David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Amdocs Limited (NASDAQ:DOX) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Amdocs

How Much Debt Does Amdocs Carry?

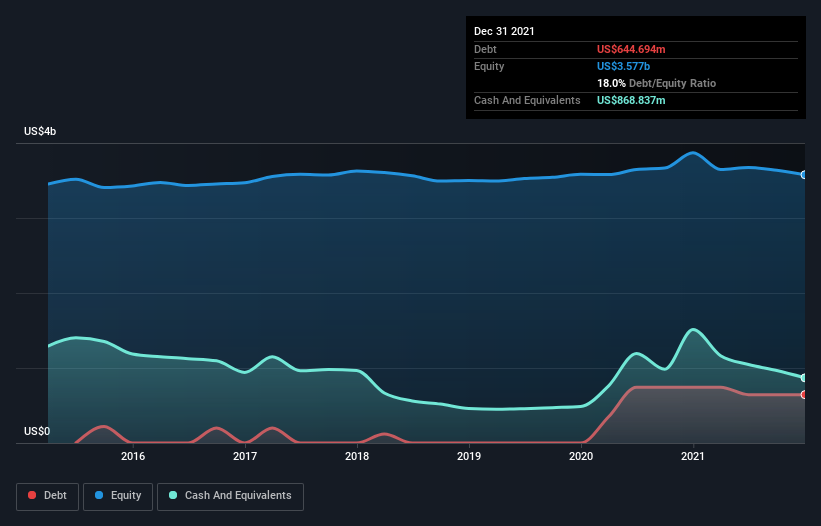

You can click the graphic below for the historical numbers, but it shows that Amdocs had US$644.7m of debt in December 2021, down from US$744.1m, one year before. However, it does have US$868.8m in cash offsetting this, leading to net cash of US$224.1m.

A Look At Amdocs' Liabilities

According to the last reported balance sheet, Amdocs had liabilities of US$1.39b due within 12 months, and liabilities of US$1.59b due beyond 12 months. On the other hand, it had cash of US$868.8m and US$954.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.16b.

Of course, Amdocs has a titanic market capitalization of US$10.2b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Amdocs also has more cash than debt, so we're pretty confident it can manage its debt safely.

Fortunately, Amdocs grew its EBIT by 4.6% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Amdocs can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Amdocs may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Amdocs generated free cash flow amounting to a very robust 98% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

Although Amdocs's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$224.1m. The cherry on top was that in converted 98% of that EBIT to free cash flow, bringing in US$495m. So we don't think Amdocs's use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in Amdocs, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOX

Amdocs

Through its subsidiaries, provides software and services to communications, entertainment, media, and other service providers worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!