- United States

- /

- Software

- /

- NasdaqGS:EVCM

Assessing EverCommerce (EVCM) Valuation After Analyst Downgrades On Liquidity And Growth Concerns

Reviewed by Simply Wall St

Analyst downgrades put EverCommerce (EVCM) under closer investor scrutiny

Recent downgrades from Raymond James and RBC Capital, citing liquidity, insider ownership and tempered near term growth expectations, have pushed EverCommerce (EVCM) back onto investors’ watchlists as they reassess risk and valuation.

See our latest analysis for EverCommerce.

At a share price of $12.38, EverCommerce’s recent 1 day share price return of 2.06% and 90 day share price return of 7.19% follow the earlier rally that prompted the downgrades, while a 1 year total shareholder return of 20.55% and 3 year total shareholder return of 22.33% point to momentum that has been building over a longer window.

If EverCommerce’s recent moves have you reassessing risk and return, it can be helpful to compare with fast growing stocks with high insider ownership as a way to spot other ideas with concentrated ownership and growth credentials.

With shares at $12.38, a small intrinsic discount estimate, recent gains and a price target that sits slightly below the market, the key question is whether EverCommerce is quietly undervalued or if the market is already pricing in future growth.

Price-to-Sales of 3.1x: Is it justified?

At a last close of $12.38, EverCommerce is trading on a P/S of 3.1x, which screens as expensive versus peers even though it sits below the wider US software sector average.

The P/S ratio compares the company’s market value to its revenue, which is a common yardstick for software businesses that are still loss making or early in their profitability journey. For EverCommerce, this means investors are paying a little over three times annual sales for exposure to its route based dispatch, payments and vertical SaaS platforms.

Simply Wall St’s fair P/S estimate sits at 2.5x. The current 3.1x level is therefore higher than the ratio the market could potentially move toward. It also stands above the 2.7x peer average but below the 4.5x broader software industry. That mix of signals points to a valuation that is richer than closest peers yet not at the top of the sector range.

Explore the SWS fair ratio for EverCommerce

Result: Price-to-Sales of 3.1x (OVERVALUED)

However, growth and valuation could be pressured if revenue, which currently sits around $718 million with slight annual contraction, remains under strain while net income stays close to break even.

Find out about the key risks to this EverCommerce narrative.

Another view on value: DCF points the other way

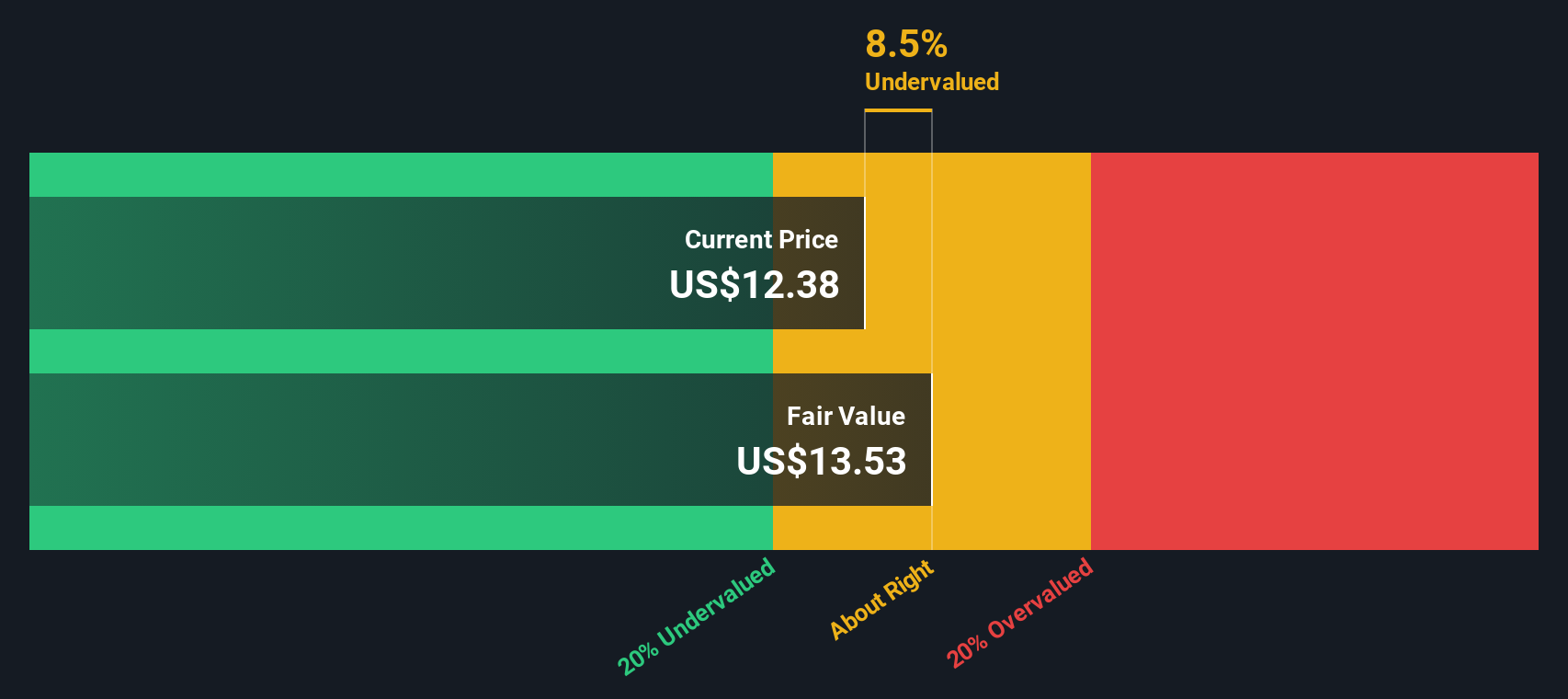

While the 3.1x P/S ratio suggests EverCommerce is trading rich versus its fair ratio of 2.5x and peer average of 2.7x, our DCF model tells a different story. On that measure, the shares sit about 8.5% below an estimated fair value of US$13.53. Which signal should investors pay more attention to?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EverCommerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EverCommerce Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a complete view in just a few minutes with Do it your way.

A great starting point for your EverCommerce research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If EverCommerce has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to hunt for fresh ideas that fit your own criteria.

- Target potential mispricings by scanning these 881 undervalued stocks based on cash flows that line up with your view on risk, quality and long term compounding.

- Back big themes in computing by sorting through these 23 quantum computing stocks where real business models meet cutting edge research.

- Strengthen your income watchlist by assessing these 13 dividend stocks with yields > 3% that may suit a yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EverCommerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVCM

EverCommerce

Provides integrated software-as-a-service solutions for service-based small and medium-sized businesses in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

M&A machine with a relentless focus on operational excellence

Britam Holdings will navigate a 2.43 fair value journey to growth

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion