- United States

- /

- Software

- /

- NasdaqGS:DOCU

Will US-China Tensions and New Federal Solutions Shift DocuSign's (DOCU) Competitive Edge?

Reviewed by Sasha Jovanovic

- In the past week, DocuSign was impacted by renewed US-China trade tensions and sector-wide volatility, as investors responded to tariff threats and market uncertainty affecting technology and digital workflow stocks.

- An important development for DocuSign was its focus on expanding secure digital agreement solutions for federal agencies and launching new biometric identity verification technology, reflecting an emphasis on compliance and security amid evolving market and regulatory needs.

- We'll examine how heightened geopolitical and sector-related risk has implications for DocuSign's recurring revenue outlook and competitive positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DocuSign Investment Narrative Recap

For shareholders in DocuSign, the core belief centers on the continued shift to digital agreement workflows and the adoption of AI-powered contract management, especially as organizations prioritize document security and compliance. While recent reports of sector volatility and global trade tensions have unsettled tech stocks, these events have not materially altered the most critical near-term catalyst: expanding enterprise and government adoption of DocuSign’s IAM platform. The main short-term risk remains persistent deceleration in revenue growth, as indicated by the company’s guidance for single-digit increases ahead.

Among DocuSign’s latest developments, its biometric identity verification integration with CLEAR stands out as especially relevant. This move strengthens the security and compliance appeal of DocuSign’s IAM solutions, a crucial selling point as regulatory scrutiny intensifies and organizations seek trusted digital workflow providers. How quickly new security features translate into recurring revenue will be key for near-term sentiment and future growth.

Yet, in contrast, investors should be aware that slowing revenue growth guidance and signs of market maturation could...

Read the full narrative on DocuSign (it's free!)

DocuSign's narrative projects $3.8 billion in revenue and $359.8 million in earnings by 2028. This requires a 7.3% annual revenue growth rate and a $78.8 million increase in earnings from the current level of $281.0 million.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 36% upside to its current price.

Exploring Other Perspectives

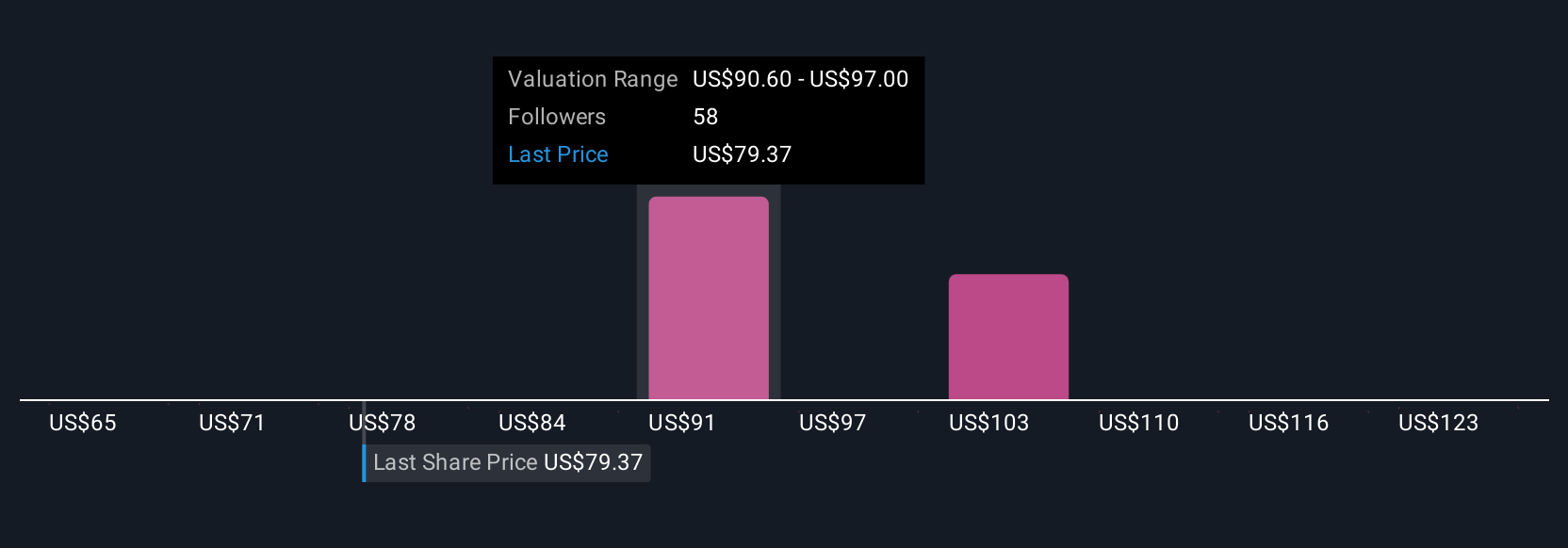

Six community members on Simply Wall St estimate DocuSign’s fair value ranges widely from US$77 to US$118 per share. While opinions vary, many are watching for evidence that DocuSign can re-accelerate revenue in a competitive environment, broader market debate continues, so review several perspectives before deciding.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth as much as 73% more than the current price!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives