for fresh possibilities:

- Unlock powerful returns with these 3575 penny stocks with strong financials. Find overlooked gems with strong fundamentals that could shape tomorrow’s market.

- Tap into the healthcare revolution by checking out these 32 healthcare AI stocks. This is where artificial intelligence meets medicine in high-growth companies you won’t want to miss.

- Boost your income with dependable yields by browsing these 18 dividend stocks with yields > 3%. Target stocks with standout dividend strength for stable, long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FROG

JFrog

Provides software supply chain platform in the United States, Israel, India, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives