- United States

- /

- Software

- /

- NasdaqGS:FROG

Did JFrog's (FROG) AI Delivery Platform and Compliance Expansion Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- At its 2025 swampUP event, JFrog announced key product updates including JFrog Fly, an AI agent-based platform for software delivery automation, an enhanced AI model catalog now interoperable with NVIDIA models, and the addition of new Evidence Ecosystem partners for compliance solutions.

- These advancements address rising industry needs for scalable AI infrastructure and automated compliance, positioning JFrog to serve organizations facing complex regulatory and development challenges.

- We'll explore how JFrog's AI platform launch and compliance ecosystem expansion could shape the company's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

JFrog Investment Narrative Recap

To be a JFrog shareholder, one must believe that accelerating demand for secure AI model management and automated DevOps workflows will support continued adoption of the company's developer platform, especially among large enterprise clients. While the swampUP product unveilings strengthen JFrog’s position as a provider of AI and compliance solutions, the ongoing pattern of insider selling, including the CEO's recent sale, is not likely to materially change the near-term cloud adoption catalyst or the primary risk of earnings volatility tied to large enterprise deals.

Among JFrog’s latest announcements, the launch of its Evidence Ecosystem partners for AppTrust stands out. This move directly responds to growing enterprise needs for centralized audit trails and compliance automation, reinforcing the company’s relevance as customers contend with stricter software supply chain and regulatory requirements, a key factor for capturing large, multi-year contracts.

Yet, in contrast, investors should be aware that ongoing dependence on a few large enterprise customers could...

Read the full narrative on JFrog (it's free!)

JFrog's narrative projects $736.3 million revenue and $96.4 million earnings by 2028. This requires 15.8% yearly revenue growth and a $182.7 million increase in earnings from -$86.3 million today.

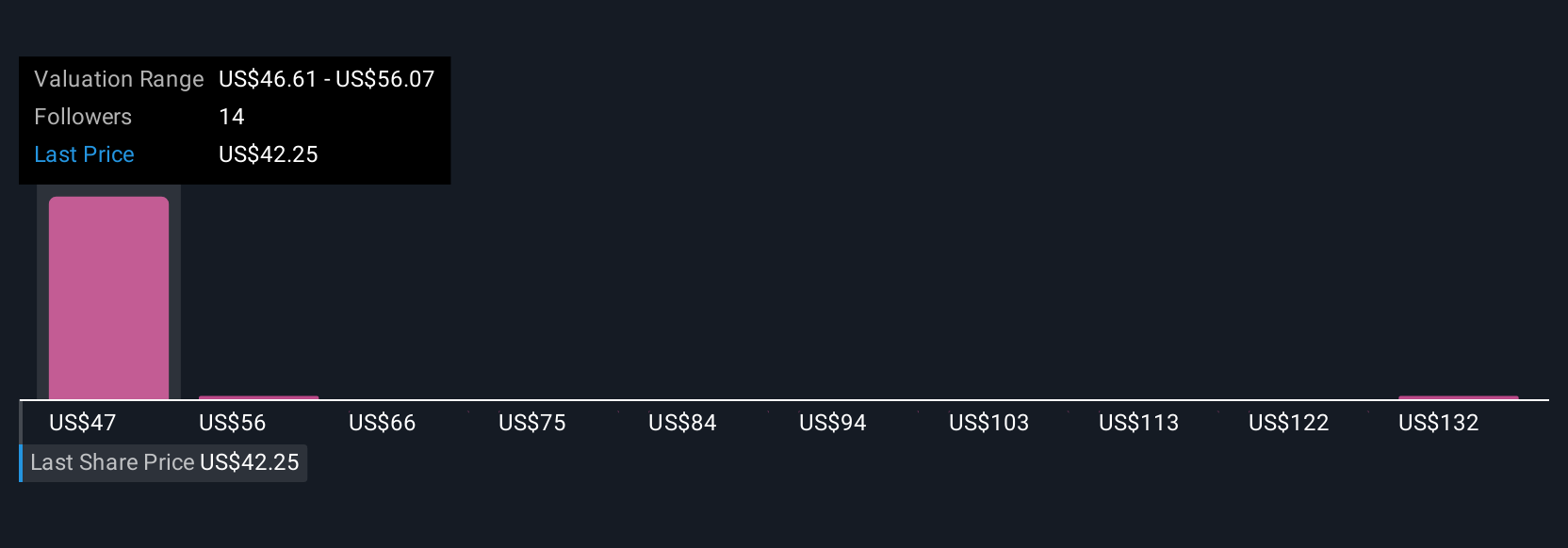

Uncover how JFrog's forecasts yield a $55.81 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community estimates place JFrog’s fair value between US$29.91 and US$141.21, reflecting vastly different outlooks. Lingering risk from earnings unpredictability due to large deal concentration means your view on future revenue stability may differ widely from others.

Explore 4 other fair value estimates on JFrog - why the stock might be worth 35% less than the current price!

Build Your Own JFrog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JFrog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JFrog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JFrog's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FROG

JFrog

Provides software supply chain platform in the United States, Israel, India, and internationally.

Flawless balance sheet with concerning outlook.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026