Amdocs Limited's (NASDAQ:DOX) investors are due to receive a payment of $0.479 per share on 25th of October. This takes the annual payment to 2.2% of the current stock price, which is about average for the industry.

See our latest analysis for Amdocs

Amdocs' Payment Could Potentially Have Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. The last dividend was quite easily covered by Amdocs' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 87.7%. Assuming the dividend continues along recent trends, we think the payout ratio could be 25% by next year, which is in a pretty sustainable range.

Amdocs Has A Solid Track Record

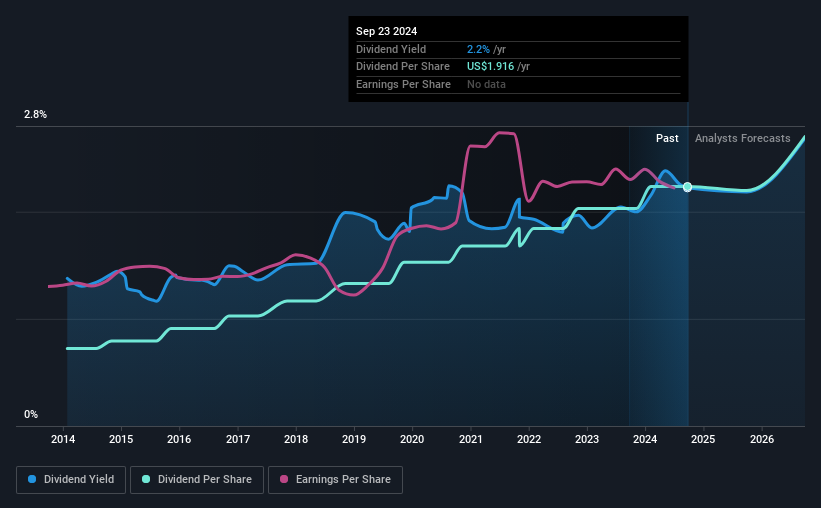

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.62 in 2014, and the most recent fiscal year payment was $1.92. This works out to be a compound annual growth rate (CAGR) of approximately 12% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

We Could See Amdocs' Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that Amdocs has grown earnings per share at 9.0% per year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Amdocs Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Earnings growth generally bodes well for the future value of company dividend payments. See if the 7 Amdocs analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOX

Amdocs

Through its subsidiaries, provides software and services to communications, entertainment, and media service providers worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)